Written by: Gabriela Santos and Tom Murray

Inflation has been a hot topic amongst investors. Globally, inflation is expected to rise this year from 2020’s low levels. This reflation, a sign that the economy is operating above potential, should lead to strong earnings growth as well. In particular, more cyclical companies stand to benefit most – a powerful catalyst for international markets, which are more cyclical in nature. Internationally, leaning into financials, materials and industrials is a way to position portfolios for the global recovery and to hedge a potential overshoot in inflation.

The pandemic’s initial effects proved to be disinflationary, as demand for services and commodities plunged. This year, pent-up demand is set to be unleashed, fueled by the reopening of activity and fiscal stimulus. As the global economy operates above potential, inflation should move higher. While the debate will continue as to whether a structural shift has taken place, the cyclical uptick in inflation should lead to a surge in nominal economic growth.

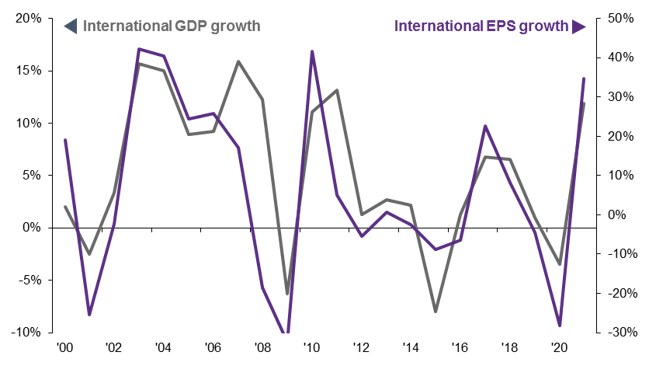

In such an environment, corporate earnings growth should be strong as well, with consensus expecting 35% earnings per share growth for the MSCI All Country World ex-U.S. index in 2021. This compares with expectations of 25% growth for the S&P 500. The greater cyclicality of international markets explains the difference: cyclical sectors make up 57% of international markets versus only 38% of the U.S. It is exactly sectors such as financials, materials and industrials whose earnings are the most geared to nominal economic growth. As we argued recently, this suggests international stocks have room to continue to outperform.

A move higher in inflation offers significant opportunities for International Investors:

- Financials: The prospect of rising inflation and steepening yield curves is a positive for earnings in the much maligned banking sector, and with capital positions built through the uncertainty of the pandemic a further opportunity arises to reward investors through capital return.

- Materials: Direct benefits from inflation should be seen within the mining sector, where years of depressed prices has created limited growth in supply. With low visible inventory and the potential for significant demand growth we can see physical markets tighten for key commodities, directly benefiting the producers of those metals.

This inflationary pulse is further supported by the structural growth in demand for some metals, such as copper, from the global drive to decarbonization. Electric vehicles are 4-5 times more copper intensive than a traditional engine, and the transition to renewable energy will drive demand for transmission and distribution of that energy. As renewable energy grows from 7% of global demand to 25% by 2030, there is a huge opportunity for international companies to benefit.

- Industrials: Fiscal stimulus and economic recovery should support an increase in activity across the industrial landscape. We will likely see significant investments in renewables, parts of the commodity complex, factory automation, construction, and the semi-conductor industry, which international companies are well placed to benefit from.

International earnings set to soar as nominal growth surges

Year-over-year, world ex-U.S. nominal GDP and MSCI ACWI ex-U.S. EPS, U.S. dollars

Source: IMF, FactSet, J.P. Morgan Asset Management. 2021 includes an IMF forecast for GDP growth and IBES consensus estimates for EPS growth. Data based on IMF World Economic Outlook as of April 2021. Data are as of April 7, 2021.

Related: How Could Vaccine Hesitancy Affect the Global Recovery?