Imagine someone gives you $100,000 and you must determine what to do with it. Would you save it, invest it, buy something? If you invested it, how would you allocate that $100,000? Would you be making these investment decisions on your own or would you enlist the help of a financial professional to help you allocate the $100,000?

Fifty percent of investors would choose to invest the money, according to recent research from Spectrem Group. This percentage increases to 64 percent among those investors that have a net worth between $10 million - $25 million. Just over a third of investors would choose to save the money in a safe type of account, like a savings account, although that percentage decreases to only 27 percent among those investors with a net worth between $10 million - $25 million. Ten percent of investors would choose to pay off existing debt with their $100,000 windfall. Among those that chose to invest the funds, would they use a financial professional to help them with their investment decisions?

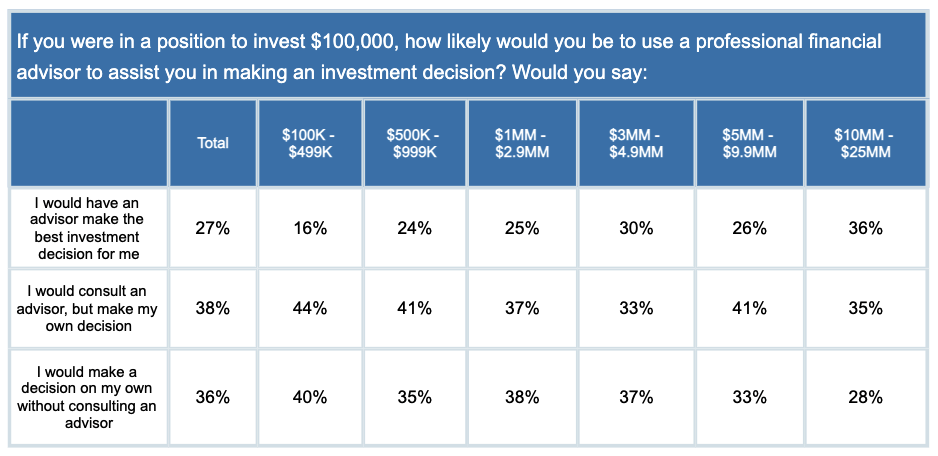

Investors are split on what level of support they would seek from a financial professional in the decision-making process of investing their $100,000. Thirty-eight percent of investors would consult with a financial advisor, but ultimately make their own decisions regarding investments, while 36 percent of investors feel they would make their own decisions without consulting with a financial professional. Just over a quarter of wealthy investors feel they would have a financial professional make the investment decisions. As wealth increases, so does the likelihood of the investor trusting a financial professional to make the best investment decisions on their behalf.

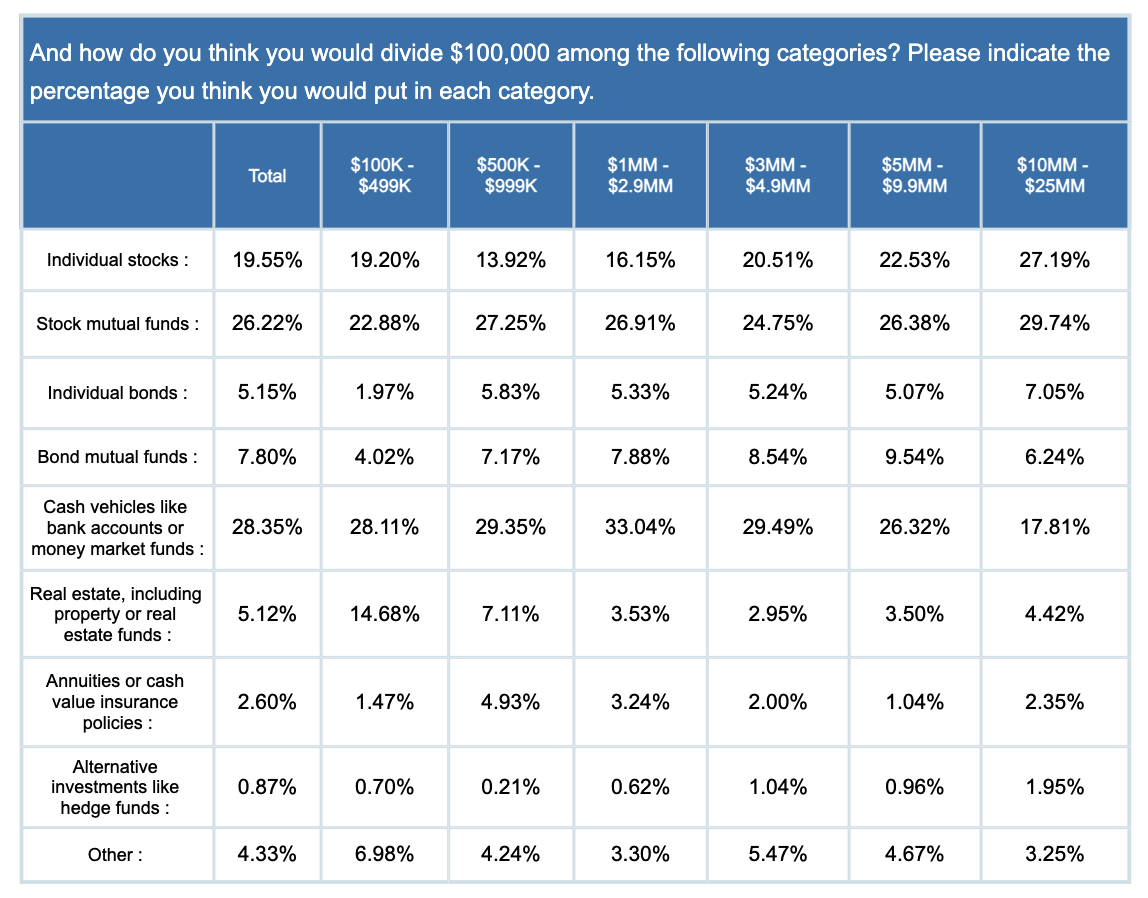

Regardless of using an advisor, or making the investment decisions on their own, investors have specific ideas as to where they would invest the $100,000. Twenty-eight percent would be invested in cash or money markets, while just over a quarter, 26 percent, would be invested in stock mutual funds. The investing in stock vehicles continues with 20 percent investing in individual stocks. When considering fixed income investments, eight percent would be in bond mutual funds, while five percent would be invested in individual bonds. Investors at higher levels of net worth are far less likely to have money in cash, and more likely to have assets in individual stocks.

Thinking about how to invest a hypothetical $100,000 can provide insight into how an investor would allocate their own assets. Investors should consider at least consulting with a financial professional regarding their investing choices to avoid common pitfalls.

Related: Do You Dine With Your Advisor?