Here’s some of the worst marketing advice a financial advisor can ever receive:

“Build your brand.”

For context, let me share a little bit about me and why I’m writing this article…

My name is James Pollard. I’m the founder of this website, and I'm the host of a podcast literally titled Financial Advisor Marketing. It has more than 100+ episodes about how financial advisors can build better businesses and get more clients.

I have also been directly responsible for thousands of financial advisor advertising campaigns. I’m best known for my email marketing campaigns, as I’ve sent and tested millions of emails in the past few years.

In addition, I write what is arguably the most prestigious financial advisor newsletter in the world: The James Pollard Inner Circle. I’ve noticed that the most successful financial advisors follow the advice outlined in this article while unsuccessful financial advisors are drawn to branding's siren song like moths to a flame.

Now, what exactly IS “branding”?

Here’s the definition straight from the Cambridge Dictionary…

Traditional branding revolves around a visual identity. Your visual identity is built around things like your website, your product/service presentation, and your logo.

Think of some iconic logos. Apple, Coke, and Nike come to mind for me. But are the logos (each company’s visual identity) their brands?

I don’t think so.

Because I believe the REAL definition of branding is how people perceive you.

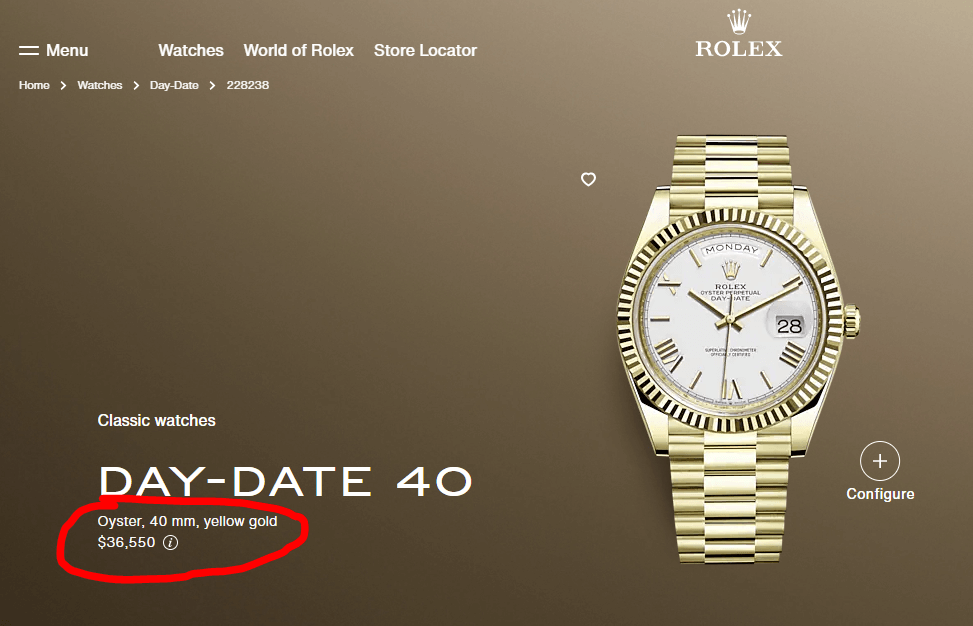

Imagine you’ve won one of two watches, and you get to pick which one you’ll flaunt on your wrist. Both watches are identical in every way - in size, shape, color, etc. - except one is a Timex, and the other is a Rolex.

Which one would you choose?

If you chose Rolex, it’s because you perceive it differently than Timex. Rolex generally signifies prominence, status, and distinction.

You’d have to be smoking the funny stuff to pay $3,000 for a standard Timex. Yet, if you found a $3,000 price tag on a Rolex Day-Date 40 in yellow gold (which retails for $36,550), you’d be a fool not to snatch it up.

PERSONAL Branding Is Key...

To be fair, most of the typical brand-building advice works well for large companies selling widgets to the general public. It also works well for companies with so much money that they have exhausted all other marketing strategies.

For example, Coca-Cola’s advertising expenses were $4 billion in 2020. Yes, that’s four BILLION dollars. At that level, they're working with so much money that they're forced to engage in brand-building because they've exhausted their alternatives.

But the financial advice industry is different. Because people do business with people. And even as robo advisors proliferate, a huge segment of the population wants to work with a real person.

Fortunately, marketing for financial advisors is deceptively simple…

Because the goal is to spend a dollar with the expectation of getting more than one dollar back.

Not building a brand…

Not generating goodwill…

And NOT “getting your name out there”.

Sadly, some financial advisors believe they have to market their businesses like Coca-Cola, so they waste lots of money in different areas.

If you want to succeed, you CANNOT make this fatal mistake. Because big companies have all sorts of reasons for the way they advertise, such as:

- Pleasing their stockholders. (Even though these people know next-to-nothing about how to make marketing pay.)

- Looking good for the media.

- Winning awards for advertising. (The only “award” I want to win is the one with Benjamin Franklin’s face on it.)

- Get clients.

That’s why the only brand I think you should build as a financial advisor is your PERSONAL brand. In my experience, there are two highly effective ways to build your personal brand…

First, is to have a specialty.

According to CEG Worldwide research, 70% of financial advisors earning $1 million or more per year focus on a particular niche. If you’re interested in reading about the best niches for financial advisors, here is an article I wrote about the topic: 5 Best Niches For Financial Advisors

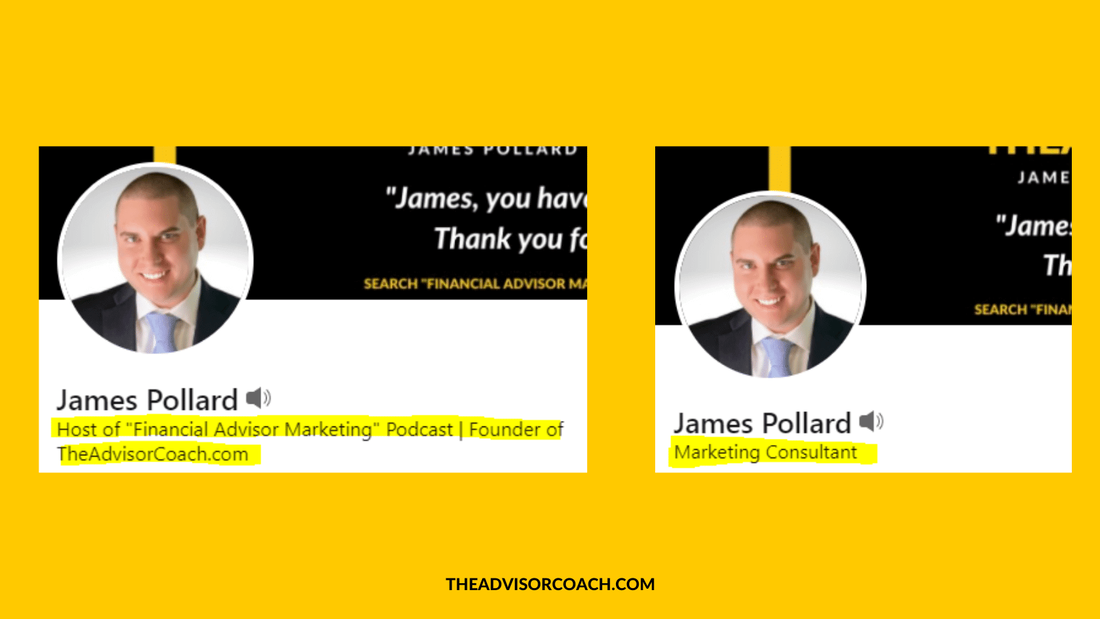

Having a niche makes nearly all marketing more effective. For instance, the most valuable piece of LinkedIn real estate is your headline. Compare these two headlines…

“Marketing consultant” is vague. I could be a consultant to many different industries, ranging from logistics to chicken farming. However, since my headline clearly states that I work specifically with financial advisors, it makes it far more likely that financial advisors will pay attention to my content. In other words, if a financial advisor is scrolling through LinkedIn and sees the words “financial advisor”, he or she will probably slow down and read what I have to say.

Let me give you another example, this time with email marketing…

Every so often, I will hear from financial advisors who ask me how to improve open rates.

To be candid with you, the more I learn about email marketing, the less I worry about opens. For example, there are several applications out there (like Outlook) that inaccurately track opens. Because if anyone is using some sort of “preview” feature, your emails aren't counted as opened. But that’s a story for another day.

Open rates don’t matter.

Appointments (and clients) do.

I’m not in business to get the highest open rates possible. I’m in business to help people who want to be helped. I encourage you to adopt this philosophy. Because you might find that the emails which set the MOST appointments have some of your LOWEST open rates!

It sounds strange to the uninitiated, but take a look at these two subject lines:

1. “Quick question for you…”

2. “How this 15-minute chat can help dentists with retirement”

The first subject line will almost certainly get higher open rates because it’s dripping with curiosity. People will see it and open it to see the question.

The second subject line will get lower open rates. Recipients will see it and think things like:

“I don’t want help with retirement.”

“I’m not a dentist.”

“I don’t want a 15-minute chat.”

HOWEVER…

The people who DO open the email will be immensely more qualified and thus more likely to set an appointment.

Why?

Because the subject line has primed them to do so.

The second highly effective way to build your personal brand is to share your values.

According to a study titled “Advisor Value Propositions”, conducted by BNY Mellon and Pershing, 63% of investors think all financial advisors make the same promises and have trouble distinguishing between them. Sharing your values is a great way to stand out from everyone else.

To be clear, having a niche AND showing your human side is a recipe for success. However, if you adamantly refuse to niche down due to fear or ignorance, this alone can still help you become far more successful than your peers

How do I know?

Because I’ve seen it in action.

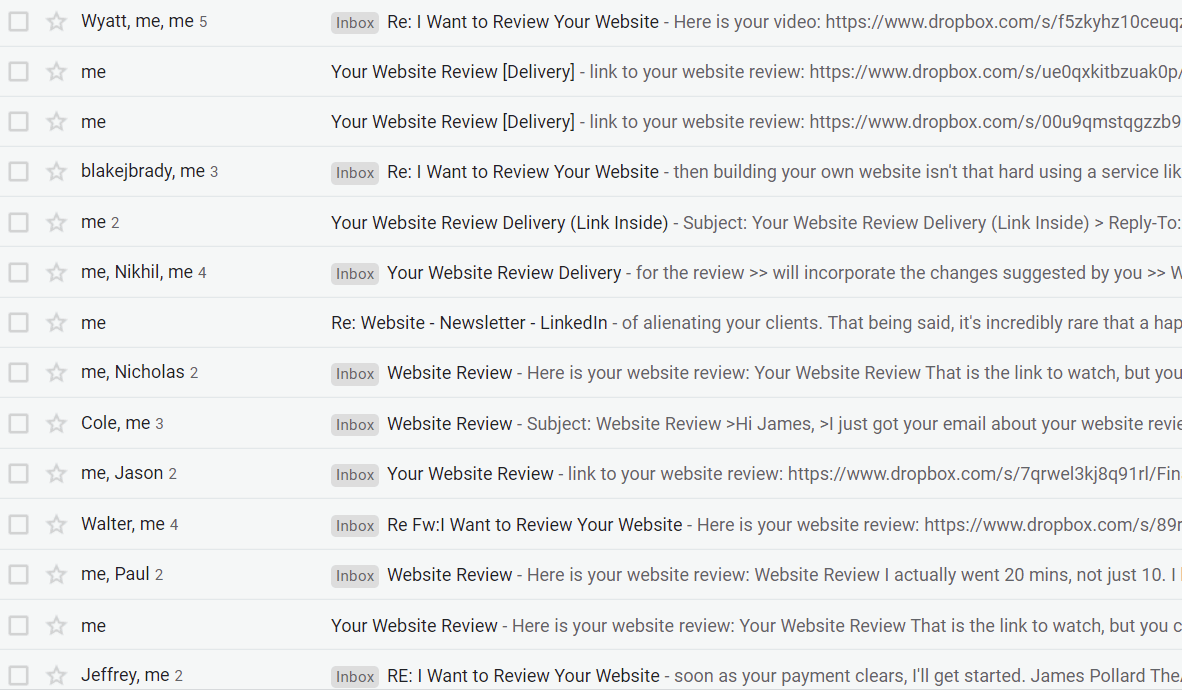

From 2017 to 2020, I offered a website review service. I would record a ten-minute video critiquing a financial advisor’s website for $497.

Financial advisors happily paid this fee because they knew my advice would be workable, tested, and proven.

After doing hundreds of these reviews, I noticed an irrefutable fact: the most successful financial advisors were the ones who shared their values on their websites.

I don’t mean they used hollow statements like “we operate with integrity”, either. I mean these advisors proved they lived and breathed their values. If they said "family" was important to them, they would talk about their families and even include photos. If they claimed freedom was their number-one driver, they would talk about where they traveled and what they’ve learned along the way.

(Today, I offer a video training called The Client-Getting Website, which is based on these website reviews.)

The data supports my findings, as well. Because another study, The CEB 2018 Client Experience Survey, surveyed investors and found that they want advisors to look out for their best interests. To be specific, “looks out for my best interests” was THE most valued advisor attribute in the entire survey. Here’s the takeaway you should have from this…

💡 The best way to demonstrate that you can look out for your clients’ best interests is to demonstrate you have some of the same interests!

Many financial advisors mistakenly believe that their “about us” page should be nothing but a recap of their experience and certifications. Some higher achievers will even include biographies of themselves. But almost nobody truly understands what I’ve just told you. Those who do are reaping the rewards.

The Branding Paradox..

Successful businesspeople who DON'T actively work on their brands generally have amazing brands.

That's because they focus on the RESULTS they generate.

I mean, really... do you honestly care what your doctor's logo looks like if you had a stroke and need help? Do you give a rat's hat about your mechanic's website colors when your transmission goes out? No! The only thing you care about is getting the result that's in it for you.

I think Jeff Bezos said it best:

A brand for a company is like a reputation for a person. You earn reputation by trying to do hard things well.

So, focus on your clients and prospective clients. Do great work for them and your reputation will take care of itself. When it does, your marketing will be more effective. It's a virtuous cycle.

Am I "Anti-Branding"?

A lot of people think I’m anti-branding. I’m not. I’m simply opposed to PAYING for brand-building.

Because building your brand should be a natural byproduct of venturing out into the marketplace and getting more clients. Any branding that occurs should be treated as a bonus.

I grew up studying direct response copywriting. Many of my heroes made their fortunes advertising products through the mail. Think about how tough these guys had it…

-

Their letters had to avoid getting thrown away with the “junk mail” pile. Gary Halbert, the man I consider to be the greatest copywriter of all time, famously said that people sort through their mail while standing over a wastebasket.

-

Their letters had to get opened. Just because a mailer avoids the junk pile is no guarantee it’ll be opened.

-

Their letters had to be read all the way to the end.

-

The recipients had to fill out an order form and insert it into the included “reply” envelope.

-

The recipients had to go outside to their mailbox (or worse, to the post office) to mail the reply envelope back to the sender.

I remember thinking to myself:

“Wow! If those guys could make money with all those obstacles, then surely I can run successful marketing campaigns online.”

If you’re running online ads, spending time on social media, or using email marketing, all you have to do is get people to click a link. Which means if you follow direct response marketing principles that are proven to work, you will have a solid foundation.

Critics of direct response marketing will say it has a short-term orientation while branding has a long-term orientation. They will use terms like “brand equity” to try to justify their thinking. But if 10,000 people see your call-to-action on LinkedIn, are you not building a brand? If 5,000 people get your emails every day, is a brand not being built along the way?

I want to win in the short term AND the long term.

It’s something to think about. I hope this helps you. If you want more, I encourage you to check out my podcast by searching “Financial Advisor Marketing” wherever you listen to podcasts.

Related: 20 Things I Wish Financial Advisors Knew About Marketing