Written by: Rafael Zorabedian

It’s no secret that the S&P 500 has been leaving all bears in the dust. How does the recent rate of change measure up to previous bull runs?

After seeing many bull and bear markets over the years, I have never quite seen a slope of this magnitude. Of course, a picture is worth a thousand words, so:

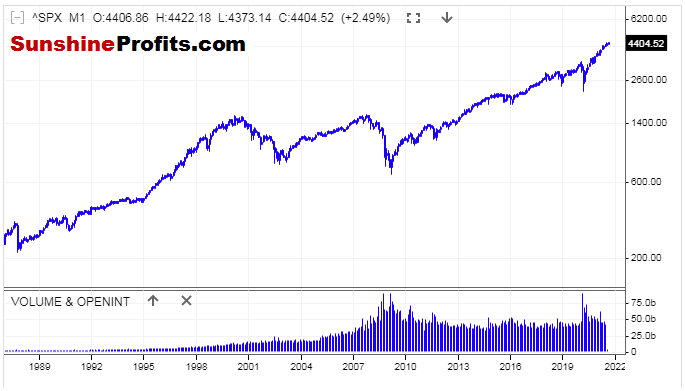

Figure 1 - S&P 500 Index June 1988 - August 2021, Monthly Candles Linear Chart Source stooq.com

The angle of the ascent has dwarfed previous bull markets by far. Of course, there is more than one way to skin a cat. The above chart is a linear chart (most traders, especially short-term traders use linear charts).

However, looking at the recent rally in a logarithmic chart, the ascent does not seem quite as steep.

Figure 2 - S&P 500 Index June 1988 - August 2021 Monthly Candles Logarithmic Chart Source stooq.com

On a regular (or linear) price chart, each value change is expressed in the same way. This means that a change of $2 to $4 looks identical to a change of $28 to $30.

On a logarithmic chart, the amount of percentage change is what is treated identically.

Knowing the difference between the two chart types can be beneficial for traders, and keep price moves in perspective. As we can see in the first chart, the upward move in the S&P 500 looks extreme, while shown in the logarithmic price chart, its angle doesn’t look as sharp.

Expressing the runup as a percentage of the S&P 500 since the pandemic lows, we are higher by approximately 103% in eighteen months.

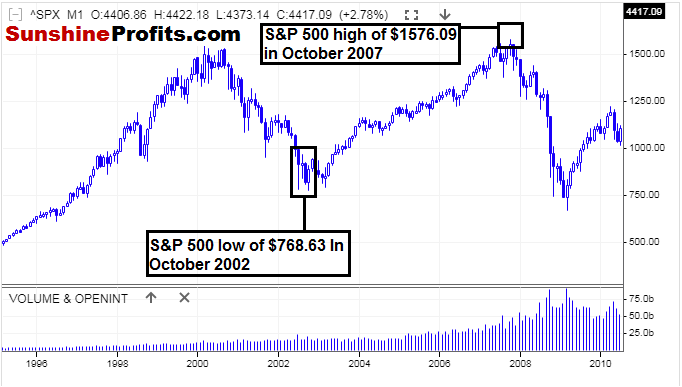

In comparison, I would like to take a look at the runup from the tech bubble selloff in 2002 to the highs that were made in 2007.

Figure 3 - S&P 500 Index January 1995 - April 2010 Monthly Candles Linear Chart Source stooq.com

From trough to peak (October 2002 - October 2007), it took the S&P 500 five years to move 105%. Let’s keep in mind that the sell-off from the March 2000 peak to the October 2002 lows was over a 2 year and 7-month period.

This is more reminiscent of how bear markets used to be in US equities; there were lower prices over longer time periods.

In comparison, the coronavirus meltdown in 2020 was a two-month affair, and we have now been moving higher for 17 months since the lows. Was the coronavirus meltdown a flash crash or indeed a bear market?

The meltdown was so short-lived and was obviously nothing that we have ever experienced before.

What Do I Emphasize Long Term Charts?

Markets do have memories. In fact, I find that longer-term charts are more valuable than short-term charts in almost all timeframe comparisons. Since we are in uncharted territory in the US stock indices, we could gain some kind of insight into the previous trough to peak bull runs.

In Summary:

From pandemic low to current highs in the S&P 500: 103% in eighteen months

From dotcom low to highs before US Financial Crisis: 105% in five years

It can be challenging to get a read on where the US equity markets are trading as a whole these days, given that there is no more chart resistance. In addition, market participants are now accustomed to higher highs, and every dip seems like it is bought more quickly than the last. Although using comparisons like this will not provide insight into exact entry and exit levels, such analysis can provide some long-term comparisons in an otherwise incomparable market. I do hope you find value in this perspective.

Related: All Eyes on Big Tech Earnings this Week

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.