It makes sense that longer-maturity bonds typically provide higher yields than shorter-term bonds. After all, more bad things can happen in a longer period than a shorter one, and visibility is poorer for the next 10 years than for tomorrow. Investors expect to be paid for these risks.

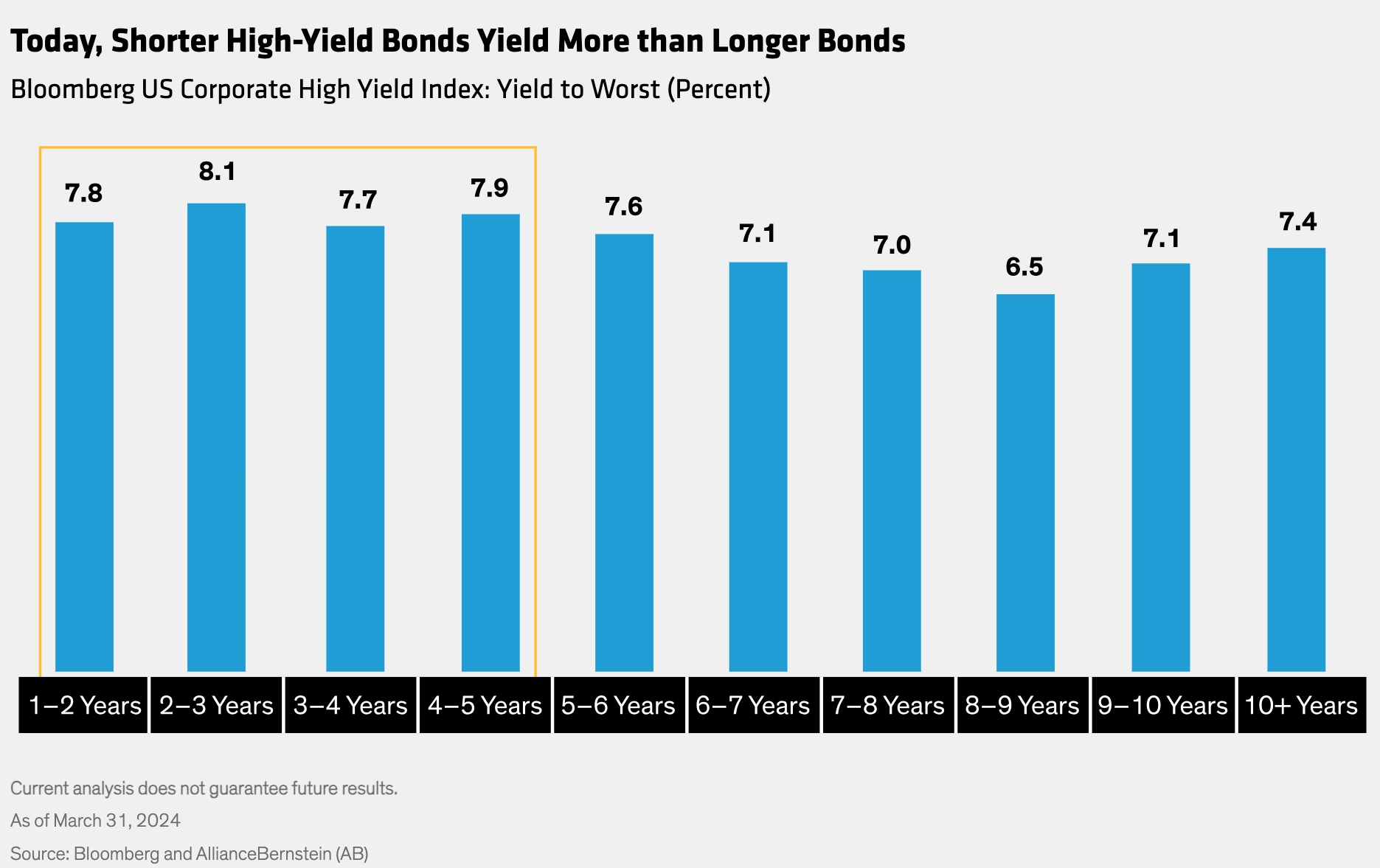

But in an unusual—and prolonged—aberration, short-term high-yield debt is currently yielding more than longer-term debt, especially in the US (Display). An inverted high-yield curve is great news for high-yield bond investors who are concerned about near-term market volatility.

Even in normal times, a shorter-duration high-yield strategy can provide high levels of income with lower volatility than an intermediate-duration strategy. Historically, a shorter high-yield approach has provided nearly the same average annualized return as a longer-maturity mandate, with about two-thirds of the volatility.

But with the high-yield curve inverted, as it is today, investors are being paid more to take less risk. We think that’s an income opportunity worth sizing up.

Related: Fixed-Income Outlook: Seeing the Forest Beyond the Trees