Written by: Samantha Azzarello

Due to COVID-19 and the discussions around social issues and climate change, Sustainable Investing (SI) is more relevant today than ever before. At the same time, SI assets have grown at a double-digit pace in the U.S. over the last few years, and now have a healthy base of assets under management (AUM) around the globe.

Although many investors, corporations and futurists believe in the durability of Sustainable Investing, many still believe that a focus on SI and ESG is a passing fad.

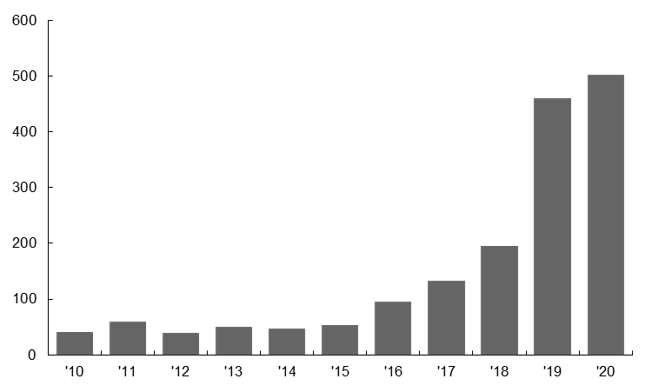

Corporations, across sectors and around the world, are taking ESG issues seriously. The amount of public commitments to these initiatives has increased and the importance of ESG has been stressed by management directly to their shareholders. The chart below shows the astounding growth of mentions of “ESG” on shareholder calls for U.S. companies.

Investors, on the other hand, have much to choose from when it comes to SI. The broad range of investment approaches under SI can be both a strength and a weakness.

- Why is this a strength? The versatility in this emerging area offers options to investors. Forms of SI consider a broader range of factors in risk analysis (ESG integration), while also matching the belief set of a client (Exclusionary). SI can also be targeted investments aimed at solving social or environmental issues, while also delivering a financial return (Impact Investing).

- Why is this a weakness? Implementing Sustainable Investing in a portfolio requires that an investor devote time and effort in understanding the range of options and then mapping those approaches to the investment goals of a client – whether those goals are around beliefs and values or risk mitigation.

Overall, the investment approaches under SI vary greatly with respect to underlying rationale, implementation and potential shifts in the risk-return profile.

While critical thinking and due diligence around any investment decision is always warranted, being dismissive of the SI movement is shortsighted. With the commitment of firms to ESG issues increasing, growth in SI assets and the range of strategies available, investors should consider what Sustainable Investing has to offer.

Companies are talking about ESG with their shareholders

ESG mentions on earnings calls, Russel 3000, number of mentions, annual