Written by: Caglasu Altunkopru and Aditya Monappa

2022 was a historically volatile year for global markets, as rapid monetary policy tightening led to steep losses across equities and bonds. In the second half of the year, inflation started to decelerate from multi-decade highs and markets started to find clarity around a possible end date for rate hikes. But with monetary policy expected to stay tight, investors face further deceleration in economic growth in 2023—and possibly a recession.

A Rare Down Year for Both Stocks and Bonds

A truly exceptional year, 2022 was dominated by historically high inflation, sharply rising interest rates and a surge in bond yields. In fact, last year stands out as the only calendar year since 1988 when returns on both global stocks and government bonds hit negative territory (Display).

2022 was a historically volatile year for global markets, as rapid monetary policy tightening led to steep losses across equities and bonds. In the second half of the year, inflation started to decelerate from multi-decade highs and markets started to find clarity around a possible end date for rate hikes. But with monetary policy expected to stay tight, investors face further deceleration in economic growth in 2023—and possibly a recession.

A Rare Down Year for Both Stocks and Bonds

A truly exceptional year, 2022 was dominated by historically high inflation, sharply rising interest rates and a surge in bond yields. In fact, last year stands out as the only calendar year since 1988 when returns on both global stocks and government bonds hit negative territory (Display).

With Commodities Relief, Services and Housing Are the New Inflation Focus

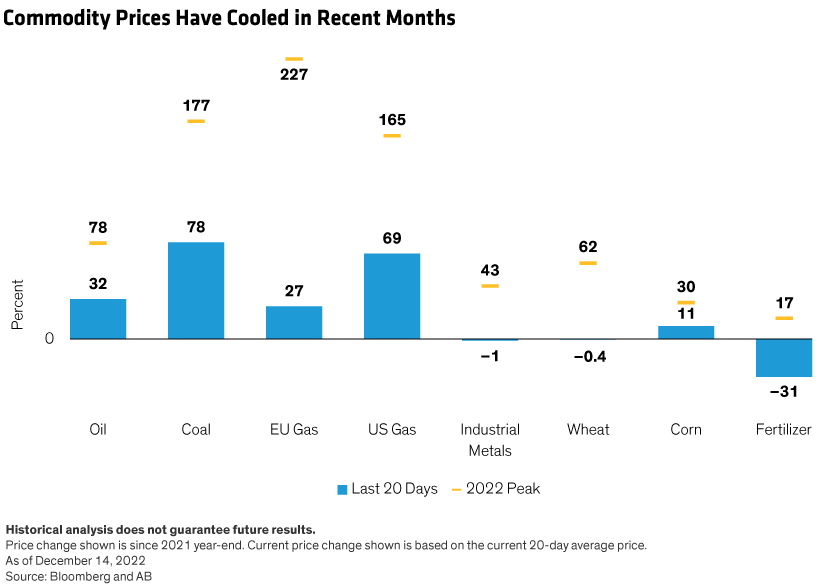

Although the Russia-Ukraine war continues unabated, commodity supplies have started to adjust, cooling many commodity prices from their 2022 peaks. Russian oil flows have been rerouted and US oil production has been rising, while Europe natural-gas supplies have held up thanks to a warmer-than-expected winter. Prices have been particularly volatile—now up by 27% from December 2021, but far below their 227% spike in early 2022 (Display). Grains have been shipping from Ukraine in substantial volume after a United Nations–brokered agreement. Due to lags in supply chains, companies are still passing through elevated commodity costs, but we expect this impulse to continue fading.

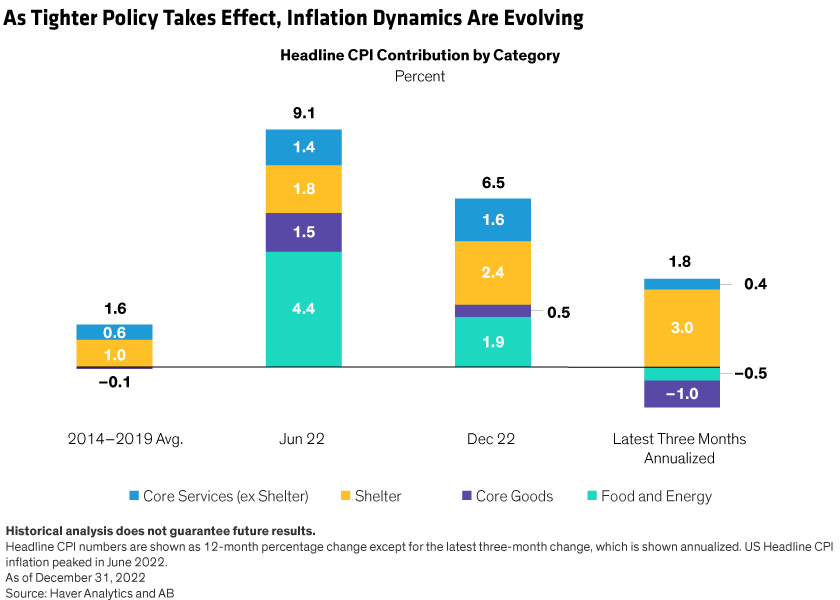

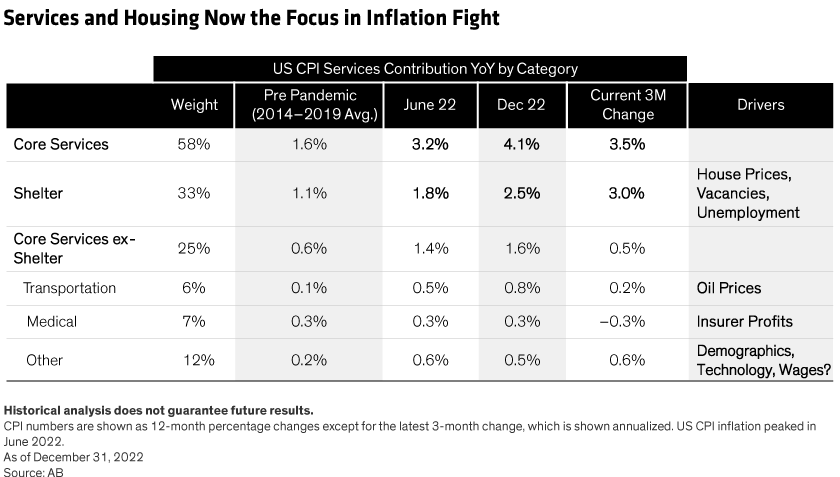

Of the 6.4% annual headline US inflation rate by year-end, 4.1% was attributable to core services: 2.5% from shelter inflation and 1.6% from other services, such as transportation, medical and education (Display). While we haven’t seen a peak in services inflation, signs look encouraging.

Growth in housing prices and rents, based on transactions, peaked in the first quarter of 2022 and have been steadily normalizing since. These changes are likely to show up in official price indices with a lag, and we’re now looking for signs of slowing shelter inflation in the first half of 2023. The travel and entertainment sectors are likely in later stages of normalization of supply and pent-up demand and could see improving price dynamics from here as well.

Wages Not Expected to Spiral Up

The labor market remains tight, and policymakers and investors worry about higher-for-longer inflation from rising wages. The relationship between wage growth and services inflation has been relatively weak, especially post-2010. Other forces are also at play in service-sector pricing, such as oil (transportation) and technological change (communication services and financial services).

Moreover, we think job growth should continue to moderate, given that gaps in pre-pandemic employment levels have mostly closed. Sectors where labor force growth had significantly exceeded pre-pandemic levels, such as retail and transportation, are now seeing either significant slowing or declines. While wage growth is elevated versus history, it has lagged inflation in 2022 and seems to be peaking as companies attempt to control costs in a tough economic environment. As a result, we do not yet see a wage-price spiral.

With supply-demand imbalances resolving and corporates now dealing with excess inventories, we expect goods prices to remain disinflationary. We’re monitoring services broadly to see when shelter inflation may roll over—which most data suggest—and whether non-shelter services inflation can normalize as the pandemic’s impact continues to fade.

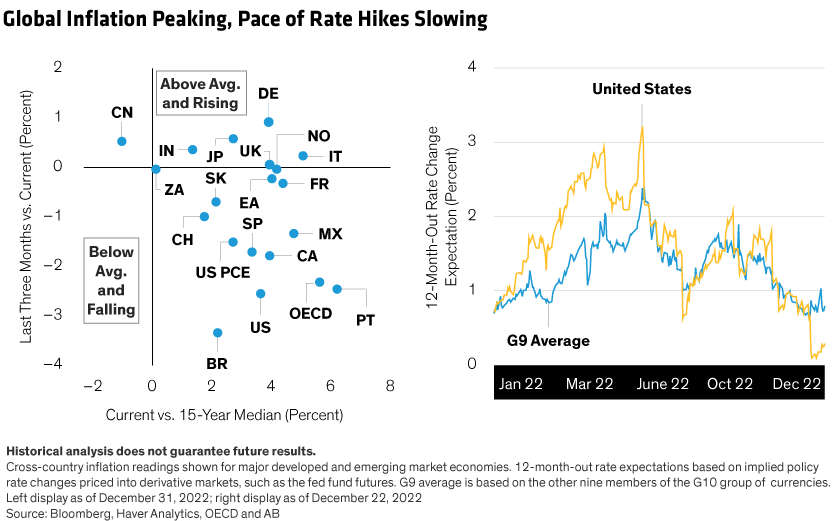

While there are some regional differences, the general trend of decelerating inflation from elevated levels holds across several economies, including Canada, Spain and France, while Japan continues to see rising inflation (Display left). Market pricing suggests that terminal rates—the point when central banks stop hiking—are getting closer, especially for the Fed (Display right).

More Focus on Weakening Economic Growth Is Likely

As tighter financial conditions take effect and pent-up demand fades, economic growth will probably continue to slow—though full-blown recession isn’t a certainty. Elevated consumer goods and tech inventories are still weighing on manufacturing activity, although these headwinds may fade in coming months. Meanwhile, capital spending intentions have weakened, pointing to a significant slowdown from 2022’s elevated growth.

China’s easing of zero-COVID policies is progressing much more rapidly than initially expected. Authorities have signaled that clampdowns on big tech companies are wrapping up and are easing some of the tougher policy measures on the property market. As economic activity normalizes, China is likely to become a driver rather than a drag on global growth, offering attractive opportunities in 2023.

Portfolio Implications of a Post-Peak Inflation Climate

The peak in inflation and policy-rate expectations, if confirmed, are positive signals for equity and sovereign bond exposure, especially among higher-quality assets with strong fundamentals and earnings power.

In previous high-inflation episodes, short-term inflation momentum was a strong timing signal for both stocks and bonds. As markets gain confidence in central banks’ ability to curb inflation, longer-term sovereign bonds could become attractive sources of income, despite flat to inverted yield curves. Given the rapid pace of China’s reopening, diversifying into an overweight exposure to emerging-market equities relative to developed markets also seems to make sense.

Over the course of 2023, as inflation normalizes, the focus of investor fears will likely shift from inflation to growth, which is what the decline in the 10-Year US Treasury yield from its 4.2% peak appears to be signaling. That means markets should remain highly dynamic, and multi-asset investors need to closely monitor both inflation and growth trajectories.

As economies approach a landing point, investors will need to balance the pursuit of inflation resilience, in case prices rise again, with growth potential as market fundamentals further strengthen. The path back to normal could still prove a bumpy ride, and investors may want to reduce portfolio risk if they’re sensitive to elevated volatility.

Related: Emerging-Market Equities: Can the Bounce Be Sustained?