Written by: Daniel Kurland, CFA, Senior Equity Analyst | Columbia Threadneedle Investments

KEY POINTS

- The obesity epidemic costs the economy billions of dollars a year in health care costs, work absences, lost wages and reduced productivity.

- A new class of drugs known as GLP-1 agonists has proved extremely effective at treating obesity, but they come at a high cost.

- Demand for GLP-1s is already robust and is expected to increase significantly, so health plan providers should weigh the costs and benefits of providing coverage.

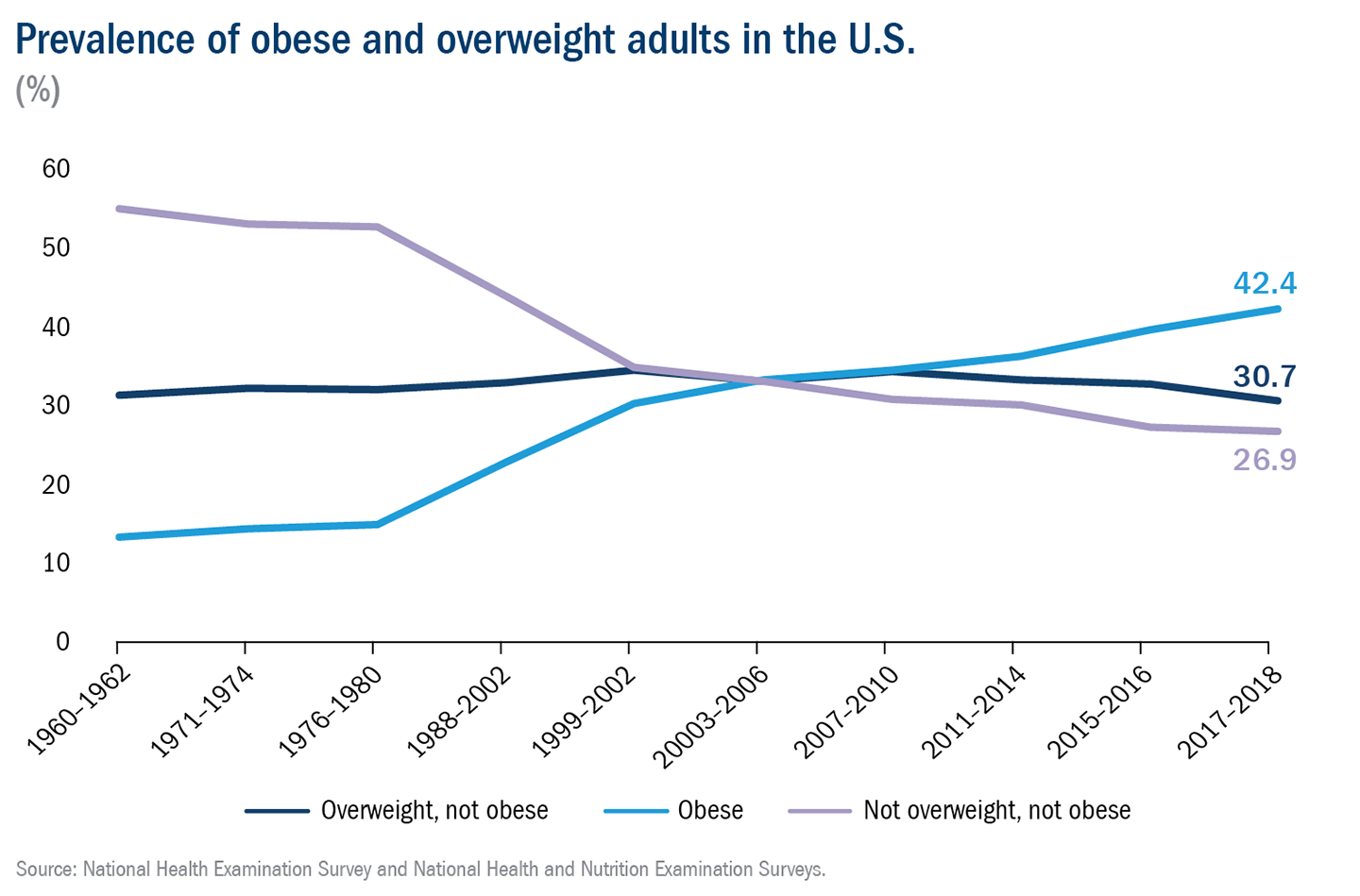

According to the Centers for Disease Control and Prevention (CDC), more than 100 million American adults (42% of the population) were obese and 80 million (31% of the population) were overweight as of 2018, when the most recent data are available. Globally, the World Obesity Foundation estimates that nearly one billion people are obese.

The obesity epidemic comes at a huge cost, not just to the individuals living with obesity, but also to the larger economy. While many of the adverse health consequences of obesity — such as increased risk for cardiovascular disease, type 2 diabetes and respiratory issues — are well-known, the financial consequences are, perhaps, underappreciated.

The Milken Institute sought to quantify the total cost of the obesity epidemic, and the numbers are eye-opening. According to their research, the direct health care costs attributable to high weight are approximately $500 billion per year. And that figure pales in comparison to the $1.2 trillion in indirect costs related to work absences, lost wages and reduced productivity. Together, the direct and indirect costs, which are borne by governments, employers, insurers and individuals, add up to 9% of U.S. GDP.

A chance to turn the tide

Given the size and scope of the issue, addressing the obesity epidemic could have positive benefits for individuals, corporations and the overall economy. After decades of increasing obesity rates and no drugs available to effectively treat it, we're starting to see options.

The class of drugs dubbed GLP-1 agonists, which were originally developed to treat type 2 diabetes, has recently proved very effective at treating obesity. In yearlong trials conducted by Novo Nordisk and Eli Lilly, diabetic patients taking GLP-1 drugs lost 15%-18% of their body weight. Non-diabetic obesity patients experienced even greater results, losing 16%-26% of their body weight.

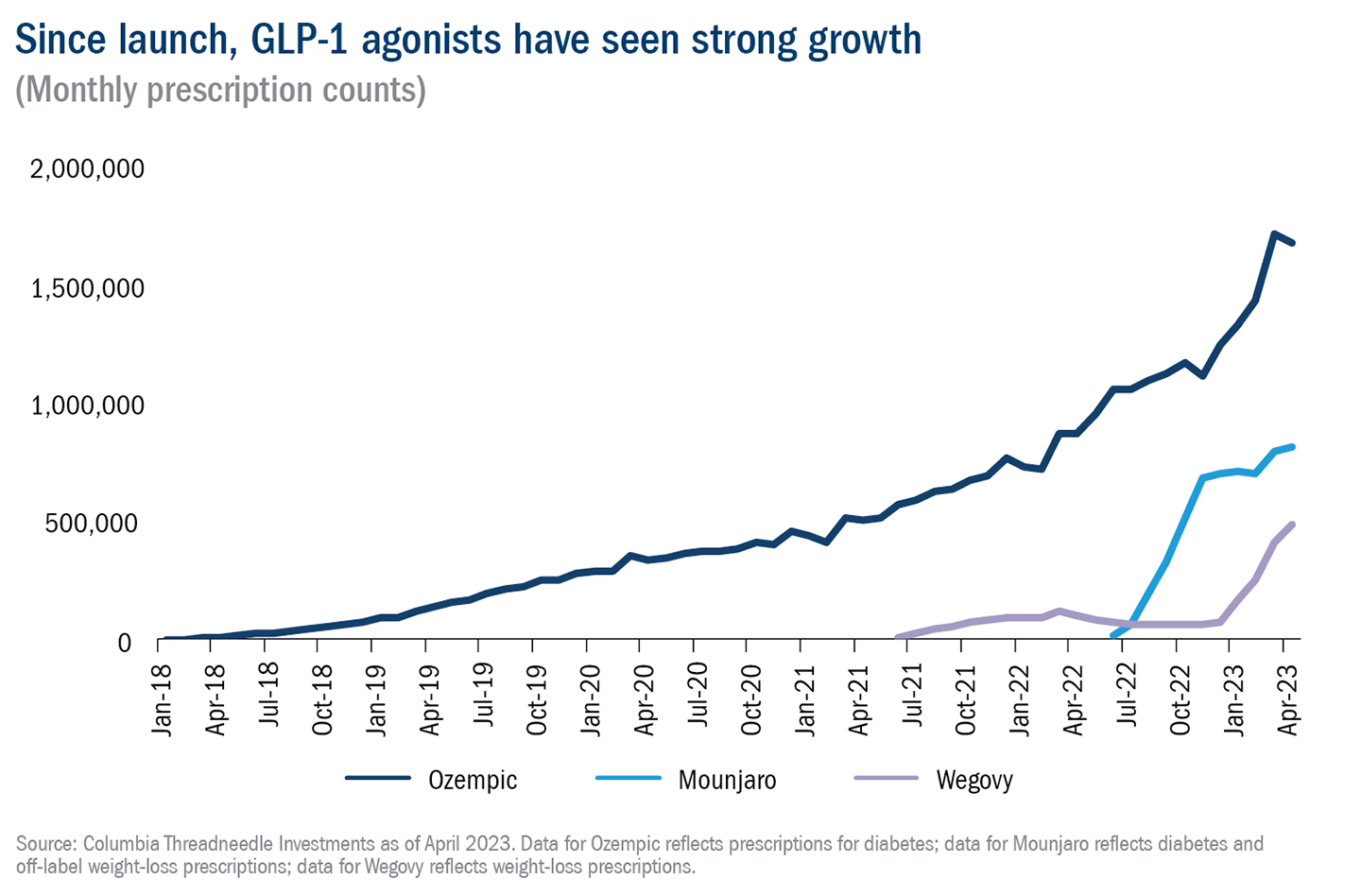

Unsurprisingly demand for these drugs has been soaring. Prescriptions have increased eightfold in three years, and approximately four million Americans are currently taking the latest generation of GLP-1s. Somewhat more surprising is how widely the impact of GLP-1s has spread across multiple sectors of the economy from drugmakers, pharmacies and insurers to food retailers, restaurants and more.

A strong runway for growth

The meteoric growth of GLP-1s has taken place despite supply constraints and high prices (prescriptions in the U.S. can cost as much as $1,400 per month). As with most drugs, we expect that prices will fall over time as a result of additional competition and increased supply. When prices do come down, demand is likely to increase accordingly.

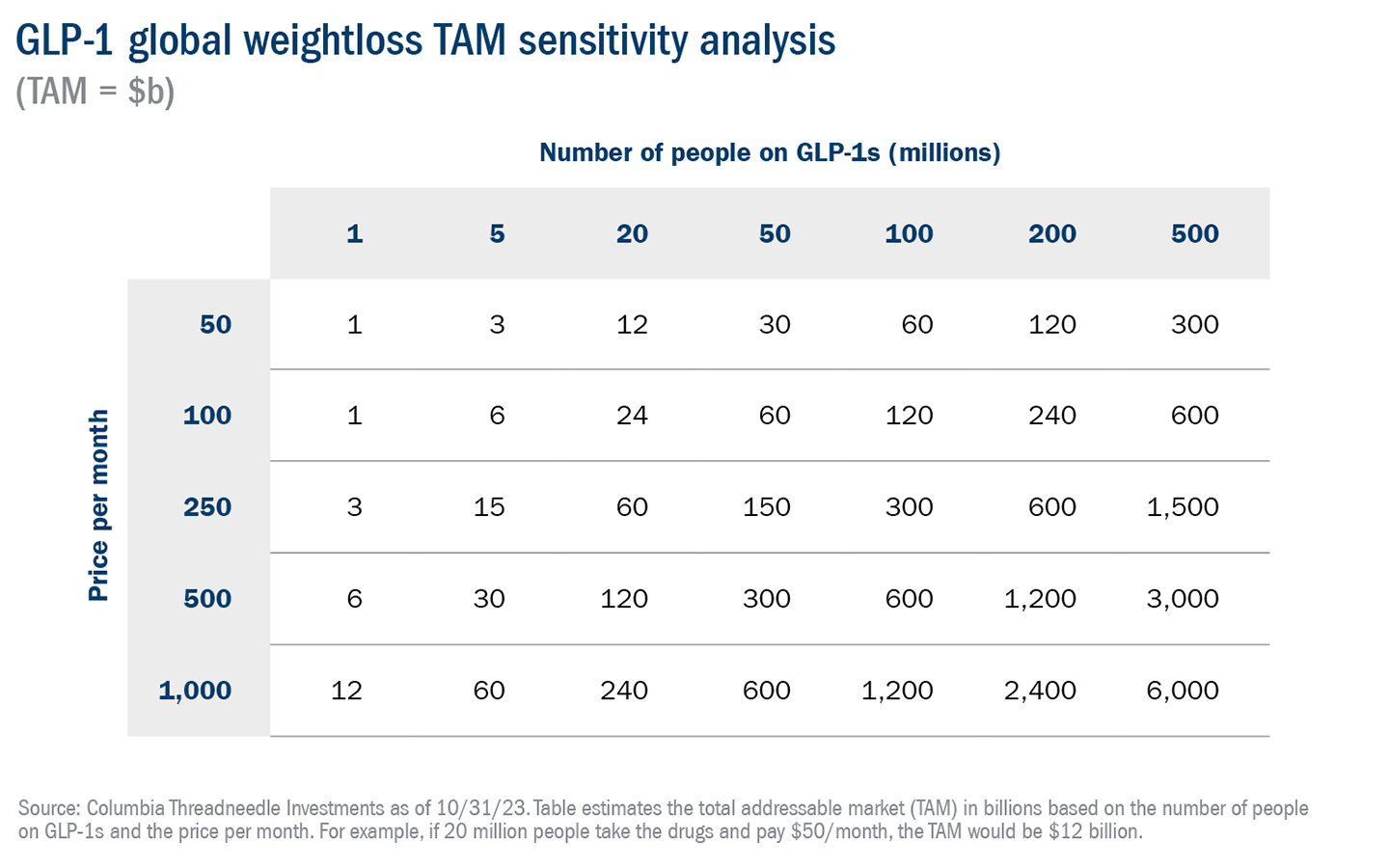

Consensus expectations forecast that the size of the GLP-1 market will double to $71 billion by 2027, and it appears likely that the market could grow substantially from there. If just 20% of the world’s one billion obese people were to pay $100 a month for a prescription, that would equate to a total addressable market (TAM) of $240 billion, which is nearly 20 times larger than that of the world’s current top-selling drug, Humira. While $100 a month is substantially below the current price in the U.S., it is roughly in line with the cost in Europe, and we believe it is a reasonable long-term estimate for the global price.

In addition to their proven success in treating obesity, GLP-1s have demonstrated promising results in preventing other serious ailments, including strokes and heart failure, and trials are underway to gauge their effects in treating Alzheimer's, sleep apnea and kidney disease. If GLP-1s are approved in even one of these areas, the market for these drugs will expand and growth could accelerate.

A choice for health plan providers

As the market continues to grow, and more people want access to these life-changing drugs, health plan providers need to decide whether or not to cover the cost for their plan participants. Most insurers are not covering weight-loss drugs unless required to by state law, so there are limited cost risks for commercial insurance.

Currently, GLP-1s are not covered for weight loss by Medicare; for those with access to Medicaid, 10 states require coverage of GLP-1s for weight loss. In a recent survey, 25% of employers indicated that they currently offer coverage of GLP-1s and 40% indicated that they plan to offer coverage in 2024.1 At up to $1,400 a month per patient, GLP-1s represent a major cost for plans that do cover them, but, as we noted above, that cost should decrease dramatically over time.

Of course, one of the reasons that some companies are willing to cover the drugs despite the high cost is that GLP-1s can bring meaningful benefits, including healthier, more productive workers; lower absenteeism; and potentially reduced spending on other drugs and procedures related to obesity, from diabetes to heart attacks.

As with many choices regarding drug coverage, the costs for health plan sponsors come in the present, but the payoffs take place in the future, and they are hard to quantify at this time. Ultimately, the decision on whether to cover GLP-1s will also include factors that are unique to each organization, including the size, age and health of the workforce; employee turnover rates; the benefits currently offered and the cost of those benefits; and the state of the balance sheet.

Given all that is at stake, and how big the market for GLP-1s is forecast to grow, health plan providers should be having conversations today with insurers, pharmacy benefit managers and industry experts about whether it makes sense for them to include coverage for GLP-1s.

Related: Birkenstock Exceeds Revenue Expectations: Stylish Sandals Satisfy Fashion Enthusiasts

1 ir.accolade.com/news-releases/news-release-details/glp-1-coverage-employer-plans-could-nearly-double-2024