Written by: Eric Winograd

US core inflation likely will be volatile during 2021, as underlying economic forces continue to rebalance from the pandemic. The gap between actual and potential output will limit how much inflation can ultimately rise this year, leaving the Fed comfortable maintaining easy policy.

Here are four things investors should know about the path and patterns of US inflation over the course of 2021 and the next few years:

1. Base Effects Should Heat up Inflation During the Summer

Pandemic-related shutdowns caused unusual monthly inflation numbers. In March 2020, core consumer price inflation (CPI) was flat but then fell by 0.4% in April and 0.1% in May—the only back-to-back monthly decline in the past 40 years. Core CPI stabilized in June before rising by 0.5% in July and 0.3% in August.

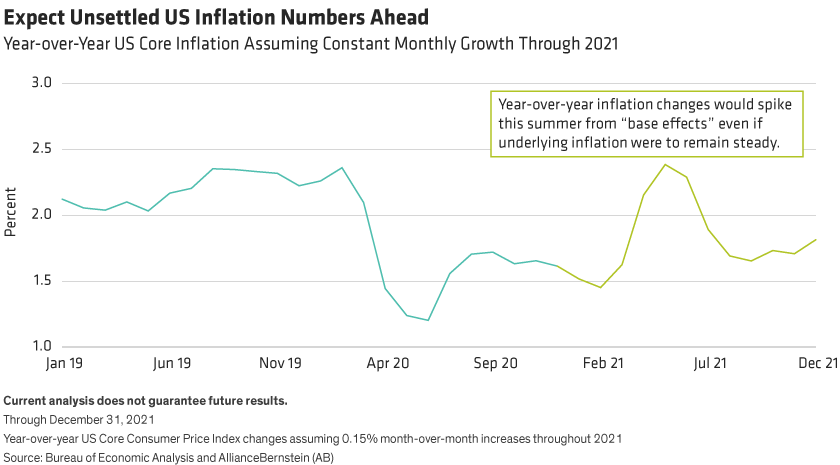

As those numbers leave the monthly data series, the year-over-year core CPI calculation will be volatile even if underlying inflation is steady. Even sedate monthly inflation of 0.15% through year-end would push year-over-year core CPI to almost 2.4% YoY in the summer (Display). This isn’t our forecast—it simply demonstrates the volatility of core CPI absent a pickup in underlying dynamics.

2. Underlying Pressure Should Pick up in the Second Half

The demand side of the economy likely will bounce back more quickly than the supply side, pushing month-to-month and quarter-to-quarter inflation up in the second half of the year even if year-over-year calculations start to fall in late summer.

With fiscal support aimed directly at consumers’ pockets, we doubt businesses will be able to keep up with a months-long spending wave once the economy reopens. They’ll need time to recalibrate resources and supplies to return to business as usual. When firms have more orders than they can fill or need to pay more to respond faster, they bump up their own prices, which boosts inflation.

We’re already seeing strain in the supply chain. Manufacturing subindices from the Institute for Supply Management, which measure things like order backlogs and supplier delivery times, are high and rising, which tends to foreshadow higher inflation. There’s a lag: even if supply constraints ease, as they eventually will, the constraints of the past few months will boost inflation over the next few months.

3. Once Supply Rebounds, Inflation Should Fall and Stay Subdued

It’s impossible to precisely forecast inflation, but we estimate core inflation running at 2.1% year over year by the end of the year and moving sideways. The short recession and massive policy support likely mean that the supply side suffered less damage than in most recessions.

That means supply constraints should ease in fairly short order, allowing core inflation to start cooling again as the output gap in the US economy tamps down price pressures. In our view, core inflation is likely to remain subdued until the output gap in the US economy has fully closed.

4. The Fed Likely Will Keep Policy Loose in 2021...and Be Slow To Tighten

The Fed’s policy response to rising inflation will be the key variable for asset prices once COVID-19 has receded. We expect the Fed to stay the course, keeping accommodation at full throttle all year even if growth is robust and inflation is rising. The central bank is more worried about tightening too soon than too late—willing to risk and even encourage an inflation overshoot to support stronger growth.

So, the Fed will stay loose all year and be very slow to tighten in the years ahead. The first step: gradual tapering of quantitative easing purchases during 2022, with communication starting later this year if all goes according to plan—in hopes of averting a 2013-style taper tantrum.

Rate hikes are still a distant prospect; tapering will take a full calendar year, followed by at least six months with no hikes. That puts the US economy well into 2023 before higher official rates seem like a reasonable possibility.

Related: Are Growth Stocks Attractive in a Post-Pandemic World?