The pursuit of financial stability has long been a component of financial success among all investors. The desire to accumulate wealth and working hard to achieve that wealth is also something that is shared amongst most investors. Millennials have very different attitudes towards accumulation of wealth, as well as how they feel about the wealth they have accumulated than Gen X investors.

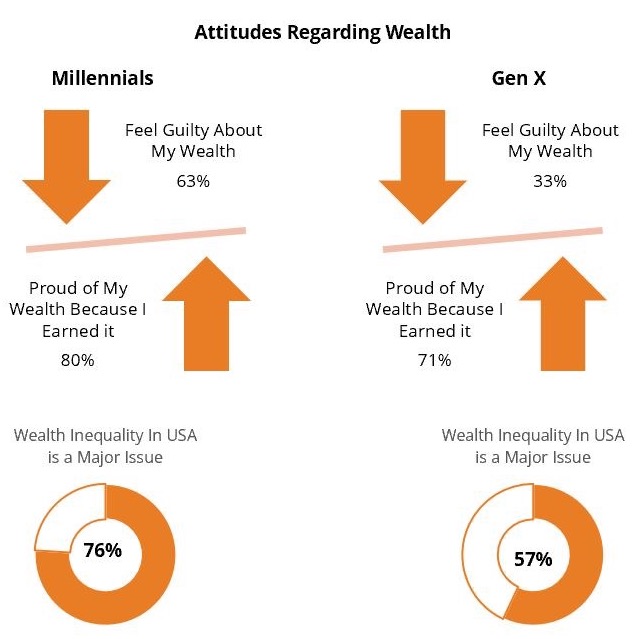

Spectrem Group recently conducted research with wealthy Millennials and Gen X investors found that Millennials have an interesting dichotomy regarding wealth. Gen X investors have a more traditional view of wealth compared to Millennial investors. These two investor segments agree that being financially stable and independent are the most significant definitions of success. These investors also feel similarly regarding the pride they feel regarding their wealth. Eighty percent of Millennials and 71 percent of Gen X investors are proud of their wealth because they earned it.

That is where attitudes begin to diverge between these two investor segments. Nearly two-thirds of Millennials feel guilty about their wealth, while only a third of Gen X investors feel that way. It is possible this guilt is driven by the believe that wealth inequality in the USA is a major issue, a believe felt by 76 percent of Millennials but only 57 percent of Gen X investors.

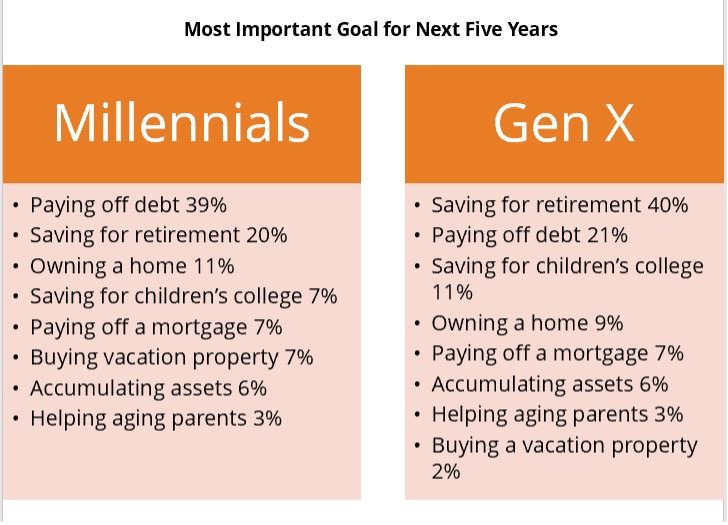

The financial goals of Millennials and Gen X regarding wealth are also significantly different. The most important goal in the next five years for Millennials are paying off debt, saving for retirement, and owning a home. Gen X investors most important goals are saving for retirement, paying off debt, and saving for children’s college education.

The financial industry has long connected these two investor segments, making assumptions that their relationships with advisors and wealth are similar, yet they could not be more different. Advisors who work with either of these types of investors need to be aware that they both have unique needs and preferences and should never be combined in terms of service or approach.

Related: Advisor Satisfaction By Generation