Written By: Tim Benzel, CFA, VP & Sr. Portfolio Manager

Asset prices were choppy last week, as investors continue to assess fundamental and relative value in what we described in our most recent post as the transition to Phase II of the present crisis.

During this time, we have fielded many questions from clients surrounding municipal credit quality. With the economy grinding to a halt, more and more articles have emerged in the press regarding various municipalities and their ability, or lack thereof, to cope with the sudden drop-off in economic activity.

The muni market has certainly not been immune to Covid-19 induced financial market volatility. We believe most of the downside price pressure in munis is attributable to forced selling from large mutual funds and ETFs, as investors have requested the redemption of large chunks of municipal holdings into cash. In order to clear the cash requests, perfectly healthy bonds, which are expected to survive the covid-19 crisis with minimal credit impact, are swept into valuation declines alongside credits of higher risk.

However, we will certainly see some municipalities struggle fundamentally to cope with the challenges posed by this environment.

We have spent the last several weeks scrubbing our holdings universe to re-examine the credit quality of each obligor we hold on behalf of clients. What came out of this exercise was the affirmation that our original underwriting thesis when we purchased these bonds, which is centered on obligors with stable to improving credit profiles in a stable economy, should also stand-up well in a declining economic environment.

In addition, there are multiple factors that we believe are important to consider when analyzing the muni market.

- Municipal bonds generally provide essential services to the public and have very strong legal protections for bondholders to assure payment.

- Municipalities generally operate with ample reserves, borrowing authority and operational flexibility, which allows them to navigate economic disruptions. In other words, municipalities can cut services or raise fees/taxes, or both, to keep budgets balanced and balance sheets strong.

- The federal government has acted to aid the economy in past crises and is acting now. The recently passed CARES act offers $400 billion in support to municipalities. Furthermore, the Federal Reserve has multiple programs currently in place to provide liquidity to the market and appears to be working on a plan to purchase municipal securities directly.

- There is very likely more Federal action to come in the form of a fourth congressional bill, where the focus appears to be on state and local government support.

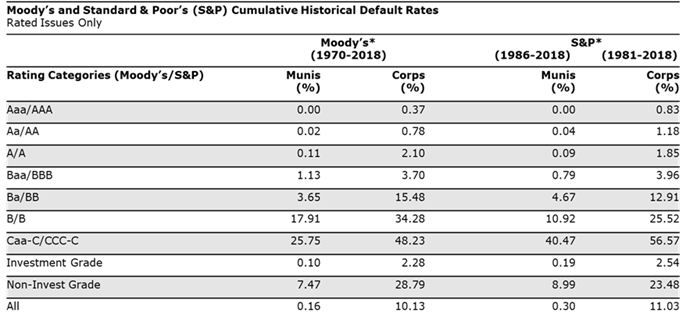

For context, the table below details default rates from Moody’s and S&P from 1970-2018. During this time, there have been several dramatic shocks to the economy and financial markets, with investment grade rated municipalities generally performing quite well.

Sources: Moody’s Investor Services (“Moody’s”) data through December 31, 2018, released August 6, 2019. Standard and Poor’s (“S&P”) data through December 31, 2018, released May 7, 2019.

We fully expect the dramatic headlines to continue over the next several weeks and months. And should new information come to light, we will not hesitate to take portfolio action to preserve capital. However, at this point, we believe our holdings are poised to stand up well in what has quickly become the most dramatic economic shock of our lifetime.

Most importantly, as we said last week, we wish all the best for you, your family and friends, and that you stay safe and remain in good health during this time.