Written by: Steve Gresham, Suzanne Schmitt and Sharad Srivastava

The wealth management industry is at a crossroads. Record M&A activity and high valuations may suggest robust health, but beneath the surface, structural headwinds threaten the very foundation of organic growth for advisory firms. For owners and principals, understanding the dynamics of the four critical client flows-and leveraging pivotal “Moments That Matter” – now essential to safeguarding enterprise value and ensuring future relevance.

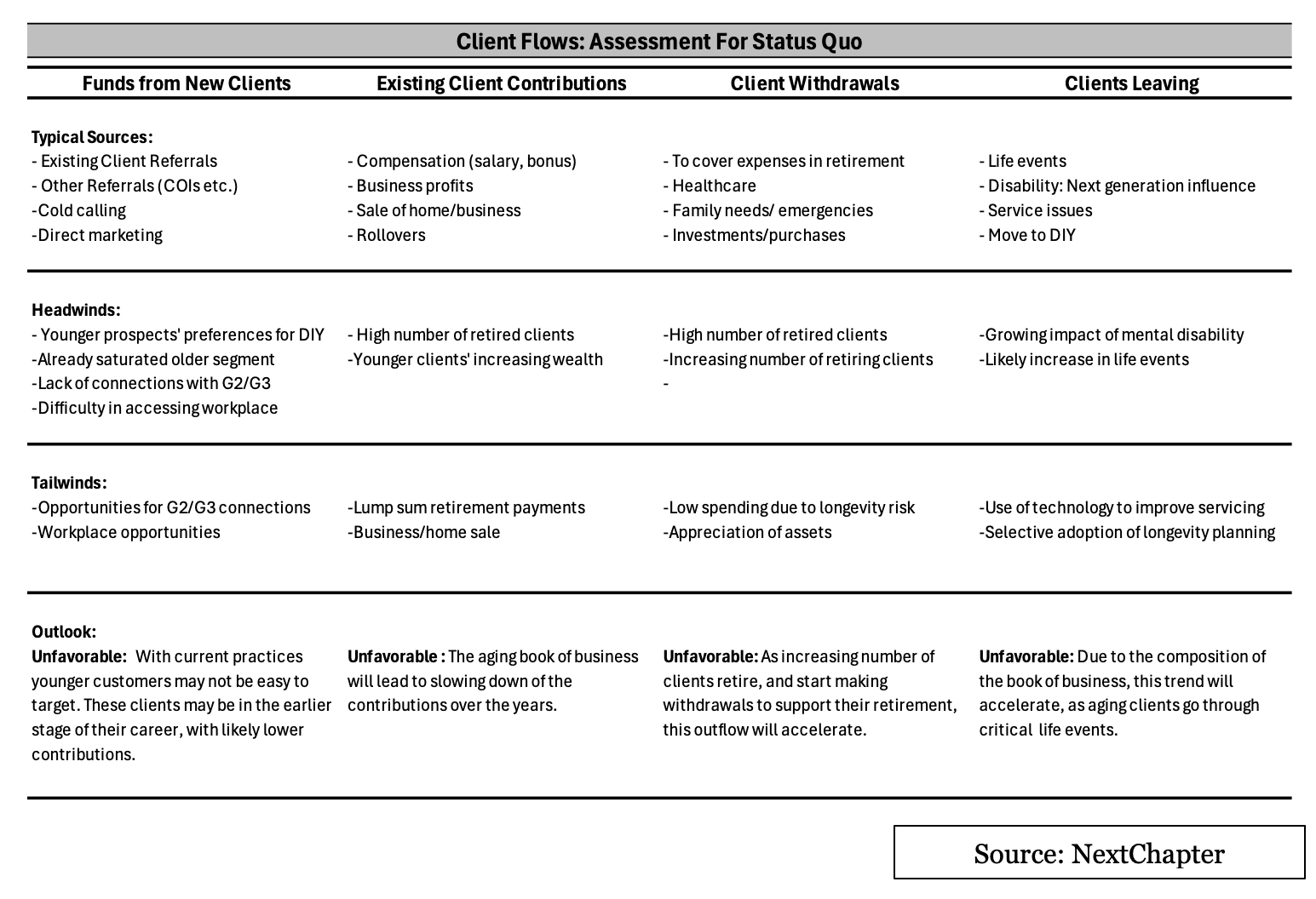

Outlook for Wealth Management Flows

The Four Flows: A Framework for Growth or Erosion

1. New Client Acquisition: Slowing to a Trickle

- The aging client base is creating a referral drought. As clients age, their social circles shrink, and so do referrals. Traditional centers-of-influence are retiring, and younger investors increasingly gravitate toward digital platforms and workplace retirement plans.

- Only 20% of next-generation clients retain their parents’ advisors, and with just 11% of traditional clients under 40, the pipeline is alarmingly thin.

2. Existing Client Contributions: Declining

With a weighted average client age over 60, recurring contributions are dropping as more clients enter retirement. Occasional inflows from events like business sales or rollovers are not enough to offset the steady decline in regular deposits.

3. Withdrawals: Accelerating

Outflows are set to rise sharply as the bulk of assets are held by clients aged 60+, with a median age of 77. Healthcare costs, family support, elder care, and lifestyle purchases are driving withdrawals. Many clients underestimate these expenses, increasing the risk of even higher outflows than projected.

4. Client Retention: At Risk

Attrition is rarely about performance or fees. Instead, it’s about relationship gaps-especially during critical life events. Approximately 70% of beneficiaries and successor decision-makers leave advisors after the death of a loved one a number that jumps to 80+% among affluent next-generation heirs (Tiburon Strategic Advisors, 2025).

Why “Moments That Matter” Are Your Secret Weapon

The traditional playbook—focused on investment returns and periodic reviews – is no longer enough. The NextChapter “Moments That Matter℠” framework identifies nine pivotal life events (unexpected health events, trouble making decisions, needs for caregiving, etc. ) that create natural openings for deeper engagement. These moments are when clients and their families are most receptive to advice and most likely to reassess relationships.

Firms that systematically recognize and act on these moments can:

- Retain assets as they transition from G1 clients to spouses and next-generation heirs.

- Expand relationships within client families, boosting revenue and profitability (engaged families generate 1.6x the revenue and 2.4x the profits of unengaged families)(Fidelity).

- Identify consolidation opportunities within the “forgotten 80%” of clients, who are often overlooked but represent untapped growth.

- Use technology and AI to proactively identify at-risk clients and engagement opportunities, multiplying the impact of advisor outreach.

Turning Challenges into Opportunity: Strategic Imperatives

1. Win the Family

- Proactively build relationships with spouses and children before a triggering event. Firms with younger age-weighted revenues (<63 years) achieved 6.4% organic growth in 2023, compared to just 0.3% for older firms (Fidelity).

- Use family meetings, educational sessions, and planning around life transitions to demonstrate value beyond investments.

2. Move Beyond 60/40 Portfolios

Address longevity and healthcare risks with protection-oriented solutions (e.g., long-term care, annuities, life insurance). These products not only meet evolving client needs but also create entry points for engaging younger family members.

3. Mine the Forgotten 80%

Most firms generate up to 88% of revenue from just 10-12% of clients (NextChapter). Systematically review your book for consolidation opportunities as clients approach retirement and offer comprehensive planning to capture more wallet share.

4. Build Digital Bridges

Combine AI-driven insights with digital engagement tools to connect with NextGen clients who expect seamless, tech-enabled experiences. Hybrid models (human + digital) increase engagement fourfold compared to either approach alone.

5. Develop Next-Generation Talent

Invest in mentorship, career development, and technology-enabled work environments to attract and retain young advisors who can relate to and win over the next generation of clients.

The Bottom Line

The market is sending a clear signal: organic growth and enterprise value now depend on your ability to manage all four flows-acquisition, contributions, withdrawals, and retention-by meeting clients and their families at the moments that matter most. Firms that embed this approach into their culture, processes, and technology will not only survive the coming wave of demographic and digital disruption-they’ll thrive.

For advisory firm owners, the mandate is clear: act now, or risk watching your firm’s future flow away…

Related: 2030: Your Best Year Ever ... If You Can Lean in to These Four Trends

This column was excerpted from the forthcoming NextChapter white paper, The Next Chapter in Wealth Management:

Five Strategic Imperatives to Address Aging Clients, Generational Shifts, and Digital Disruption in a Rapidly Evolving Industry

For more information contact us at [email protected]