Written by: Jordan Jackson and Brandon Hall

It’s well understood that consumption is the largest contributor to economic growth in the United States accounting for just under 70% of GDP. Therefore, to a large extent, any outlook on the economy hinges on the health of the consumer. Since the turn of the century, real personal consumption growth has averaged 2.5%; yet the second half of 2023 saw consumption grow comfortably above 3% even amidst high interest rates and elevated, albeit declining, inflation. Moreover, the Atlanta Fed’s GDP now tracker is forecasting 1Q24 GDP growth of 2.9% q/q saar, with real consumption growing at an impressive 3.5% q/q saar.

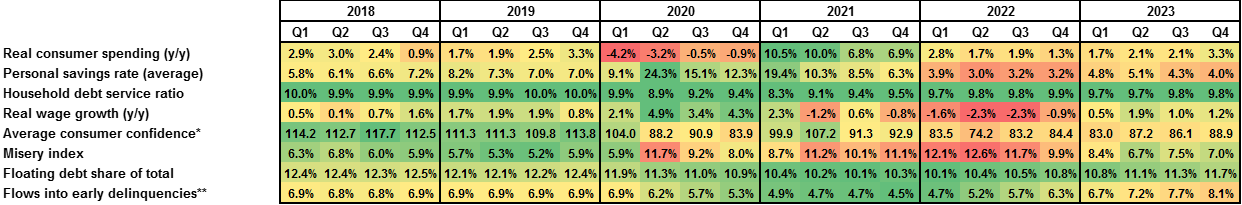

Following the string of upside surprises in incoming data, topped off by the strong retail sales print for March, investors and policymakers have more evidence that the economy is continuing to grow above trend with consumers doing the heavy lifting. However, in considering where the economy may be headed, it’s important to look at a broad array of consumer data to inform the outlook, which suggest a gradual step down in the pace of activity rather than a sharp contraction.

- Consumer sentiment: Given tight labor markets and declining gasoline prices, consumer confidence has recovered nicely after troughing in early 2022, though is not signaling exuberance. Moreover, the misery index (headline CPI + unemployment rate) has declined considerably over the past two years thanks to low levels of unemployment and falling inflation.

- Consumer incomes: With wage growth running consistently at 4-4.5% and inflation declining below 4%, consumers have benefited from positive real wage gains all last year. While low levels of savings are a concern, we think strong incomes driven by tight labor markets should keep consumption growth afloat.

- Consumer debt: Consumer balance sheets underwent a notable restructuring given many Americans took the opportunity to refinance or purchase a home at 2-4% mortgage rates, with the overwhelming majority being fixed rate. In turn, household debt service looks very manageable at below 10% and floating rate debt as a share of overall debt are well below levels seen leading up to and following the GFC.

On balance, it appears there are some cross currents that could impact consumption in the quarters ahead. Auto loans and credit card delinquencies have been rising signaling some pressure on consumer balance sheets. Moreover, elevated interest rates are likely to incentive savings rather than spending on big ticket items. That said, American consumers are rather adept at spending beyond their means suggesting that so long as labor markets remain tight and incomes are supported, barring an unforeseen shock, gradually cooling consumption growth should allow for a soft landing.

On balance, consumers are still on decent footing

Source: BEA, BLS, Conference Board, Federal Reserve Bank of New York, University of Michigan, J.P. Morgan Asset Management.

All data represents end of quarter figures unless stated otherwise. Misery index is calculated by adding the y/y headline inflation rate and the unemployment rate at the end of each quarter. Personal savings rate data represents the average reading during the quarter. Real wage growth is calculated by subtracting the y/y change in headline CPI from the y/y change in average hourly earnings of production and non-supervisory employees at the end of each quarter. *Average consumer confidence represents the average of the University of Michigan's Consumer Sentiment Index and the Conference Board's Consumer Confidence Index. **Flows into early delinquencies represents the average of the % of new auto and credit card loan balances that transitioned into early delinquency. Green shading represents a positive signal for consumer health whereas red shading represents a negative signal for consumer health. Heatmap based on data back to 1Q 2004.

Related: Analyzing Investment Outlook Amidst Escalating Conflict in the Middle East