Next edition of this newsletter, we’re going to do a special on REITs. We will discuss which real estate sectors could see significant recovery after a brutal 2020.

Which real estate sectors could be long-term solid bets? There are a few you might not be thinking of, and we will also discuss why REITs could be a great hedge against rising bond yields and inflation scares.

Do you realize what Tuesday (Mar. 23) marked? One year since the market bottomed. Can you believe that it’s already been a year? Calling it a roller coaster is an understatement.

One of the most crucial market concepts is that the market never looks back. It is a forward-looking instrument. Talking about the past as it relates to the market really doesn’t do anyone any good.

However, after the year we’ve had, it’s essential to take a breath, reflect, and see what lessons we can learn from.

Ethan Wolff-Mann, a Senior Writer for Yahoo! Finance, put out a great article, “ What we have learned in the 12 months since ‘the bottom ’” and discusses several key points:

- ‘Every crisis is the same’

- Panic can hurt a portfolio

- You genuinely don’t know what’s going to happen

- Rebalancing comes out as a huge winner

As we sit here a year later, we can finally see the light at the end of the tunnel. Vaccines are weeks away from being available to all adults over 16 in the U.S., while COVID numbers continue to drop. But we are still confronting the reality of a pandemic that is still raging in Europe and other parts of the world. Inflation signs are flashing, and unstable bond yields are scaring tech investors every few days. But keep the above lessons in mind.

My personal biggest takeaway from the last year that I have applied since the several market downturns we’ve had thus far in 2021? Nobody can predict the future and never ever try to time the market. Many investors a year ago didn’t stick it out through the volatility and lost out. Some panic sold near the bottom and never bought back in.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

A year after we bottomed, there is optimism but signs of concern. The market has to figure itself out. More volatility is likely, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Russell 2000- Time to Pounce?

I kicked myself for not calling BUY on the Russell after seeing a minor downturn during the second half of February. I also realized I may have broken my own rule about “not timing the market.” I’ve wanted to buy the Russell 2000 forever but never thought it dipped hard enough (whenever it did). I was waiting for it to at least approach a correction.

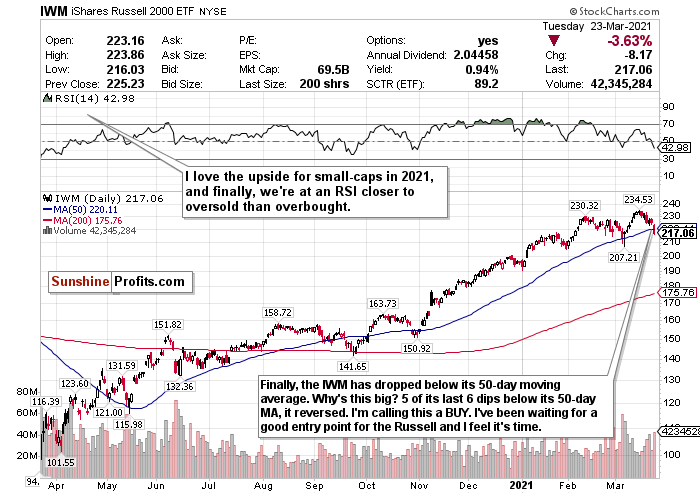

But once I looked at the iShares Russell 2000 ETF (IWM) chart, I had an epiphany. I noticed that almost every time it touched or minorly declined below its 50-day moving average, it reversed.

The chart does not lie. Look at it above. Excluding the recovery in April from last year’s crash, 5 out of the previous 6 times the Russell did this with its 50-day, it saw a sharp reversal. The only time it didn’t was in October 2020, when the distance between its 50-day and its 200-day moving average was a lot more narrow.

Fast forward to Tuesday (Mar. 23). The Russell 2000 saw its worst day since February 25- and I loved every second of it. I felt almost similar to how I felt over the weekend during March Madness when I correctly called 13 seed Ohio to upset 4 seed defending NCAA champion Virginia. Finally, after weeks of waiting for a time to pounce on the Russell 2000 and missing golden opportunities, I think the time has come. We’re back right below its 50-day.

Aggressive stimulus, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for.

I’m finally switching this to a BUY.

For more of my thoughts on the market, such as inflation fears and why I love emerging market opportunities, sign up for my premium analysis today.

Related: Return of the Rising Yields

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.