As the holidays approach, I find myself reflecting on the many reasons we have to be thankful for in this land of plenty. In particular, the season offers a moment to appreciate the shifts in our economy, as seen through the lens of our traditional Thanksgiving celebrations.

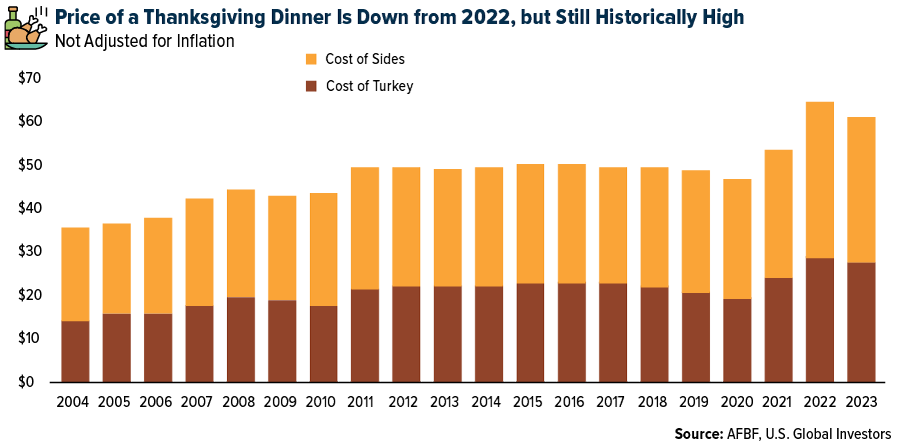

This year, the cost of a typical Thanksgiving feast for 10 is approximately $61.17, marking a 4.5% decline from last year’s historically high prices, according to the American Farm Bureau Federation. The centerpiece, a 16-pound turkey, now accounts for 45% of the Thanksgiving basket at an average $27.35, a 5.6% decrease from 2022.

Although the overall cost for a Thanksgiving dinner is still 25% higher than pre-pandemic levels, and although the price for some items rose slightly from last year, including pumpkin pie mix and dinner rolls, the overall decrease is a positive sign that inflationary pressures may be receding.

Besides the Federal Reserve’s monetary tightening efforts, one of the reasons for this is the resilience and superior efficiency of the U.S. food market. Despite global challenges like food inflation and supply chain disruptions, American consumers spend an estimated 6.7% of their disposable income on food, the lowest of 104 countries measured by the United States Department of Agriculture (USDA). This efficiency is a testament to the effective risk management that stabilizes agriculture markets in the U.S., a factor that keeps food prices comparatively low.

Thanksgiving Travel To Hit Near-Record High

Shifting the focus to travel, the American Automobile Association (AAA) projects a significant increase in Thanksgiving travel this year. With 55.4 million travelers expected, the U.S. is poised to witness the third-highest Thanksgiving forecast since AAA began tracking holiday travel in 2000.

This includes 49.1 million Americans driving to their destinations, benefiting from lower gas prices compared to last Thanksgiving. As of today, a gallon of regular gas costs $3.33 on average in the U.S., a more than 10% reduction from the same time last year, AAA says.

The number of air travelers is also on the rise, with 4.7 million people expected to fly over Thanksgiving. If this ends up happening as AAA expects, it will mark the highest number of passengers since 2005.

These trends not only signal a return to normalcy post-pandemic but also hint at growing consumer confidence, an essential ingredient for economic growth.

Election Years And The Stock Market

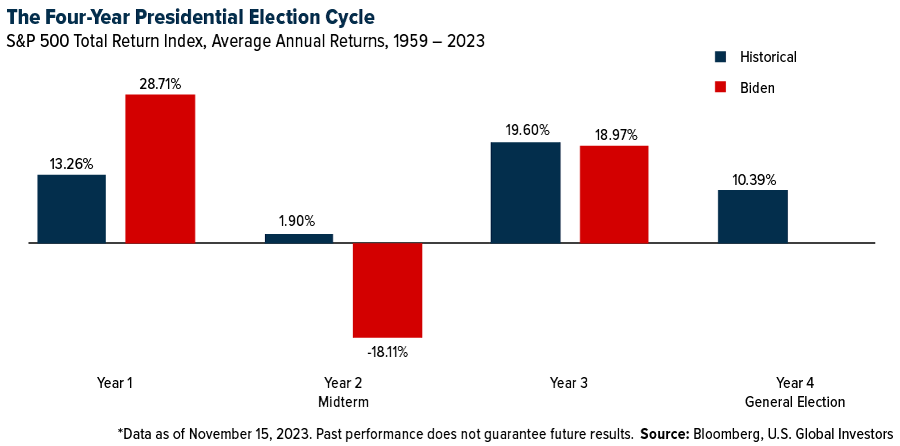

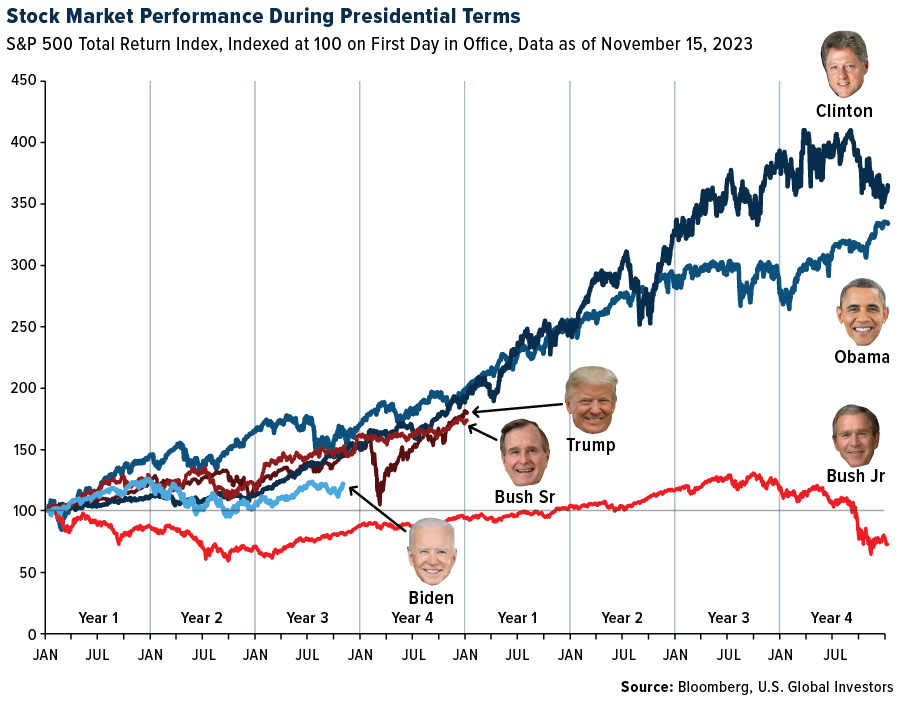

Turning our gaze to the stock market, it’s crucial for investors to understand how presidential elections can impact investments in the short term. Stocks have historically performed best during the third year of a president’s term, climbing 19.6% on average. If today marked the end of 2023, President Joe Biden’s third year in office, stock returns would be just under the average.

Contrary to what you might think, the data shows that stocks have trended upward regardless of which party wins the White House. As I’ve said many times before, it’s the policies that matter most, not the political party—and neither of the two major parties has a monopoly on good or bad ideas. Ours is a hyperconnected world, after all, and there are macro forces greater than the office of president that can have a significant impact on the performance of equities.

Indeed, over the decades, the S&P 500 has shown remarkable stability during presidential matchups, especially when there’s an incumbent running for reelection. Since 1952, the only three times when the market fell in an election year (1960, 2000 and 2008) were when two new candidates were on the ballot, according to Comerica’s weekly market update.

Here’s some good news: Real GDP growth has been strongest during the election year of first-term presidents, followed by even stronger expansion in the year following their reelection. Markets tend to favor certainty, even if the president is generally unpopular, as is the case with Biden.

The next thing we have to look forward to is primary season, which begins on January 15. I urge investors to stay the course. Expect volatility, but historically, stocks have returned 11.3% in the 12 months following primaries, compared to 5.8% in similar periods of non-election years, Comerica says.

The message is clear: It’s time in the market, not timing the market, that investors should be concerned about.

Happy Thanksgiving!

As we gather with family and friends this Thanksgiving, let’s be thankful for living in a country where food is (mostly) affordable, travel appears to have fully rebounded and our capital markets remain resilient amid political and economic uncertainties.

Let’s embrace the opportunities that lie ahead, especially in the upcoming election year, with the potential for the Fed to start lowering rates.

On behalf of the U.S. Global Investors team, I wish you and your family a happy, healthy and joyous Thanksgiving!

Related: Sustainable Aviation Fuel and the Blended Wing Body Revolution