The conversation around a highly anticipated “retention deal” from Merrill Lynch has advisors wondering, “If I get the offer, what should I do?”

Conversations throughout

the wealth management industryhave escalated around the topic of “enhanced” sunset programs with talk that the advisor elite at Merrill Lynch will be offered a “retention deal” in the near future.Whether you’re one of the chosen few at Merrill or another firm, offers such as these should serve as a catalyst to either re-up your commitment to the firm or to consider other options. For a long-tenured advisor with a goal of working less than a decade more, or a next gen advisor with a considerably longer runway to retirement, it’s important to understand both the

rewards and risksof binding yourself further to your firm via a “retention deal,” a sunset program or the inheritance of a retiring advisor’s business.

So, for those who may soon find themselves with a decision to make, there are 3 options:

1. Take the deal.

No doubt that taking a retention or an enhanced retire-in-place deal is the path of least resistance and can be a real win for the advisor who sees himself finishing his career with the firm. But before you accept the money and sign on the dotted line, first and foremost, be sure you are clear on the terms and are completely comfortable with binding yourself, your business and your clients to the firm for the life of the agreement.Take the time to revisit and clarify your goals, evaluate your ability to meet them at your current firm and, if appropriate, get educated on what has become a highly evolved landscape. This exercise will ensure that you are agreeing to the terms of any deal from a strategic position of strength—and not because you feel you have no other choice.

2. Move once, monetize twice.

What if you aren’t certain that your firm will enable you to best run your business for the remainder of your career? You may be feeling that the freedom, flexibility and support you had hoped for at this stage just isn’t there, yet are concerned about the disruption a move might cause.If you find that changing firms could offer benefits that outweigh the risks, there is the ancillary bonus of monetizing your business twice: By accepting a recruiting deal on the way in, then subsequently a sunset program upon retirement.Whether you’re a soon-to-retire advisor or the next gen inheritor of a business, the potential of solving for any frustrations combined with the opportunity to

monetize twice in one move can be a sound strategy.

3. “Build-Your-Own” sunset program in the independent space.

For a team that is contemplating independence, the decision is often complicated by the fact that partners could have different risk tolerances, financial goals and time orientations. The soon-to-retire advisor may be thinking, “If I’ve only got 5 years until retirement, how do I still monetize my business in lieu of signing my firm’s sunset program?”Since a move to the independent space often comes with little-to-no upfront money, all parties would need to be comfortable with

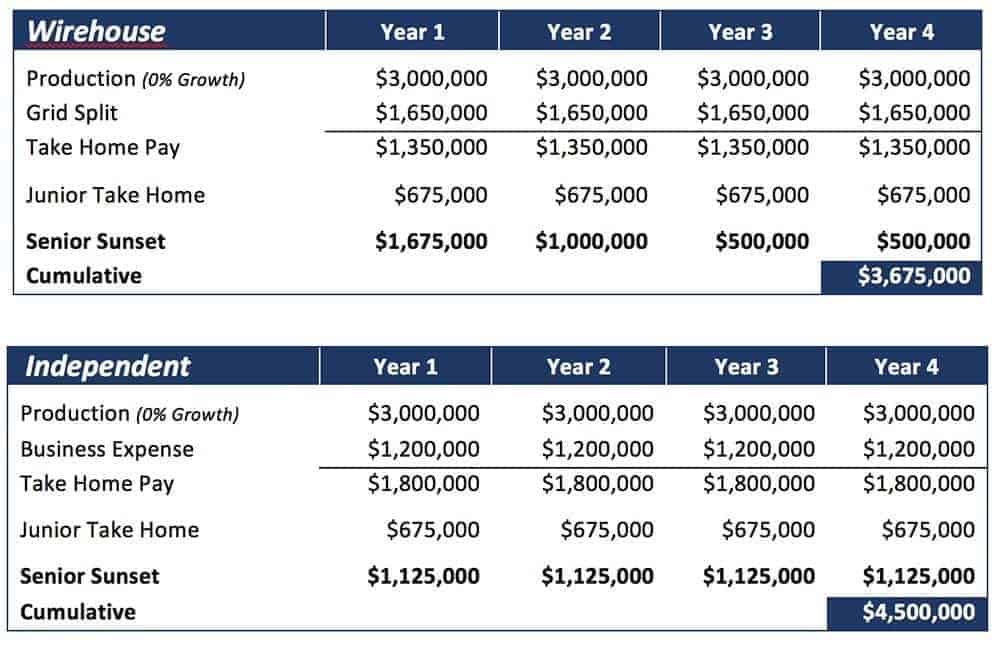

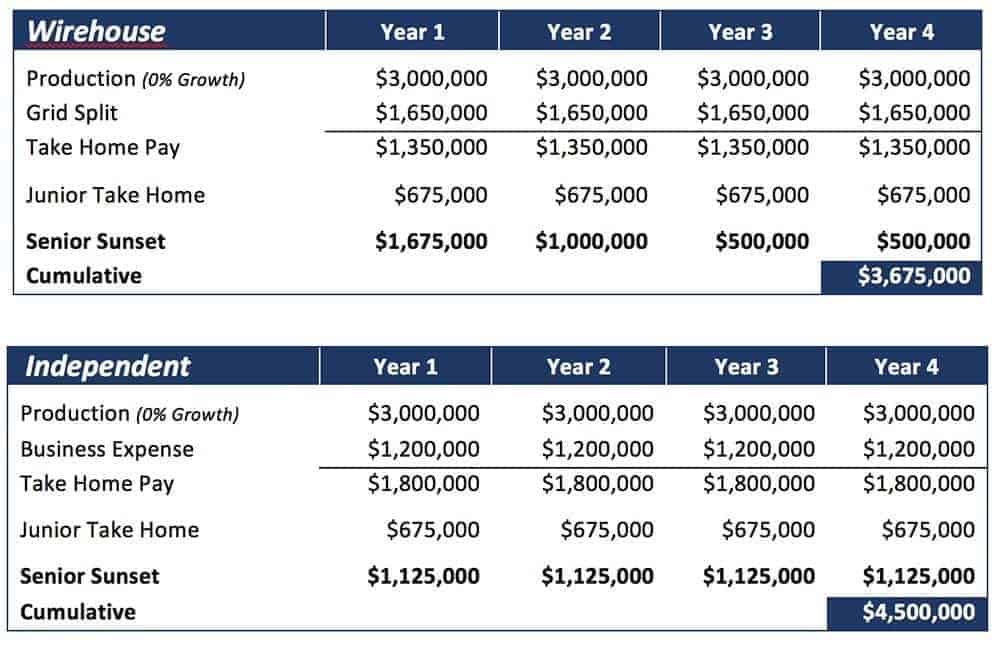

creating their own sunset program and liquidity event.Let’s consider the example of a former wirehouse team who chose to go independent. Two 50/50 advisor partners ran a $400mm business generating $3mm in annual production. The older partner was looking to fully retire in 3 years and the second had more than a decade left in his career.The team earned a 45% payout at their brokerage firm and its sunset program would have been valued at 200% of production plus an additional year of current payout. So, on the retiring advisor’s $1.5mm in production, he would have received a $3mm cumulative sunset payment plus an additional $675k of payout.If this same business were an independent enterprise, we’d expect to see a 60% profit margin. This team at the wirehouse would have taken home a combined $1.35mm (45% of $3mm), while an independent business would hypothetically generate $1.8mm in net income (60% of $3mm).The tables below illustrate how the younger advisor in an independent construct can maintain his take-home pay of 45% and use the delta in payout to fund the retiring advisor’s buyout—with better terms, more flexibility and at a tax-advantaged purchase price.

This is just one example of how a team solved for their succession needs—the beauty of independence is that all parties have significantly greater flexibility and control over how and when the older advisor will ultimately retire without sacrificing his hard-earned liquidity event.

Decision-Making: 4 Key Questions

The notion of re-committing to your firm, changing jerseys or considering independence brings up many thoughts about your financial future,

your business and the legacy you leave behind. Ultimately any decision-making process should be driven by the answers to these critical questions:

Where will my clients be best served? Where will I be able to take my business to the next level with the greatest ease, efficiency and support? Where will my next gen partners and legacy thrive? And where can I best monetize my life’s work?The key is to make all decisions mindfully—that is, understanding the risks and rewards of any path you might choose.Related:

Exploring M&A: Finding the Perfect Match Between Buyers and Sellers

This is just one example of how a team solved for their succession needs—the beauty of independence is that all parties have significantly greater flexibility and control over how and when the older advisor will ultimately retire without sacrificing his hard-earned liquidity event.

This is just one example of how a team solved for their succession needs—the beauty of independence is that all parties have significantly greater flexibility and control over how and when the older advisor will ultimately retire without sacrificing his hard-earned liquidity event.