He rocks in the White House all day longHoppin’ and a-boppin’ and singing his songAll the little traders on Wall StreetLove to hear the President go tweet-tweet-tweetAdapted from the Bobby Day classic “Rockin Robin”These are strange times indeed that we live in. Last Sunday around noon President Trump tweeted that the trade negotiations with the Chinese were going too slowly and that the tariff truce would end on Friday unless a deal was agreed to on Thursday.From Monday through Thursday global stock marketsshed an estimated $2 trillion in value, and further losses were mounting on Friday until Trump’s tweet that talks were “candid and constructive” triggered a 2% afternoon gain in the market. Despite that rally, the S&P 500 still finished with a loss of 2.18% and the Russell 2000 dropped 2.54%. The action was largely in the equity markets as the dollar, gold, and oil were all virtually unchanged, while the yield on the Ten-Year Treasury declined 8 basis points to 2.46%.During this tense trade “war” with China, it seems worth noting that we rely on them to rein in Kim Jong-un, to avoid a real war. It’s probably not a coincidence that North Korea launched short-range ballistic missiles on Thursday for the second time in a week. Although the tests were well short of the distances that the U.S. has been most worried about, the tests highlight the potential risk to Seoul or American troops based in South Korea.Also probably not a coincidence, one year after the U.S. pulled out of the Iran nuclear accord, Tehran has indicated that it is no longer committed to parts of the deal. On Wednesday, President Hassan Rouhani said the remaining signatories – the U.K., France, Germany, China and Russia – had 60 days to implement their promises to protect Iran’s oil and banking sectors, giving them a choice of following President Trump or engaging with the Islamic Republic in violation of American sanctions. Iran will also begin to build up its stockpiles of low enriched uranium and heavy water and threatened to resume construction of the Arak nuclear reactor.Largely drowned out by all the geopolitical noise, earnings seasoncontinued on course, with the projected decline of composite earnings shrinking to 0.5% from 0.9% the week earlier thanks to positive surprises from the Financial and Communication sectors. Companies with more global exposure are suffering as a result of the strong dollar and trade tensions. In fact, companies that generate more than 50% of sales inside the U.S. are generating a blended earnings growth rate is 6.2%, while companies that generate less than 50% of sales inside the U.S. are experiencing a blended earnings decline of -12.8%.The much-anticipated Uber IPO did not provide a ‘lyft’ to the market, as the shares were priced at $45 and closed down 7.62% to $41.57. The good news is that the tone of the dialogue can change with a tweet-tweet-tweet as we saw on Friday afternoon.Earnings season will wind down with only 9 S&P 500 companies reporting results. The economic calendar is light, with April Housing Starts on Thursday and May Consumer Sentiment on Friday both expected to show modest improvement.Related: Investors Should Be Attentive When Others Are Complacent

The good news is that the tone of the dialogue can change with a tweet-tweet-tweet as we saw on Friday afternoon.Earnings season will wind down with only 9 S&P 500 companies reporting results. The economic calendar is light, with April Housing Starts on Thursday and May Consumer Sentiment on Friday both expected to show modest improvement.Related: Investors Should Be Attentive When Others Are Complacent

This Week:

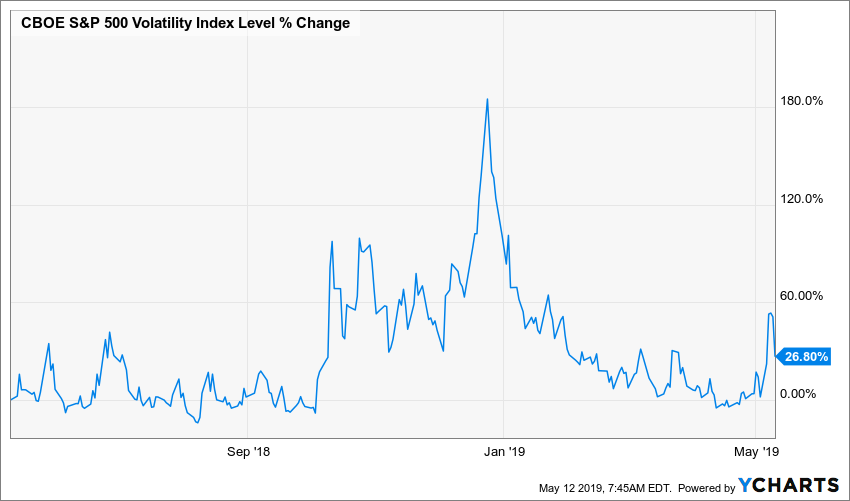

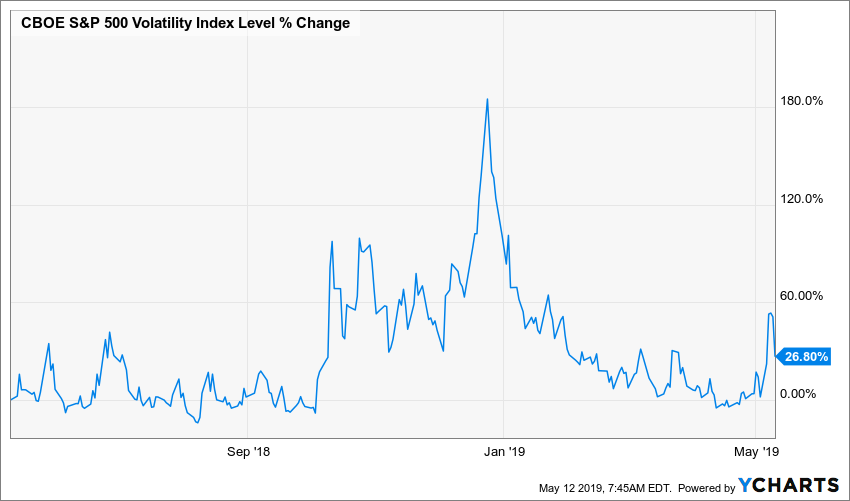

Our previous blog was titled “Be Attentive when others are Complacent”. What a difference a week makes, as investors’ comfortable complacency cocoon was disrupted. It is likely that the trade and other geopolitical issues are going to dominate the narrative in the near-term. The tariff strategy will cause a global economic slowdown, reduce corporate earnings, increase inflation, and lower equity prices. We saw this movie in the fall of 2018 and it was quite unsettling, and the preview of the sequel to “Tariff Man” clearly has the audiences’ attention as indicated by the spike in volatility this past week: The good news is that the tone of the dialogue can change with a tweet-tweet-tweet as we saw on Friday afternoon.Earnings season will wind down with only 9 S&P 500 companies reporting results. The economic calendar is light, with April Housing Starts on Thursday and May Consumer Sentiment on Friday both expected to show modest improvement.Related: Investors Should Be Attentive When Others Are Complacent

The good news is that the tone of the dialogue can change with a tweet-tweet-tweet as we saw on Friday afternoon.Earnings season will wind down with only 9 S&P 500 companies reporting results. The economic calendar is light, with April Housing Starts on Thursday and May Consumer Sentiment on Friday both expected to show modest improvement.Related: Investors Should Be Attentive When Others Are Complacent