Generation X grew up with pay phones, pagers, hard-copy mail, and dial-up internet. This generation entered the workforce and learned basic computer software and the era of mainstream electronic communication began. Millennials were immediately immersed in technology, with cellphones, texting, and emails being commonplace. The differences in these generations from previous generations is often their preferences in communication. Financial professionals that work with Gen X or Millennial clients and prospects need to be aware that the previous approach of a phone call may not be the preferred method of communication. To maximize communication success, providers and advisors should do what they can to meet the client and prospect on the communication platform they prefer.

Spectrem Group recently conducted a study on the communication preferences of wealthy investors and discovered some significant differences in communication methods by age. When looking at communication, Spectrem focused on four different channels of communication: texting, video-chat, email, and telephone. Social media communication was also researched, however the differences by the four major channels was more significant, as communication through social media is still not widely used in the financial services industry.

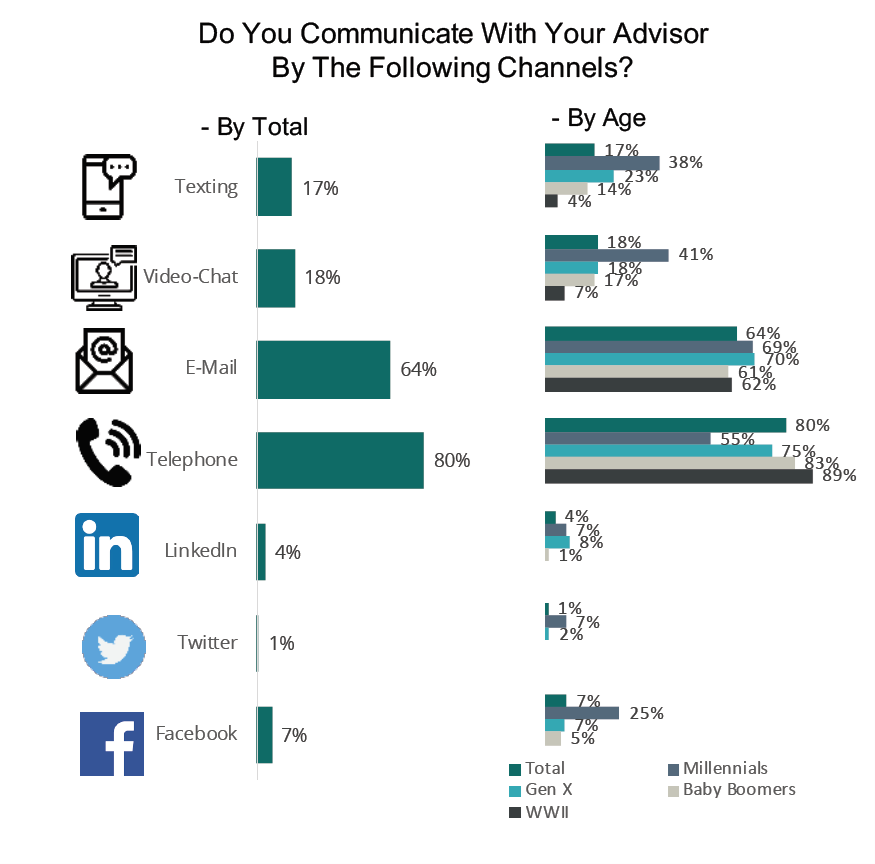

Overall, telephone remains the most common communication method that investors utilize for communicating with their financial advisor, with 80 percent indicating they communicate using this channel. Email is followed closely behind with 64 percent. Texting and video-chat are 17 percent and 18 percent, respectively. When examining the results by age however, the differences are immediately apparent. Only 55 percent of Millennials communicate with their advisor via the phone. This is a significant difference from the over 80 percent of Baby Boomers and WWII investors that communicate through this method. Millennials and Gen X are slightly more likely to utilize email to communicate with their financial advisor than Baby Boomers or WWII investors. Interestingly, over 40 percent of Millennials communicate with their financial advisor through video-chat, compared to only seven percent of WWII investors who communicate in this manner. Nearly 40 percent of Millennials also text with their financial advisor. Twenty-three percent of Gen X investors text with their advisor as well. This is again in stark contrast to the four percent of WWII investors who text with their advisor.

For financial advisors that are working with younger clients, this is a clear sign that communication through text and video-chat is something that needs to be a regular part of client communication and service. Does that mean those financial advisors with older clients do not need to worry about texting or video-chat? Not at all, as many older investors would be willing to communicate through those channels. In fact, 37 percent of Baby Boomers would be willing to communicate with their financial advisor through text messaging. Forty-six percent of Baby Boomers would be willing to speak with their financial advisor through video-chat. Over a third of WWII investors would even be willing to communicate through video-chat with their advisor.

Related: You Have an Obligation To Respond Timely to Your Clients