Written by: David Lebovitz

My daughter is almost 3, and has two types of cries – signals and noise. If something is actually wrong, the cry is a signal. If she wants my attention, the cry is just noise.

Despite the horrible human and social impact, the conflict in Eastern Europe is currently noise for the market. Time will tell how things evolve, but the key risk is that higher commodity prices – and energy prices in particular – fail to be transitory. Russia is a major commodity producer, and further escalation of the situation could exacerbate supply chain disruptions and drag on global growth.

Meanwhile, the Federal Reserve (Fed) has sent a signal that policy normalization is coming. What investors are failing to realize is that the two cannot coexist. If the situation in Eastern Europe escalates further, the Fed will be forced to reconsider its pace of normalization. If not, energy and commodity prices will come off the boil and the Fed will proceed accordingly.

Profit growth will remain the key driver of returns, and the current environment will reinforce the momentum in value. Importantly, what is happening in Eastern Europe seems to be a modest risk for U.S. corporate earnings – the consumer staples sector is most exposed, with 1.7% of sales in Russia as of the end of 2021. Furthermore, bank exposure is manageable, as U.S. banks had about $15bn of exposure as of 3Q21. Given these dynamics, any earnings impact will be a function of indirect effects on global growth and consumer spending. However, if it becomes evident geopolitics or the Fed are weighing on economic activity, the parts of the market hit hardest year-to-date (i.e. technology and growth) may begin to show signs of life.

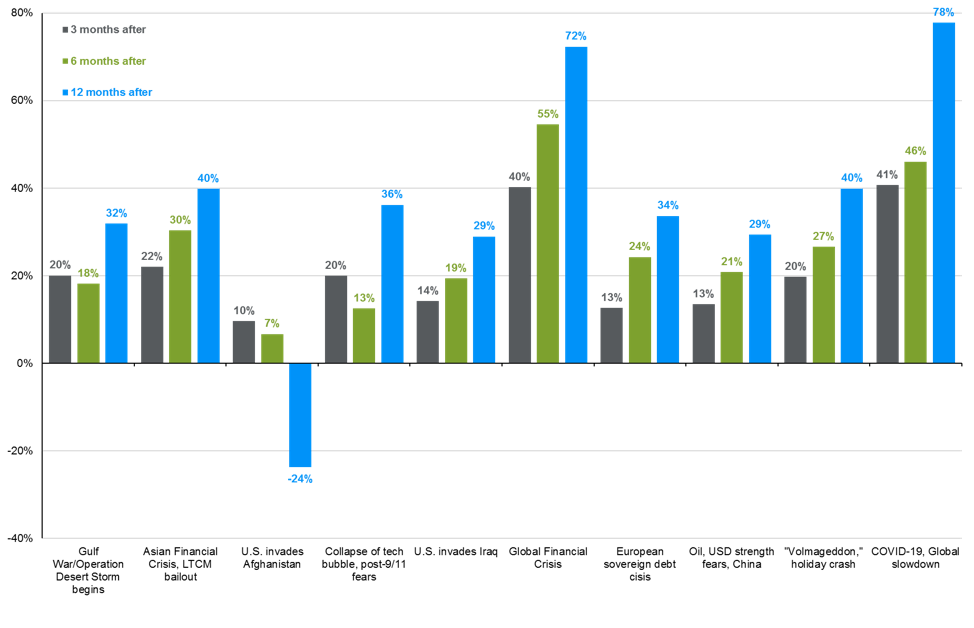

The chart below looks at S&P 500 returns after notable spikes in volatility. Unless the situation in Eastern Europe escalates to the point where it undermines the economy or the Fed commits a policy error, this sell-off is a buying opportunity. However, any recovery in equities will likely coincide with a decline in interest rate volatility, which seems unlikely to happen until we hear from the Fed in the middle of March.

Spikes in volatility typically represent buying opportunities

S&P 500 total return

Source: FactSet, NBER, J.P. Morgan Asset Management.

Related: How Would International Equities Perform During a U.S. Boom-bust Recession?