Written by: State Street Global Advisors

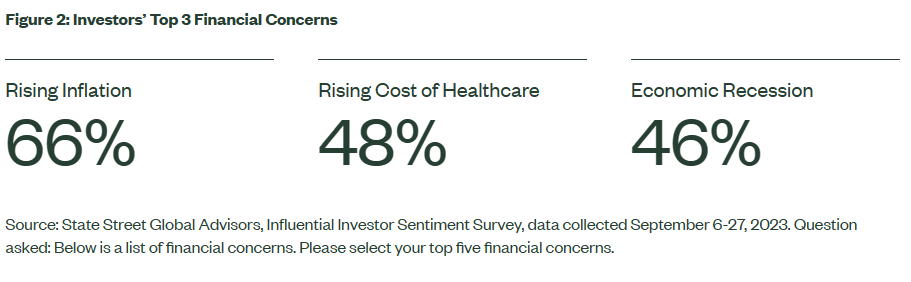

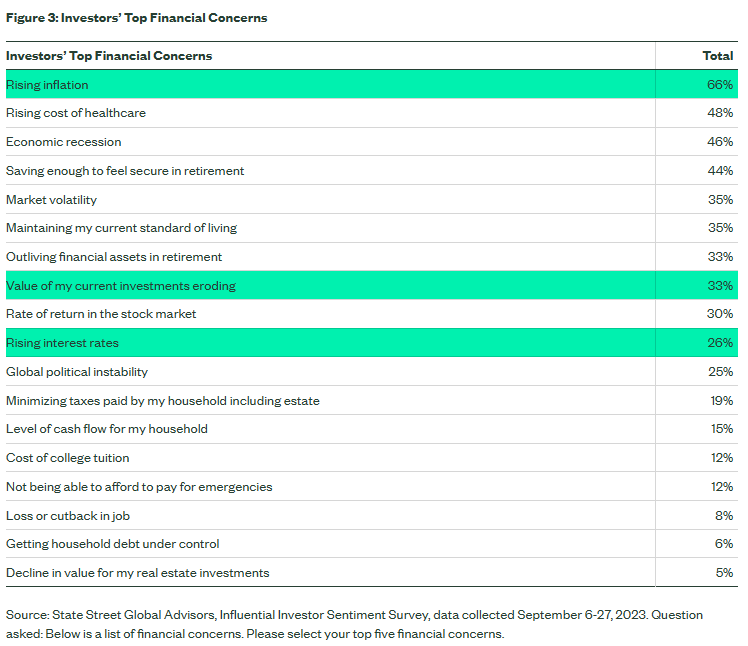

- Although inflation is moderating, 66% of individual investors ranked rising inflation as a top financial concern, according to our recently published survey results.

- But far fewer investors expressed worry about inflation-linked impacts, like rising interest rates (26%) or the value of their portfolio eroding over time (32%).

- In the face of a potentially more challenging year, there are still opportunities investors can take advantage of to preserve and even grow their wealth.

Inflation reached a red-hot level in June of 2022 when the Consumer Price Index (CPI) spiked to 9.1% Year-over-Year (YoY), its highest level in more than 30 years.1 To temper inflationary flames, the Federal Reserve (Fed) embarked on its most aggressive rate-hiking cycle in decades.

While the hikes may be over, investors are left to contend with rate volatility, an uncertain economic future, and higher priced goods and services that create cost of living pressures. The State Street Global Advisors Influential Investor Sentiment Survey: Outlook on 2024 offers new insight into investors’ views on the economy and their concerns for their own financial futures.

Inflation Cools but Investors Still Wary

Two-thirds (66%) of individual investors ranked rising inflation as a top financial concern according to the recently published Influential Investor Sentiment Survey results. Even though inflation moderated to a 3.1% YoY increase as of December 2023 data,2 investors may still feel rattled by a number of economic factors following a year of surprises in 2023:

- Post-COVID Fiscal Stimulus: In the height of COVID lockdowns, consumers found ways to cut unnecessary expenses and hold onto more of their money. Upon reentering a post-pandemic world, consumer spending — terrifically supported by government-backed stimulus — skyrocketed. While this spending injected life back into the economy, it also placed extreme pressure on a lean labor force trying to keep pace with the increased demand for goods.

- A Global Supply Chain Crisis: Disruptions in shipping, manufacturing, and logistics led to supply shortages for various goods, creating an imbalance in supply and demand. As businesses grappled with increased costs and delays, these challenges translated into higher prices for consumers.

- The Russian Oil Market: Geopolitical tensions like the Russia-Ukraine War and supply chain disruptions impacted Russia’s oil production and exports, causing fluctuations in international oil prices. This volatility, coupled with the world’s heavy reliance on oil, resulted in elevated energy costs.

- A Booming Labor Market: Following the pandemic, in 2022 the US economy added more than 4.5 million jobs, averaging 375,000 each month3 — and those figures steadily rose in the first half of 2023. With increased job opportunities, more competitive wages, and low unemployment, consumers found themselves with more disposable income, further heightening the demand for goods and services. But as businesses struggled to keep up, prices soared.

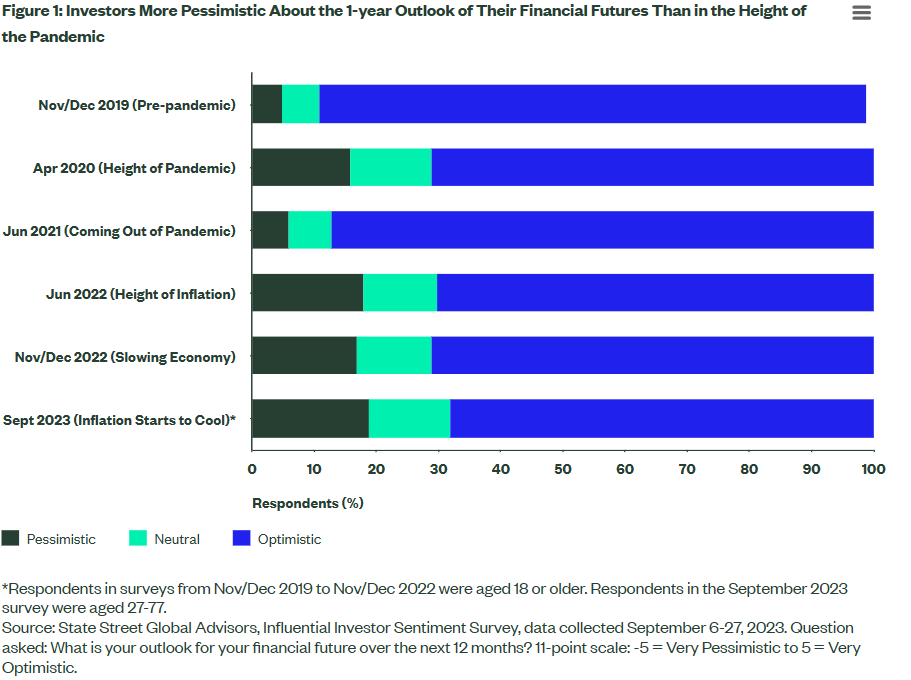

Investor Pessimism: Higher than During Pandemic and Peak Inflation

When inflation peaked in June 2022, 18% of investors said they felt pessimistic about their personal financial outlook over the next 12 months — two percent more than at the height of the pandemic.

Since then, despite cooling inflation and that most economists are anticipating a soft landing, investor pessimism has stayed the same or slightly higher, reaching 19% in our most recent survey.

Market economists and seasoned investors have rightly talked about how resilient the economy was in 2023. After all, the stock market rallied in a way few expected. But individual investors — worn down by higher prices, rising healthcare costs, geopolitical conflicts, and recession fears — appear wary and even weary as we enter yet another year of challenges. In 2024, investors’ resilience is likely to be tested.

Investors Less Concerned About Inflation-linked Risks

Despite the fact that inflation, which erodes purchasing power, ranked at the top of investors list of financial concerns, surprisingly fewer investors said they are worried about inflation-linked impacts like rising interest rates (26%) or the value of their investments eroding over time (33%) (Figure 3).

This may suggest individual investors are more focused on short-term concerns, like pain at the gas pump or grocery store, than on long-term impacts on their borrowing power or ability to sustain and grow wealth over time. It may also suggest a gap in their understanding about the relationship between monetary policy, or the Fed’s ability to control interest rates and inflation.

Whether or not the Fed has pulled off the nearly impossible soft landing, Chief Investment Strategist Michael Arone says a healthy amount of skepticism is warranted as the new year begins.

In Will 2024 Repeat, Rhyme, or Rattle Investors?, Arone wonders whether investors aren’t pessimistic enough, but rather emboldened by the magnificent performance of the market in 2023. As the economy begins a hoped-for transition from policy-supported resilience to organic-led expansion, and as the Fed attempts to unwind rates without sending the economy into recession, Arone cautions that risks skew to the downside.

In the face of a potentially more challenging year, what can investors do to preserve and even grow their wealth now?

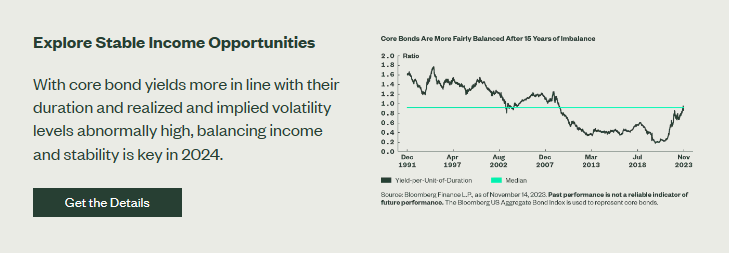

Seek Stable Income

Because rate volatility is abnormally high as we enter 2024, it may be difficult to construct portfolios to pursue high income with stable returns. Investors may want to look to shorter duration bonds, which have the potential to be less sensitive to interest rate fluctuations, and active strategies, which potentially provide more flexibility to respond quickly to market shifts in the search for income-generating opportunities.

Pursue Growth with Tech Leaders and Dividend Growers

With slower global growth expected in 2024, investors may want to look to higher quality US equities, specifically a multi-factor strategy that blends Quality, Value, and Minimum Volatility factors to capture a quality-centric upside with a defensive bias. Tech leaders across the Information Technology, Communication Services, and Consumer Discretionary sectors whose earnings have been resilient and who may benefit from advances in artificial intelligence (AI) also present opportunities.

Additionally, companies that have historically increased their dividends for years have shown their ability to balance returning capital to shareholders and reinvest capital for future earnings growth. Achieving this balance over a long period of time requires financial strength and disciplined capital management — usually offering high quality traits like lower financial leverage and more stable earnings than the broader market and higher-yielding companies.4

2024: Investor Resilience May Be Tested

Despite waning investor optimism and the likelihood that 2024 will be a more challenging year for markets and the economy, there are things investors can do now to potentially pursue pockets of growth and mitigate downside risks beyond inflation alone.

And, as is always the case, navigating challenging markets requires a steadfast approach to avoid falling into emotional decision-making. Consulting a trusted financial advisor can help investors understand the risks they may encounter and stay on a steady path toward pursuing their long-term financial goals.

Footnotes

1 US Bureau of Labor Statistics, June 2022 Consumer Price Index.

2 US Bureau of Labor Statistics, December 2023 Consumer Price Index.

3 US Department of Labor, December 2022 Jobs Report: A Strong End to 2022.

4 FactSet as of October 31, 2023. Based on weighted average long-term debt to capital and average earnings growth variability of constituents of the S&P High Yield Dividend Aristocrats Index, compared to the S&P Composite 1500 Index.

Related: Managing Return Expectations for 2024, Under Any “Landing” Scenario