In 2020, we saw the COVID-19 pandemic spread across the globe and change the way we live, work and do business. In a world limiting hand shaking and eye contact, funds under management (FUM) CEOs and CMOs needed to quickly evolve the way they reach direct investors and gain trust.

At BlueChip's 2020 CEO briefing event; How to grow FUM in a COVID-19 disrupted Australia, we asked our room of FUM CEOs and CMOs what hurdles they were facing, and the digital opportunities they see advantageous to plan and stay ahead. Below we've summarised 5 trends that FUM CEOs and CMOs should expect in 2021.

6 hurdles for funds winning business

- Geographical dispersion of people in the business

- Visibility

- Risk on versus risk off movement

- Thought leadership penetration

- Compliance and application processes that are clunky and heavy

- Bandwidth

- Profile

- More sales staff

The extent of digital channels used to support sales, relationship and service activity

- 29% voted to a limited extent but digital and other channels are not well integrated/ it's very manual and could be much better

- 64% voted that this is done routinely or have do for some time, but it's not yet seamless

- Only 7% said digital is well integrated and that it supports and enables marketing, sales, relationship and service activity

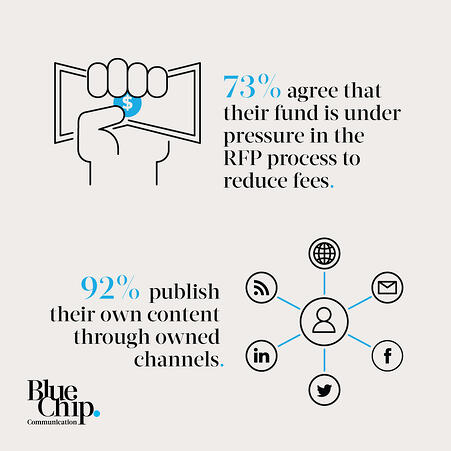

73% agree that their fund is under pressure in the RFP process to reduce fees and 92% publish their own content through owned channels

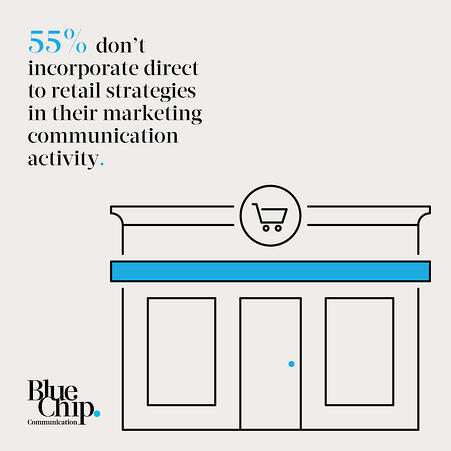

55% don't incorporate direct to retail strategies in their marketing communication activities

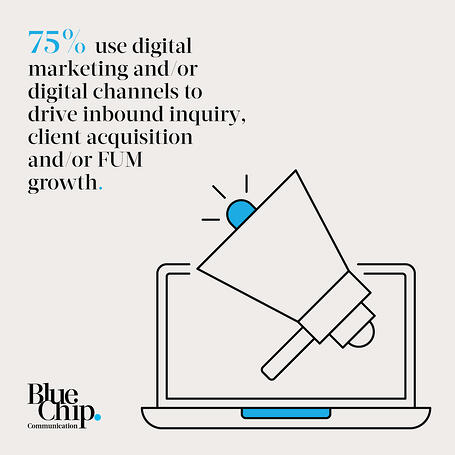

75% use digital marketing and/or digital channels to drive inbound inquiry, client acquisition and/or FUM growth

90% spend more on digital advertising than print/broadcast advertising

Related: Three Steps To Get Magical Results From Integrating PR, Marketing and Paid Media