I was struck by a comment made by Chris Brendler, an analyst at D A Davidson, about FinTech Affirm (a US BNPL start-up):

“These hybrid financial technology stocks trade like tech stocks, when they’re growing really fast and the financial side of their business doesn’t cause any problems but, if you start having higher losses or funding problems, that’s when they start to perform like financials.”

What’s the difference between a tech stock and a financial one? About 1,000 basis points. Tech stocks trade on future market potential and sees firms valued for billions when they’ve never made a profit and have revenues in the millions. A financial stock trades in millions when they have revenues in billions.

This is a big frustration for those in banking, as their measurements for the investment community are all about Return-on-Equity, Cost-Income Ratio, Cost of Funds, Net Interest Margin and such like. These are then stacked up against a community of equivalent financial firms and typically creates a share price of almost nine times earnings. A tech firm gets price-to-earnings ratios of five times that level.

This is because technology companies grow far faster than financial firms. Therefore, if you invest in the right ones, there is far more potential. Take a company like Stripe who, in 2021, processed $640 billion in payments and was valued early that year at $95 billion. Out of all of that processing however, it’s profits are minimal. Based on its latest EBITDA figures, Stripe is making profits of $120 million.

But then roll this back to Amazon, who took years to ever make a profit. Founded in 1994, it made a small profit in 2001 but has spent most its life re-investing in their business model to fuel growth. That’s what tech stocks can do. A financial stock cannot do this, as growth is seen as far less opportunity.

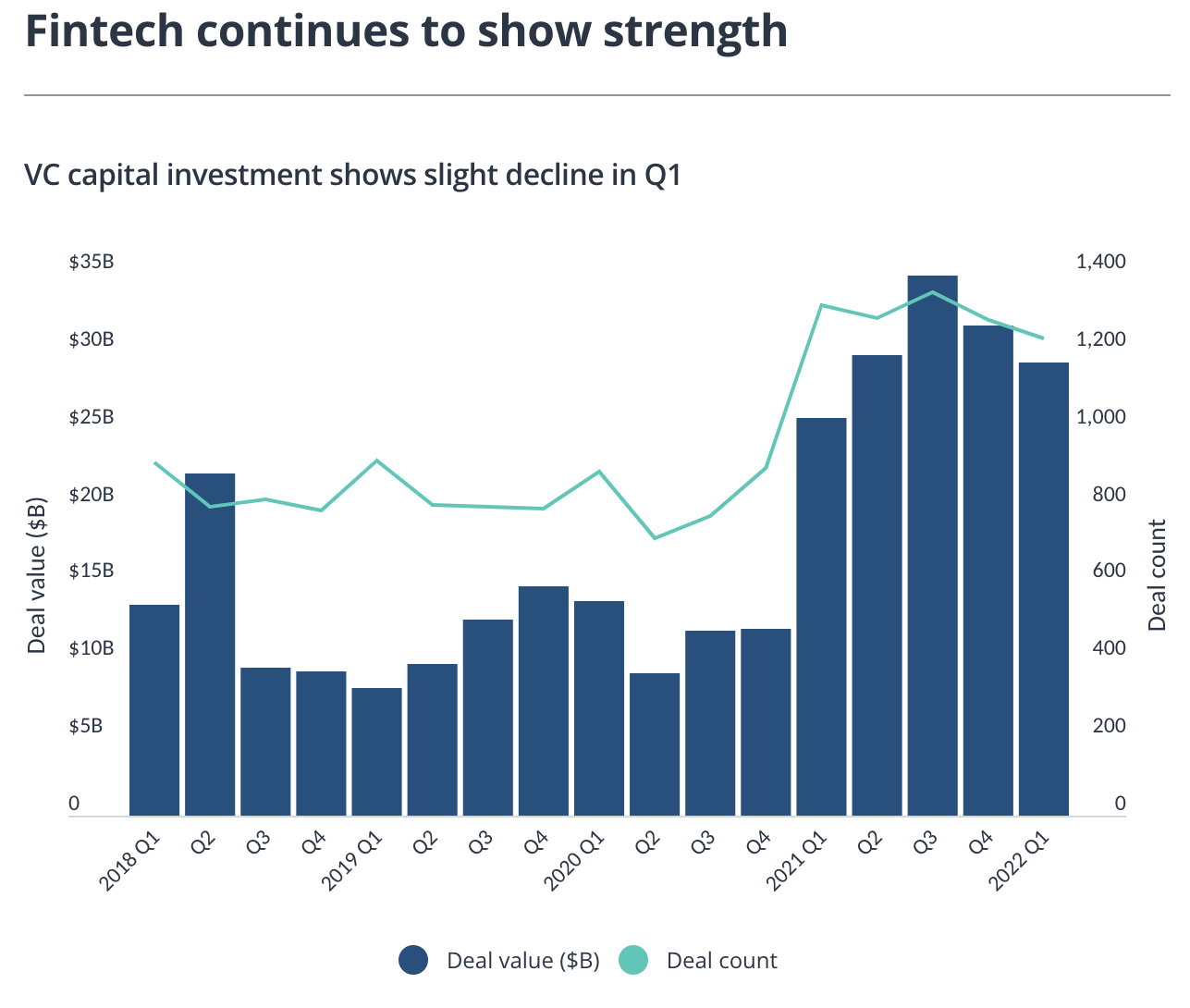

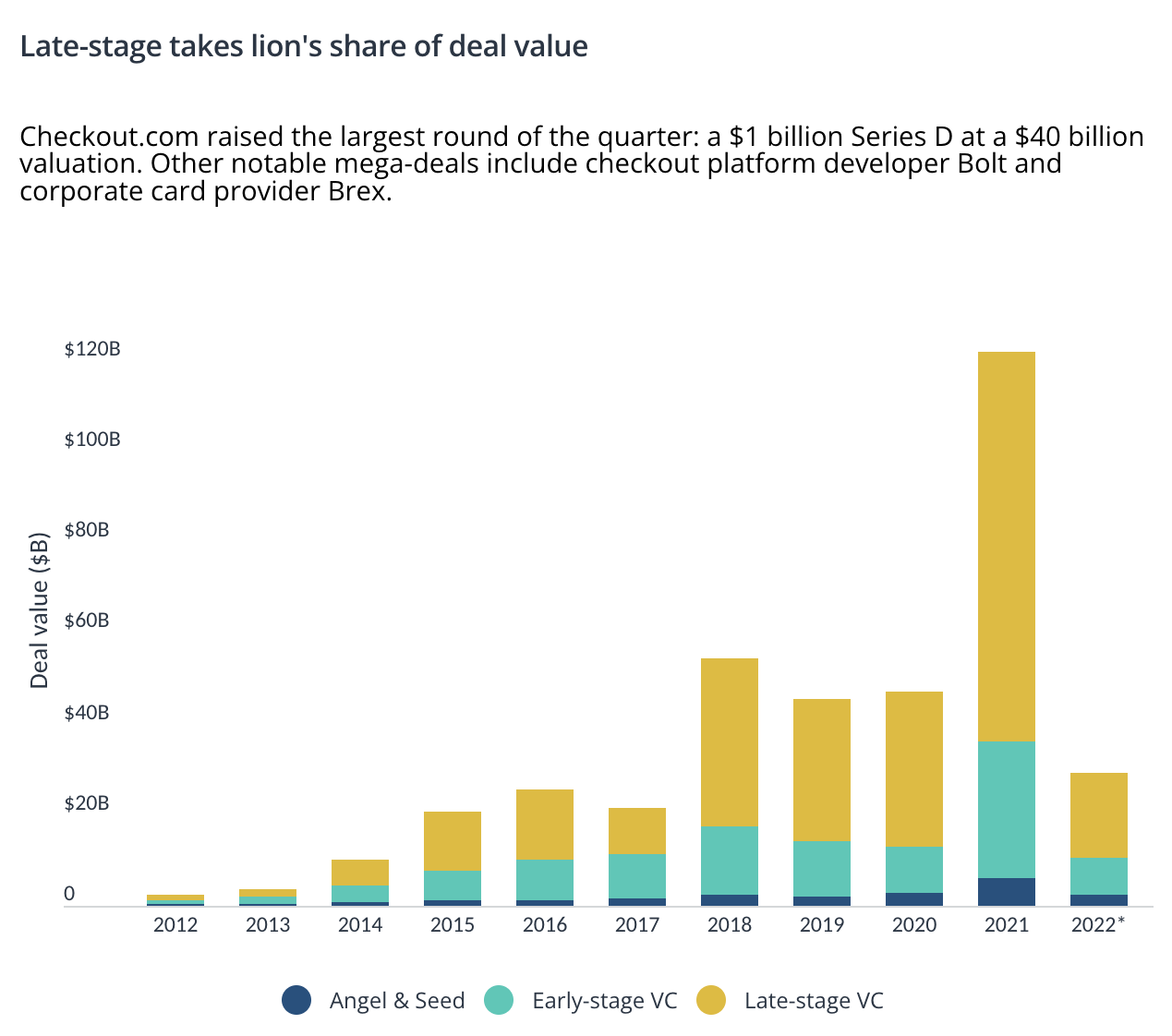

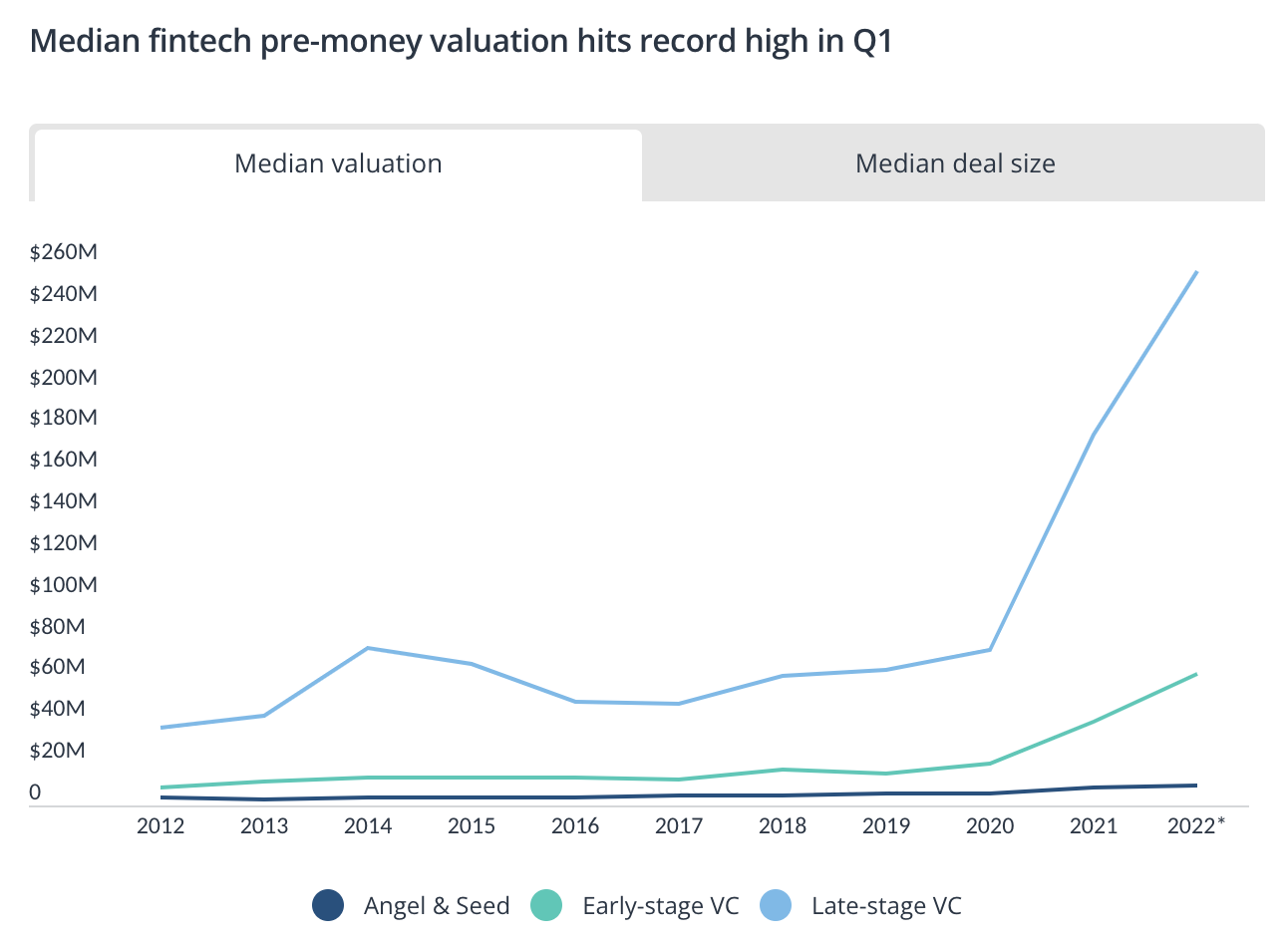

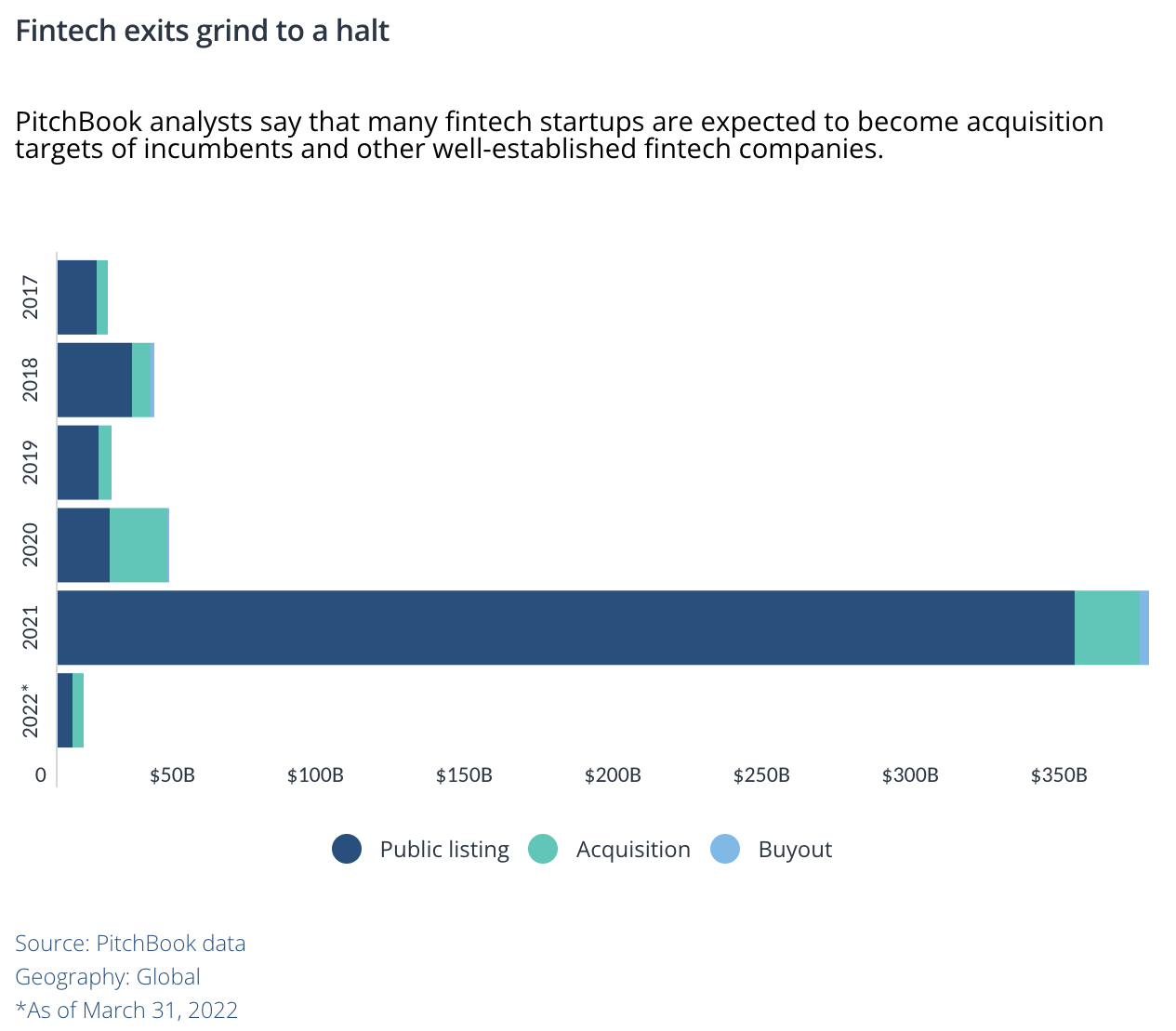

The net:net of this is that FinTech stocks are valued as tech stocks at start but, if they stumble, they start being valued more like bank stocks. Nevertheless, FinTech is still going strong, as these five charts show:

Source: Pitchbook

Conclusion: I’d rather be a tech stock than a financial one.

Related: We Need Same-Day Financial Firms