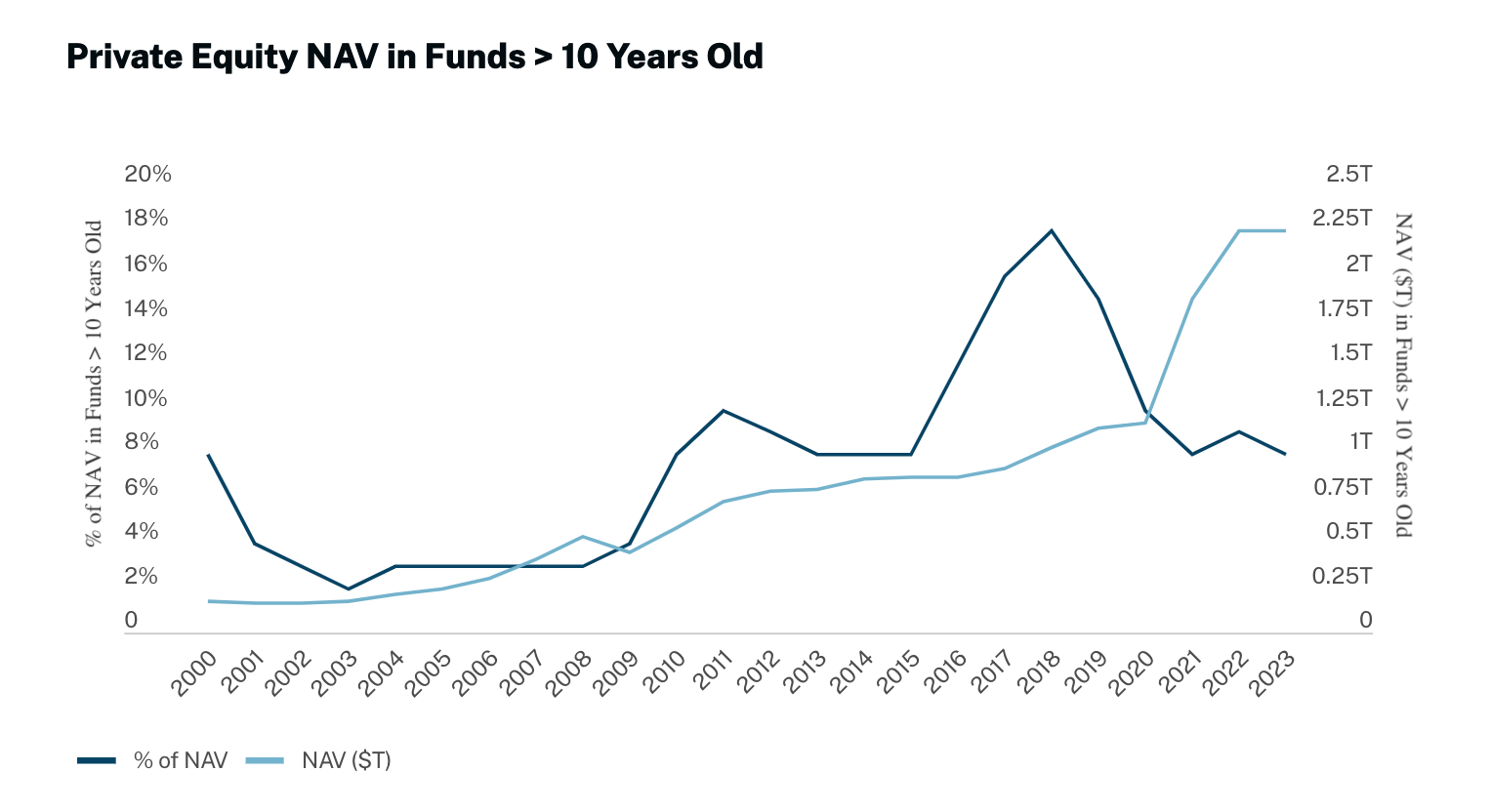

The NAV trajectory of private equity funds in the last five years has generated concern about a shift in the private equity landscape.

A prevalent perception suggests a surge in capital residing within "zombie" funds, loosely defined as funds that hold assets well past their intended life cycle with little hope of exiting those assets. This week we examine the NAV in funds 10+ year old funds, as a proxy for so-called “zombie fund” NAV.

While the absolute dollar value of such funds has increased, this is partly attributable to the industry's overall growth. It's essential to contextualize this increase within the broader landscape of the private equity sector. As a percentage of total NAV, 10+ year old funds reached their zenith between 2016 and 2018, largely influenced by funds originating during the Global Financial Crisis era. Since then, the landscape has witnessed robust fundraising and increased investment activity, resulting in a notable decrease in the share these elder funds occupy in the average LP portfolio. That is welcome news for most LPs.

Related: Five Questions for Considering Private Markets

Source: Hamilton Lane Data (October 2023)