It’s been roughly two years since Vanguard’s patent expired, opening the door for exclusion of ETF share classes from Rule 6C-11. Or in plain English, Vanguard once held a monopoly on being able to introduce ETF classes of previously established index and mutual funds.

That patent protection is widely viewed as one of the reasons why Vanguard is now the second-largest U.S. ETF issuer. Now that the protection is expired, it’s also widely expected that more mutual fund issuers will capitalize on that liberalization by introducing ETF classes of popular mutual funds, potentially breathing new life into those actively managed products.

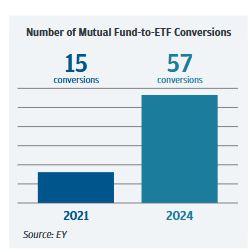

It’s been widely documented that the mutual fund-to-ETF conversion cycle is in its early innings and is gaining significant momentum as sponsors of active mutual funds look to stem the tide of outflows. While full conversion has been the road chose by many issuers, a new regulatory landscape could make it easier for issuers to roll ETF classes of mutual funds while leaving the latter intact – the easier option for many sponsors.

Expect Conversion/Share Class Debate

With active managers looking for ways to better compete with passive funds, there’s been significant momentum for the mutual fund-to-ETF conversion concept.

(Image Courtesy: J.P. Morgan)

Over the past several years, roster of mutual fund-to-ETF conversions has increasingly included old mutual funds, funds with sizable asset bases, products from well-known issuers or all three of those traits. It’s possible that with the Vanguard patent expired, the fund-to-ETF conversion swell will morph into a tidal wave of ETF share class applications and launches. Indeed, that move has its perks.

“The addition of an ETF class to a mutual fund is also seen as a quicker approach to entering the ETF market without launching a new legal structure or executing a mutual fund to share class conversion,” notes J.P. Morgan. “While it may be a relatively quicker alternative (if approved), it may not come with all the benefits of an ETF such as capital gains tax exemptions, access to double taxation treaties and other benefits afforded to an ETF. Launching a successful ETF strategy is not just as simple as adding a share class to an existing mutual fund and expecting it to gain assets. An issuer needs to focus on the addition of capital markets services, a specific ETF distribution plan, platform strategies, and operational impacts as part of a successful launch plan.”

ETF Share Class Idea not for Everyone

It’s clear that ETFs are actually helping active management, not killing it as was previously thought, but that doesn’t mean that every active mutual fund issuer on the block will be rushing to embrace ETF share classes. Simply put, such moves aren’t for everyone.

“Combining traditional mutual funds with ETF share classes may suit certain strategies, but it is not ideal for every asset manager entering the ETF market. Launching a separate ETF range or converting a mutual fund to an ETF might be better options,” adds J.P. Morgan.

As for predicting which issuers beyond Vanguard are most likely to apply for ETF shares class additions to existing mutual funds, it could be as simple as identifying those that are already operating in the ETF space or those that have the expertise and resources to rapidly enter the industry while not feeling pressure to garner immediate success.

Related: Breaking up Is Hard to Do…When You Don’t Have Money