We’re all familiar with inflation, whether it’s at the grocery store or gas pump. What cost you $10 last year might cost you $12 or more today, representing a hidden “tax” that steadily corrodes your purchasing power like rust on iron.

But did you realize there’s another form of inflation that’s just as corrosive and yet is nearly impossible to measure? Some economists call it “shadow inflation,” and it refers to instances when you pay the same price for a good or service one year to the next, but the quality or quantity has diminished.

Many companies, faced with paying higher prices for materials, labor and transportation, pass some or all of the extra costs on to customers. Others opt to charge the same as before but cut back on certain things.

Ever feel like you’re being gypped on potato chips in the bag you just bought? Or that your hotel room isn’t cleaned as well or as frequently as you once remembered? It could just be poor customer service. Or it could be shadow inflation.

CPI: Fact or FUD?

Shadow inflation is yet another indication that the traditional consumer price index (CPI), as provided by the U.S. Bureau of Labor Statistics (BLS), isn’t telling you the full story. Last year, I suggested the CPI might be fake news. I would also describe it as FUD, or fear, uncertainty and doubt.

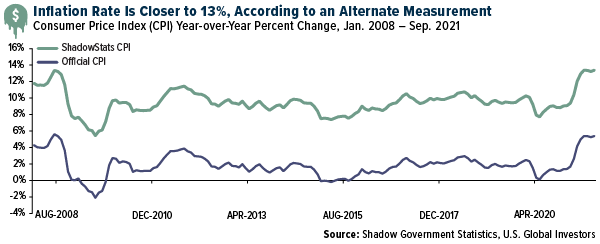

Last week the BLS reported that consumer prices rose 5.4% in September compared to the same month last year. That’s the highest such rate since 2008. But real inflation could be even higher if we measure it using the BLS’s methodology from 1980. According to that yardstick, consumer prices increased a whopping 13.4% in September. (Thank you, again, to John Williams’ Shadow Government Statistics for the data.)

And there could be even higher inflation on the way. Brent crude oil, the international benchmark, touched $85 a barrel on Friday for the first time since October 2018, with Russian president Vladimir Putin saying $100 oil is “quite possible” before year end.

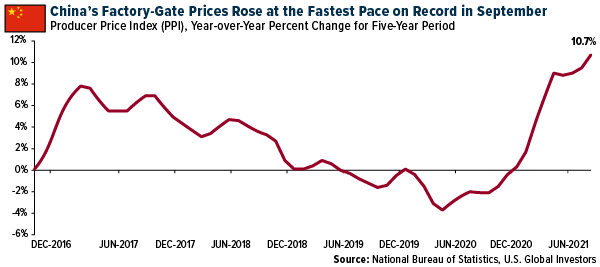

Meanwhile, factory-gate prices, or prices that distributors pay manufacturers for finished goods, rose at a record pace in China last month as worker shortages and shipping bottlenecks continued to gum up the global supply chain. Year-over-year, China’s producer price index (PPI) increased 10.7%, the fastest pace on record. These higher rates will most certainly spread across the globe, from wholesalers to retailers to end consumers.

Gold Hit $1,800, Bitcoin at $61,000

No one can say for certain how long this current period of inflation will last, but I believe it’s only prudent to make sure you have exposure to gold and Bitcoin at this time. Both haven assets responded positively last week to news that inflation may not be so “transitory” as the Federal Reserve would have us believe.

Following the CPI report, gold touched $1,800 an ounce in intraday trading, the first time we’ve seen that level in about a month.

As for Bitcoin, the crypto topped $61,000 on Friday on its quest to surpass its all-time high of $64,863, set in April 2021. Contributing to the price surge was news that the Securities and Exchange Commission (SEC) is finally set to allow Bitcoin futures ETFs to begin trading in the U.S., possibly as early as this week. Up until this point, the agency has blocked all efforts to launch such an ETF, despite incredible pent-up demand from investors. Bitcoin to $100,000 by Year End? On a final note, I returned this week from Dubai, where I attended and spoke at the AIM Summit, a gathering of some of the world’s leading investors and thought leaders on alternative assets. This year, a lot of the buzz was on crypto miners, including HIVE Blockchain Technologies.

Bitcoin to $100,000 by Year End?

On a final note, I returned last week from Dubai, where I attended and spoke at the AIM Summit, a gathering of some of the world’s leading investors and thought leaders on alternative assets. This year, a lot of the buzz was on crypto miners, including HIVE Blockchain Technologies.

I was extraordinarily impressed with Dubai, by the way. It’s right up there with Singapore and Hong Kong, perhaps even more so. Many of the city’s futuristic skyscrapers and other buildings are the work of Canadian infrastructure company Brookfield Properties.

To attract business and workers, the city has a tax-free zone that uses common law for corporate dealings. But across the street, they use Sharia law.

Unless you’re a big drinker, Dubai is relatively affordable, which is why many young people from Canada and elsewhere go there to find employment. Oh, income is entirely tax-free.

But back to crypto and the AIM Summit. Sentiment was very strong for Bitcoin, with some presenters and attendees talking about $100,000 by year end due to a number of reasons, including negative bond yields, rising inflation, institutional participation and general widespread adoption. Robinhood, PayPal and other platforms that allow you to buy fractional shares of coins have made investing in cryptos much more doable for a great number of people.

I can’t promise $100,000 Bitcoin by year end, but I can say it’s definitely plausible, mathematically. The crypto has a 10-day standard deviation of ±14, so a jump to $84,000 is possible by Halloween. After that, we could see $100,000 and beyond.

Related: Bitcoin Powers Past $57,000 on Its Quest to Hit a New All-Time High