What You Need to Know

As 2023 heads into its final quarter, the current period of market resistance is likely to persist. However, in 2024, the “resistance” theme we’ve been discussing should give way to economic “normalization.” As we see it, this should lead to more reasonable valuations, which will create opportunities for patient investors.

Download PDF

Key Takeaways

- As we close the book on 2023, the theme of “resistance” should transition to “normalization.” Despite a challenging second half of the year, our assessment of the capital-markets landscape still shows opportunities in the stock and bond markets.

- While equity market conditions remain less than picture perfect, we are still finding opportunities for investors. These include some of the more defensive sectors within areas like low volatility, high dividend and quality growth.

- Fixed-income yields are up across the board, and high-yield bonds look particularly appealing. In the tax-exempt space, we think munis could be poised for strong returns, given attractive yields and the stage of the monetary-policy cycle.

Prepare for Resistance to Give Way to Normalization

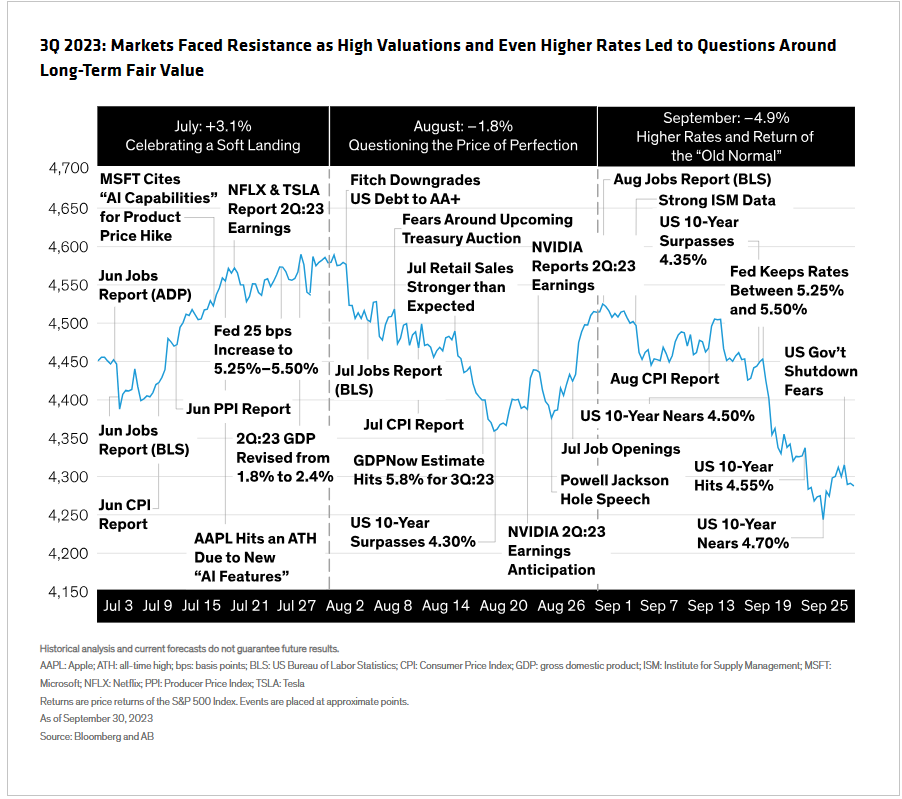

After a strong first half of 2023, markets struggled to sustain the rally in the third quarter, with returns mostly lower across asset classes. The period initially started strong as the rally pushed into July, but then cooled as we entered August; September brought a sharp sell-off in stocks as the longer end of the yield curve rose meaningfully (Display 1).

So what does the macro and market picture look like as the final quarter gets under way? First, inflation’s path lower will continue to not be linear. After bottoming this past June, headline inflation bounced higher during the third quarter. This bounce is expected to peak in December, before gradually settling near the Fed’s target later next year. Second, interest rates will remain higher than the post-global financial crisis era—a situation that increases the chances that a current unknown “breaks.” Finally, we expect economic growth to hold up, but to start to show signs of softening.

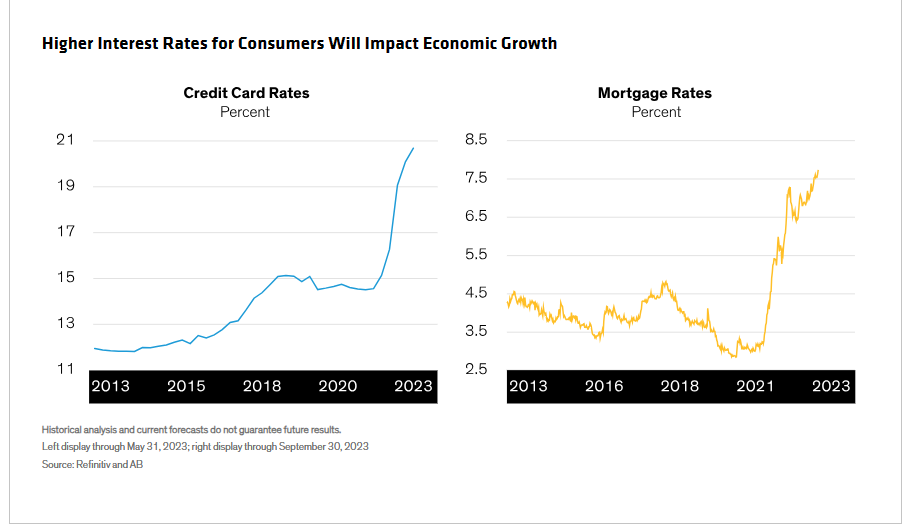

To keep a better eye on these three variables, the consumer bears watching. A tight labor market and receding inflation have bolstered take-home pay, but the sizable excess savings consumers built up during the pandemic are declining. Credit card rates have jumped by over 40% over the past two years, and mortgages are more expensive (Display 2). Both of these could create consumer-spending headwinds—a factor in our lower growth forecasts.

As growth slows, inflation declines to target and the labor market softens, we expect the Fed to start cutting policy rates during the second half of 2024. Lower rates should bolster bond returns and support equity market valuations—as well as lower uncertainty premiums.

Despite the more challenging returns we saw in the third quarter, our assessment of the capital-markets landscape still reveals opportunities in equity and fixed income.

Not an Ideal Equity Market—but Potential in the Right Neighborhoods

Corporate earnings will have a higher bar to clear than they did in the first half. While 79% of S&P 500 firms beat their second-quarter earnings-per-share estimates—well above five- and 10-year averages—the results didn’t really move the needle, given what investors had already discounted. And comparisons aren’t getting any easier.

On a positive note, valuations have softened from near-bubble levels as fears over inflation and growth have come back into focus. Higher-beta stocks proved they weren’t immune to mean reversion, as they hit a speed bump. Popular equity indices seem to be expensive and still concentrated in a handful of large stocks, but a closer look reveals opportunities beyond those big names.

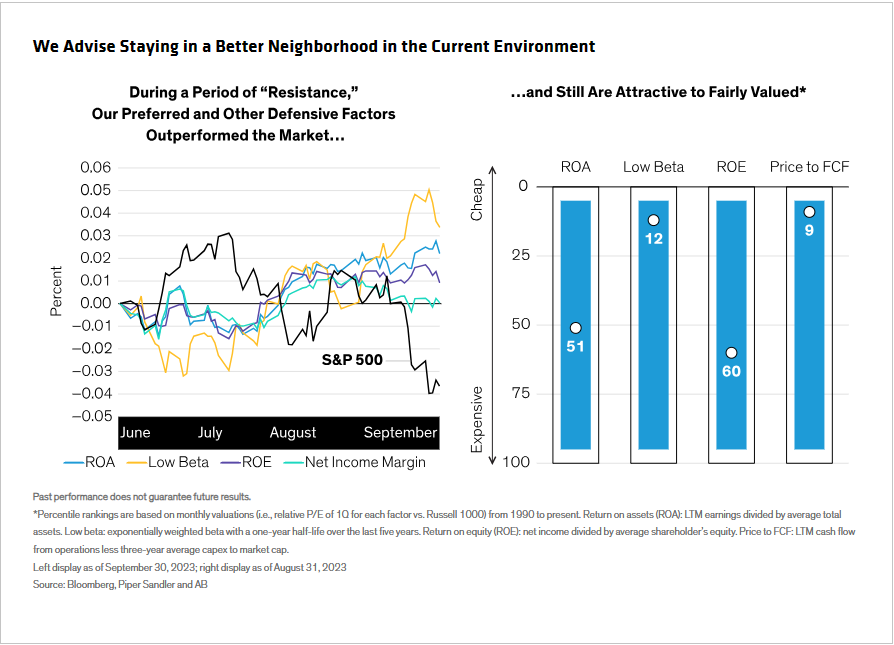

As investors seek out potential, we think it makes sense to stay in a better neighborhood in the current environment. A case in point: during the current resistance phase of the market, our preferred factors and other defensive factors were able to outpace the market and remain attractively valued (Display 3).

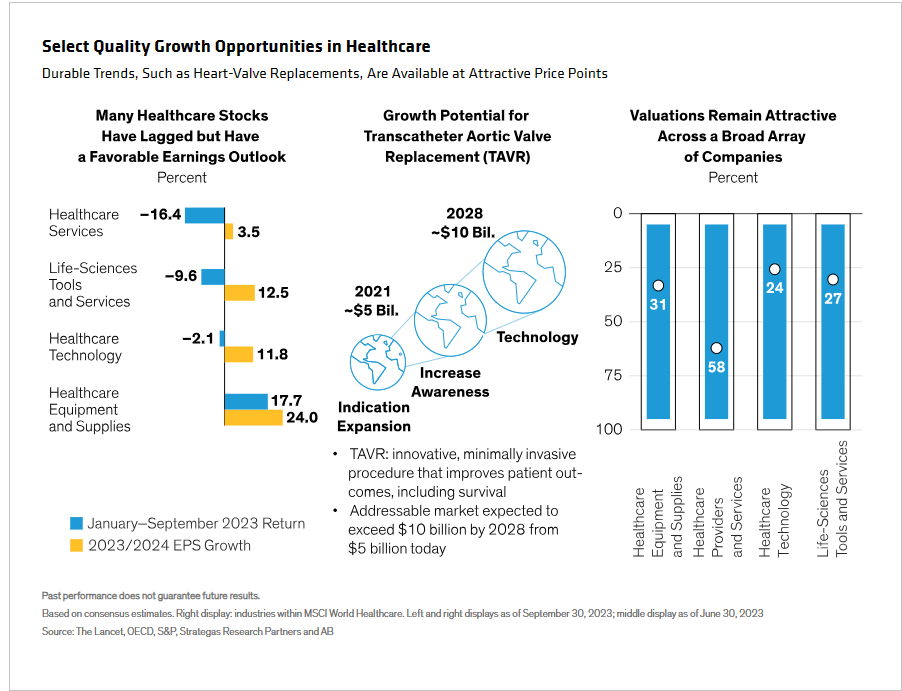

Though our base case doesn’t call for a recession, that’s not the same thing as calling for a recovery. That’s why we continue to emphasize a quality growth approach to equity investing. One place that focus leads us is to select healthcare companies (Display 4) doing business aligned with durable trends (such as heart valve replacements) at attractive price points.

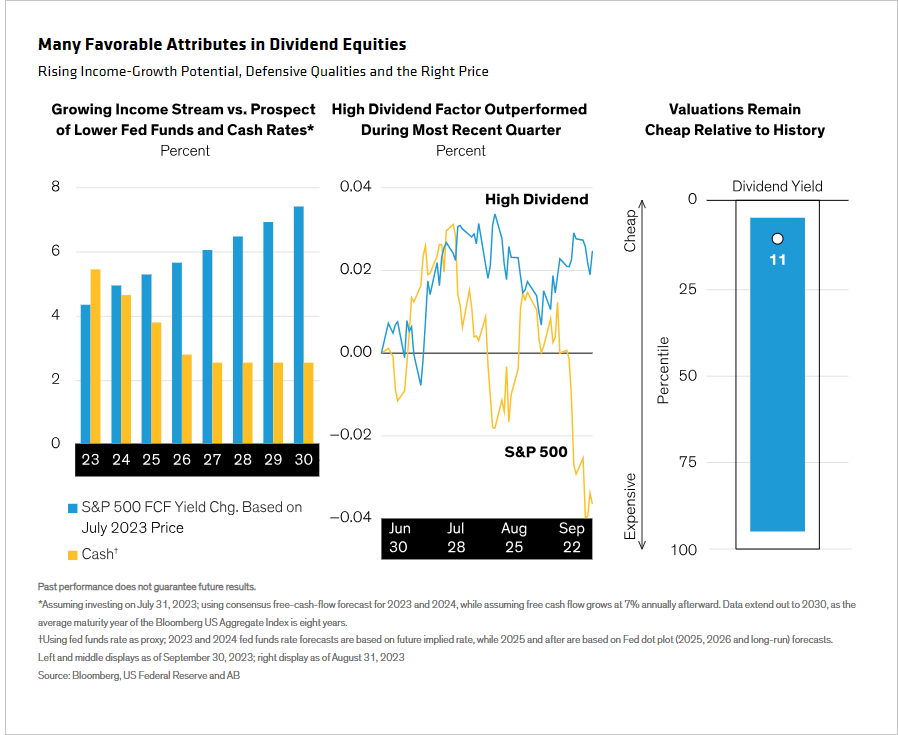

The prospects of higher-for-longer rates and the lower likelihood of Fed rate cuts should boost risk aversion. In a volatile world, return patterns matter more, and that makes the relatively attractive valuations of defensive sectors intriguing. We also think quality dividend-paying stocks are worth considering, given their rising income stream over time (Display 5), and value stocks seem to offer an attractive entry point for investors considering selective rebalancing into that equity style.

Attractive Bond Yields—Highlighted by High-Yield Bonds

Potential isn’t exclusive to equities in this environment—especially as yields remain high due to a multitude of fundamental and technical reasons.

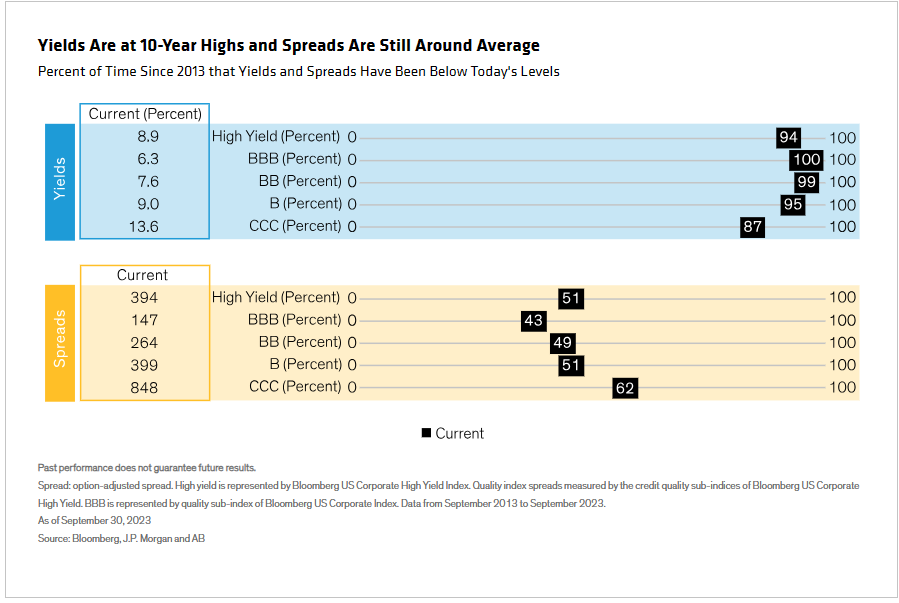

Yields on both investment-grade and high-yield bonds have climbed to levels rarely, if ever, seen over the last decade (Display 6).

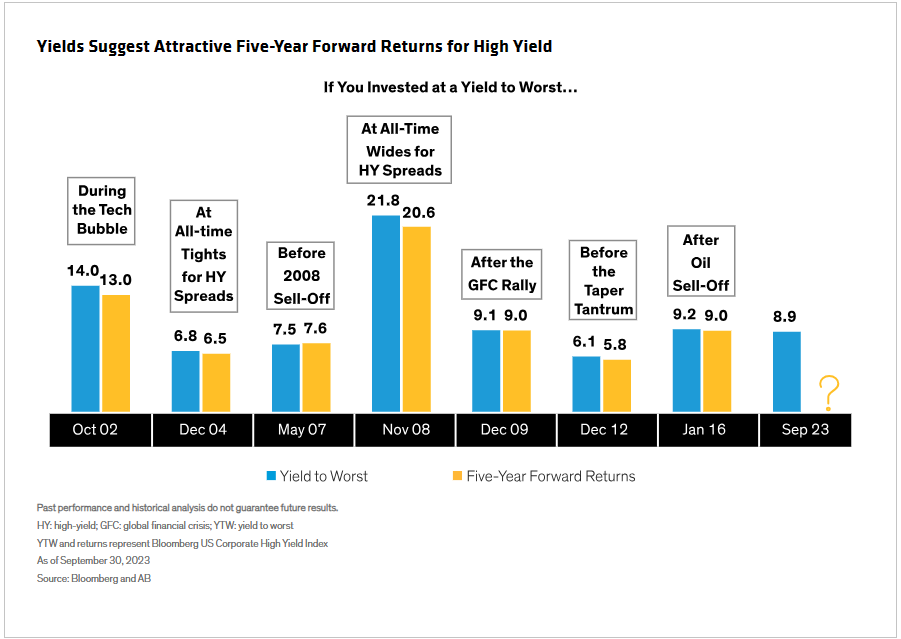

While there is concern that spreads are not wide enough for the potential risks we are facing, the good news is that yields alone have been highly predictive of forward returns (Display 7). However, we do expect those returns to be heavily front-loaded, with the bulk of returns coming over the next year or two. So time is a material factor in capitalizing on these opportunities.

Even as concerns of an economic slowdown persist, the underlying health of the high-yield space remains robust, especially as it starts from a stronger foundation compared with past slowdowns. Furthermore, only 10% of existing bonds must be refinanced in the next two years, reducing the risk of issuers being compelled to refinance at more costly rates. And while CCC-rated bonds typically bear more default risk, they make up a very small portion of bonds coming due in this two-year window.

Municipal Bonds: Set Up for a Strong Run?

On the tax-exempt side of the fixed-income world, municipal bond yields followed Treasury yields higher in the third quarter. Outflows from the market increased, causing after-tax yield spreads to rise substantially: at the 10-year maturity, yields climbed from the low 40-basis-point range to the mid-70s.

Muni credit investments were a bright spot, as declining credit spreads fueled outperformance. While spreads are lower now, they’re still above historical averages. The supply outlook could also offer support, with relatively low issuance leaving demand to chase fewer bonds. We think this environment creates an attractive entry point: high yields, cheap valuations and wide credit spreads.

The muni yield curve currently features high yields on shorter-maturity bonds and a steeper slope in the 12- to 20-year maturities, enabling investors to add duration exposure using a “barbell” maturity structure. A strategy that combines exposures in those two maturity ranges to achieve an overall duration target has fared better through the first three quarters of 2023 than approaches targeting duration through a concentrated structure, or a “ladder” design.

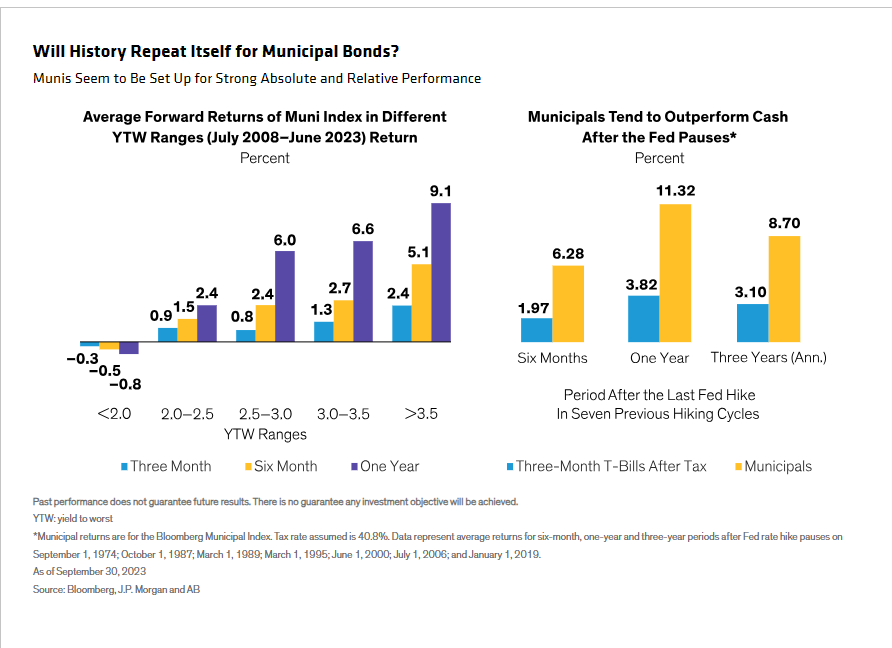

Given where yields and the policy cycle are today, we think munis are set up for strong performance. Yields have been in the range of 3.5% or higher over the past few months—and were above 4% at the end of the third quarter. Historically, munis have returned an average of 6.6% in one-year periods when yields were between 3% and 3.5%, and have returned an average of over 9% when yields were over 3.5% (Display 8). What’s more, they’ve historically beaten cash after the Fed has paused a cycle of rate hikes.

To sum things up, during this time of resistance, and as we head down the path toward normalization, we firmly believe that well-researched opportunities in capital markets can lead to favorable outcomes for patient investors.