Interest rates are certainly rising, but that's not deterring income-hungry investors from embracing high dividend sectors and funds.

It's a strategy delivering mixed results through the first four months of 2021. Looking at the sectors with reputations for above-average payouts and bond-like traits, the trio of consumer staples, real estate and utilities are all higher year-to-date. Using the S&P 500 sector indexes as the gauges, only real estate – likely owing to a recovery from the coronavirus plunge of 2020, is topping the S&P 500. Consumer staples and utilities are up an average of 5.45% while the S&P 500 is higher by 12%.

Staples and utilities are defensive sectors. As has been widely noted, cyclical value fare is what's in fashion right now. Those two sectors are, historically, negatively correlated to interest rates. In other words, it's practically a perfect storm to avoid those groups and it can be said the aforementioned performance data isn't all that bad against what's clearly a challenging backdrop.

Clients still need and want income. Fortunately, news on the dividend frontier is good to start 2021 and expected to remain that way throughout the year, meaning payout growth, not yield, should be taking center stage in equity income conversations with clients.

Rising Rates Don't Always Ding Stocks

Stocks with enviable track records of payout growth have myriad advantages, including lower volatility (seen last year and time and again before that) and the ability to deliver for clients regardless of interest rate gyrations.

“Dividend growth strategies focused on companies with the longest track records of consistent dividend growth tend to be all-weather strategies that have performed well during a variety of interest rate environments,” according to ProShares research. “They may contribute positively to performance through both price appreciation and growing income streams, even when interest rates are rising.”

Advisors know the basic fact that when interest rates rise, most bonds, excluding some fixed income segments with variable rates and other hedging mechanisms, aren't responsive. Bonds with fixed rates are vulnerable to rising rates, but that isn't true of equities.

“A bond paying fixed coupons is defenseless in the face of rising rates—when rates rise, bond prices typically fall,” says ProShares. “Stocks, however, are different. Earnings grow. So too can dividends. It is the battle between growth and higher discount rates that can muddle the relationship between stocks and rising interest rates.”

One way for advisors to convey to clients why the time is still right for equities, including dividend growth names, is the low starting point from which the current surge by 10-year Treasury yields started. History confirms that the lower the initial yield in a prolonged move higher, the better stocks perform. The higher the starting point, the weaker equities perform.

Dividend Growth Is the Way to Go

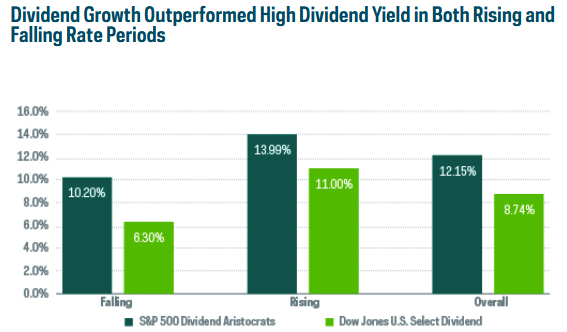

For clients that can't kick the high dividend habit, perhaps the following nugget will convince them. The S&P 500 Dividend Aristocrats Index, which requires components to have minimum dividend increase streaks of 25 years, is higher by almost 13% year-to-date and frequently tops high dividend benchmarks during periods of rising rates, as the chart below indicates.

Courtesy: ProShares

But wait. There's more.

“Interestingly, dividend growers have outperformed high dividend yielders during both rising and falling interest rate periods, which can make them an all-weather strategy capable of performing well under a variety of interest rate regimes,” adds ProShares.

For the clients that need a bit more convincing, it's worth noting that the S&P 500 Dividend Aristocrats Index sports a higher yield than 10-year Treasuries and that dividend growth historically beats inflation, a relevant consideration for advisors and clients today as consumer prices rise.

Advisorpedia Related Articles:

Put the Top Down to Convertibles Upside as Rates Rise

There's Value and There's Deep Value. The Latter Merits Looks, Too.

With Value in Style Again, Advisors Should Size Up Shareholder Yield

It's Not Too Late to Bank on Bank Stocks