It’s time to rethink what “safe” investing really is

The stock market can get pretty crazy. That is nothing new. But when the bond market offers little income, and bond price swings start to resemble that of stocks, it’s a sign. Specifically, instead of trying to pull blood from the old stone of fixed income investing, look around for substitutions for what bonds used to provide for you.

Bonds to the rescue? Not anymore.

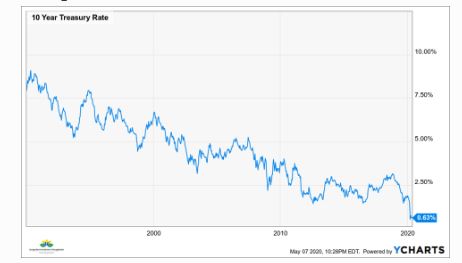

As you see below and know quite well, interest rates have been in a progressive downward spiral since before this chart even shows. Rates on the benchmark 10-year U.S. Treasury Bond peaked in the early 1980s.

Since so many investors are conditioned to associate “bonds” with “safe and predictable,” that leaves them entirely unprepared for the inevitability of historically low bond returns. In the end, there is no such thing as “safe” investing. There are ways to manage risk in a way that angles you more directly toward your desired outcome, financially-speaking.

For years, bonds were the “easy” way, but conditions have changed. You need to pivot with that, or risk some nasty surprises in how portfolio’s value changes.

Bond investing in the future: many ways to lose

Rates may stay low, but that will produce insufficient returns. Rates may rise and that will shock investors, as they see bonds lose significant value for the first time in their investing lives and just when they need bonds to be the “safety valve” they assume they are.

Or, rates may continue to fall toward zero and perhaps even negative, as we have seen in other parts of the world. But that would imply some pretty dire financial conditions and take away whatever yield potential remains.

So, counting on bonds to be that traditional complement to stocks now assumes much greater risk of disappointment than in the past. And, high-yield, municipal and corporate bonds are not much help here. Their yields are also historically low, and they have the additional issue of “credit” risk. Corporations, state and local governments and especially highly-leverage companies are a big part of the bond market.

The most under-rated risk of bonds?

Liquidity is also an issue. Ask a bond pro about how that market is functioning, and you are bound to get a frown or at least an eye-roll. Suffice it to say, the evolution of the bond market has created some unprecedented hurdles for retirees and pre-retirees who simply want to invest their money in something they can count on.

Between trillions in debt, the Federal Reserve’s not-so-invisible hand by backing otherwise questionable securities, and ETFs soaking up a lot of the bond market’s assets, this not your father’s bond market. Not at all.

Bond investing…without bonds?

However, I see this as far more of an opportunity than a problem. After all, if you break it down, what did you get from bonds all those years? You received steady return (in the form of income), your principal didn’t change too much or drifted up, and you got your money back when the bond matured. Or, if you invested in “callable” bonds, you got repaid sooner.

My suggestion: focus on your objective in investing in bonds, not bonds themselves. If you want a less dramatic return stream than stocks, you can pursue that. If you want a high-percentage chance that your investment will appreciate, and be worth at least what you paid, say 5 years after purchase, there are ways to invest with that objective too.

Can you get cash-income as you did with bonds? Yes, though you may want to set your sights on more of a “total return” outcome, instead of getting nearly all of your return from the income portion, as you did with bonds.

Bond replacement: an introduction

Let me be very clear here. None of this has a thing to do with annuities, or other less-liquid forms of pursuing those objectives formerly achieved by bonds. There are many ways to replace the investment “experience” you derived from investing in bonds.

I am going to talk about an approach I have used for my clients for the past decade, instead of using bonds. The tools involved here are stocks and ETFs, two types of securities you can buy between 9:30 AM and 4:00 PM every day the stock market is open. There are two parts to the strategy:

The part that pursues growth and income

The part that protects your capital from a big drop in value

Part 1: Growth and Income

This is very much a “dealer’s choice” situation, where you are the dealer. What types of investments do you want to own, with the goal of profiting from potential ongoing gains in the financial markets?

You can try to assemble a group of individual stocks (there are over 3,000 of them listed in US stock exchanges, and thousands more around the globe). Do you want to grab as much dividend income as you prudently can, to make up for all that bond interest you are no longer getting?

Or, would you rather think of this as a total return pursuit, where the sum of your income and capital gains is really what matters? Importantly,your answer does not have to remain your answer forever, even if some on Wall Street simply tell you to “set it and forget it.”

These are strange times we live in. So, you might decide to use this as a period to tread lightly in whatever direction you want your portfolio to travel. If there were ever a time to re-think what and how you get there, it is now.

Because we don’t know the future, but I think it’s pretty clear it will be different from the past. That applies to investing, and a lot of other things, too.

Or, do you prefer using ETFs or mutual funds? That reduces the risk of owning a single stock, since these are essentially “baskets” of securities under one roof.

Part 2: Protect That Thing!

So, with the “offense” game plan outlined, you can then determine how to replace your bonds by installing the key element to making your portfolio act more like what your bond-heavy portfolio used to. There are many ways to do this, but I will highlight 3 that I have made “staples” of my own work.

One approach is to have something in the portfolio that is likely to go up when your “offense” portfolio goes down. That does not mean you should buy the exact opposite. I wrote an article for Forbes.com not long ago that talked about “pairs” of investments, or to use a fancy Wall Street term, “arbitrage.”

If you own 3 ETFs that you think will outperform the S&P 500 for a while, but you are less confident that the stock market itself will continue higher, you can offset some of that “market risk” through hedging. “Single Inverse ETFs” aim to move in the opposite direction of a market index. There are some unique features of these that require you to do some homework, so make sure you do if you venture here.

Importantly, I am NOT a fan of highly-leveraged inverse ETFs. These try to take a 1% drop in some stock indexes, and earn 2 or 3 times that return as a profit. To me, this is for day-traders and casino gamblers only.

Options can be a pretty cost-efficient way to accomplish what inverse ETFs do. However, they have a time limit and a lot of nuances regarding how market volatility shifts, and other factors that are less important to the more straightforward stocks-and-funds approach. So again, this requires a serious self-education process, or outsourcing some of this expertise.

The other defensive measure to highlight is one we are all very familiar with. Its cash. Whether it’s a money market fund, funds that invest in short-term US Treasuries or something of that variety, I think cash is in a unique position to be a defensive weapon. No, it doesn’t yield much. In fact, it yields about nothing.

Still, it’s how you use that cash that matters. All 3 parts of a portfolio: the offense, the hedging and the cash, can be static (known as a “strategic allocation”) or more active (”tactical allocation”). I make no mystery of where I stand. I am in the tactical category.

However, from a strategic standpoint, I think that the way investment returns are generated has changed. It started changing years ago, and in 2020 the pace of that change has accelerated. The stock market will not simply go up without taking major steps backward.

And, to finish where we started this story, bonds of all varieties are a portfolio accident waiting to happen for way too many investors. Fortunately, as I spelled out above, this is far more of an opportunity than a hurdle. You just need to acknowledge what has changed, and make the decision to do something about it.

Related: Three Ways To Invest In Stocks Today