Technology isn't just a premier growth destination, nor is it simply just the largest sector weight in the S&P 500.

It's a sprawling sector home to stocks with an array of industry and sub-industry classifications. Another way of looking at the scenario is that advisors have a dizzying amount of tactical ideas to mull over in the technology sector on behalf of clients. That universe is growing at warp speed, meaning adaptability with technology allocations is paramount for clients.

Still, one of the backbones of investing in futuristic tech is semiconductor stocks – long a mainstay of investing in this sector, particularly on the mature, older company side of the ledger.

For multiple reasons, not the least of which is the current global chip shortage that's commanding so many headlines, it's practical for advisors to discuss the current state of semiconductor opportunities when talking tech with clients.

Impressive Track Record

Past performance is never a guarantee of future returns, but the track of semiconductor stocks is undeniably compelling as the group has long been a driving force of the broader tech sector's stellar long-term returns.

“The PHLX Semiconductor Index (SOX) was launched on December 1, 1993, and has enjoyed a storied history, becoming one of the best-known and most widely-tracked subsector indexes,” according to Nasdaq Investment Intelligence. “During the 2010s, SOX returned 513% on a total return basis, besting even the Nasdaq-100 Index (NDX) which soared 426%.”

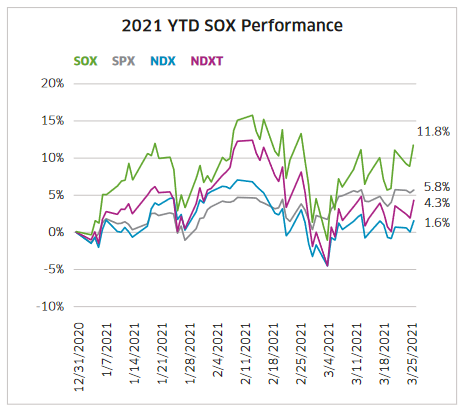

It happened again last year as SOX topped the Nasda-100 by 500 basis points and as the chart below indicates, chip stocks started 2021 in impressive form as well.

Courtesy: Nasdaq

“SOX has outperformed both the Nasdaq-100 (NDX) and the S&P500 (SPX) in the first three months of 2021, with a gain of 11.8% (price-return basis),” notes Nasdaq Investment Intelligence. “Even the Nasdaq-100 Technology Sector Index (NDXT) has not kept pace with SOX, which is still in the midst of the longest-running and sharpest streak of outperformance in its history.”

How good has the benchmark semiconductor gauge been on a recent basis? For the 12 months ending the close of the first quarter 2021, not one of the index's 30 components delivered negative returns – a feat made all the more impressive when considering that period includes the coronavirus market swoon of March 2020.

Looking Ahead

With the aforementioned statistics, advisors certainly have the tools to regale their clients with tales of past chip stock success. Of course, what really matters is what's yet to come. On that front, semiconductor stocks and funds check a lot of positive boxes for clients because chips are integral to the success of so many emerging growth technologies.

SOX components “have been riding a wave of increasing demand for their products, which power an ever wider array of devices thanks to the rise of Cloud Computing and the Internet of Things (IoT),” according to Nasdaq. “As more devices connect to the cloud, there will continue to be a need for ever smaller and more powerful computer chips and processors.”

Thinking about all the advances being made with concepts such as cryptocurrency, data centers, gaming, mobile phones and more, and it's easy to see why so many SOX components are forecast to deliver double-digit top line growth over the next several years. That makes it easier for advisors to discuss chip stocks with a broader client audience.

Advisorpedia Related Articles:

How Advisors Can Offer Clients Alternatives to Domestic Small Caps

An Effective Way to Fight Inflation in Client Portfolio

Like Chocolate and Peanut Butter, Growth, Value Better Together

Correlation, Dispersion Say It's a Good Time to Embrace Sector Investing