Written by: Kunal Shah | Head of Private Equity Solutions, Co-Head of Research at iCapital

Given the noise around recent swings in technology valuations, it may be easy for advisors to lose perspective on the long-term opportunity in the tech space. While the coverage of consumer technology demand is substantial, the scale of corporate demand for technology and its potential long-term upside is underappreciated. Recent data illustrate that there is significant headroom for increases in corporate tech budgets. Further, analyzing where spending is likely to increase can point the way to potential investment opportunities—particularly for investors in private markets, which are well positioned to benefit from this growth.

An uneven transformation

The implications of the “digital transformation” taking place across the corporate world have garnered less attention than they deserve. Corporate IT spending—predicted to be nearly $4.5 trillion globally in 2022—will be an ongoing driver of growth for many existing and emerging tech players. As MIT Sloan Management Review puts it, “Digital transformation is better thought of as continual adaptation to a constantly changing environment.” This process cannot, by definition, ever be complete.

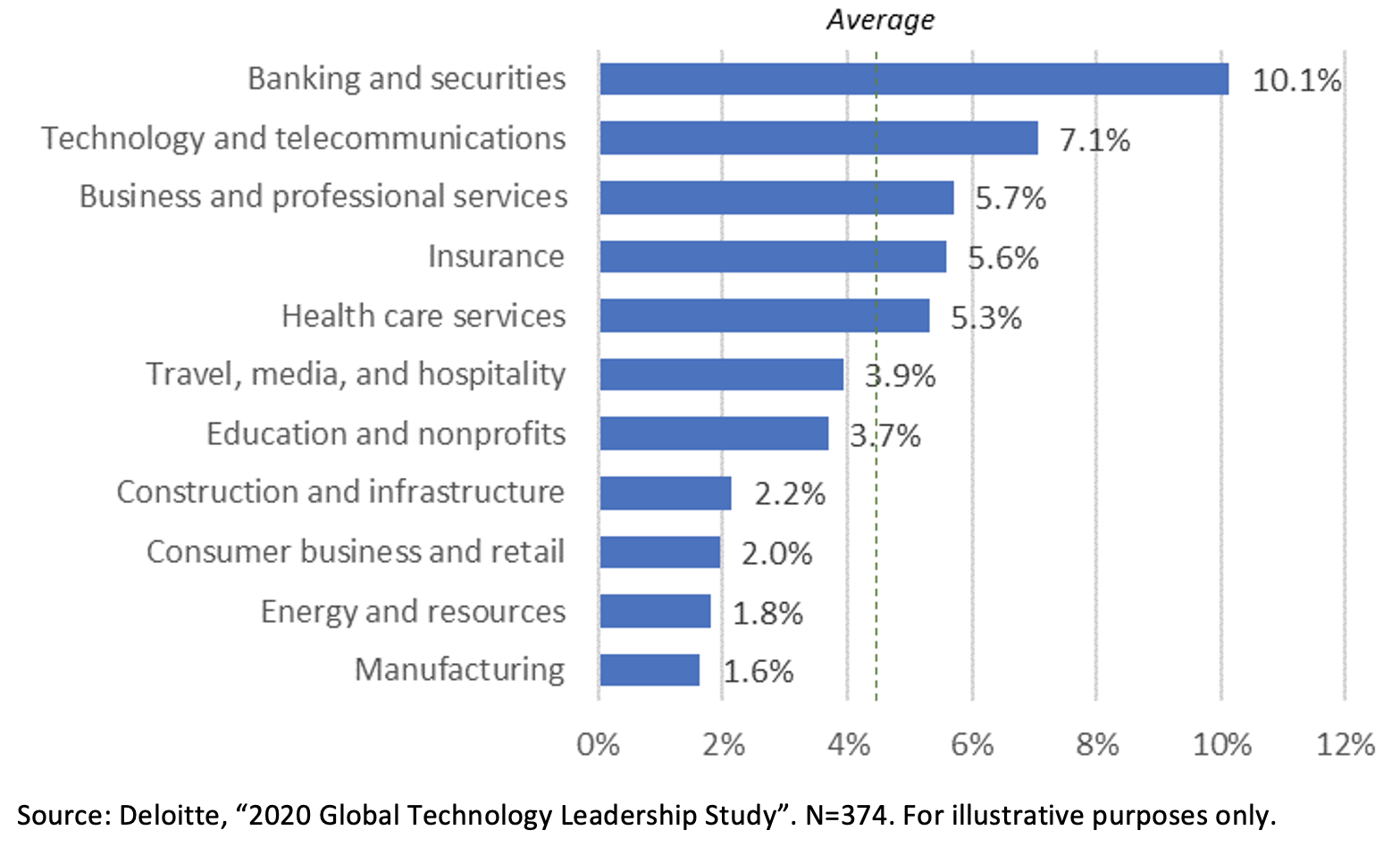

However, certain sectors are way ahead of others in this transformation. Financial firms, for example, are investing heavily in technology solutions, devoting on average more than 10% of revenue to their technology budgets, partly reflecting fierce competition from tech-led challengers.

Wide variance in tech budgets between industries

Average technology budget as a % of revenue

We believe that banking and securities firms are establishing a trend, and that, when it comes to tech spending, they will not be permanent outliers. As the digital transformation spreads, other industries are likely to increase their tech spending.

Research from International Data Corporation predicts that spending on technologies and services aimed at facilitating digital transformation will rise to $2.8 trillion by 2025, up from just $1.5 trillion in 2021—representing a compound annual growth rate of 16.9%.

Current higher business costs should also accelerate this process. While input costs will be passed along to customers where possible, businesses will also seek efficiencies via technological solutions, such as automation and artificial intelligence, to improve productivity and reduce costs.

From physical to intangible, internal to external

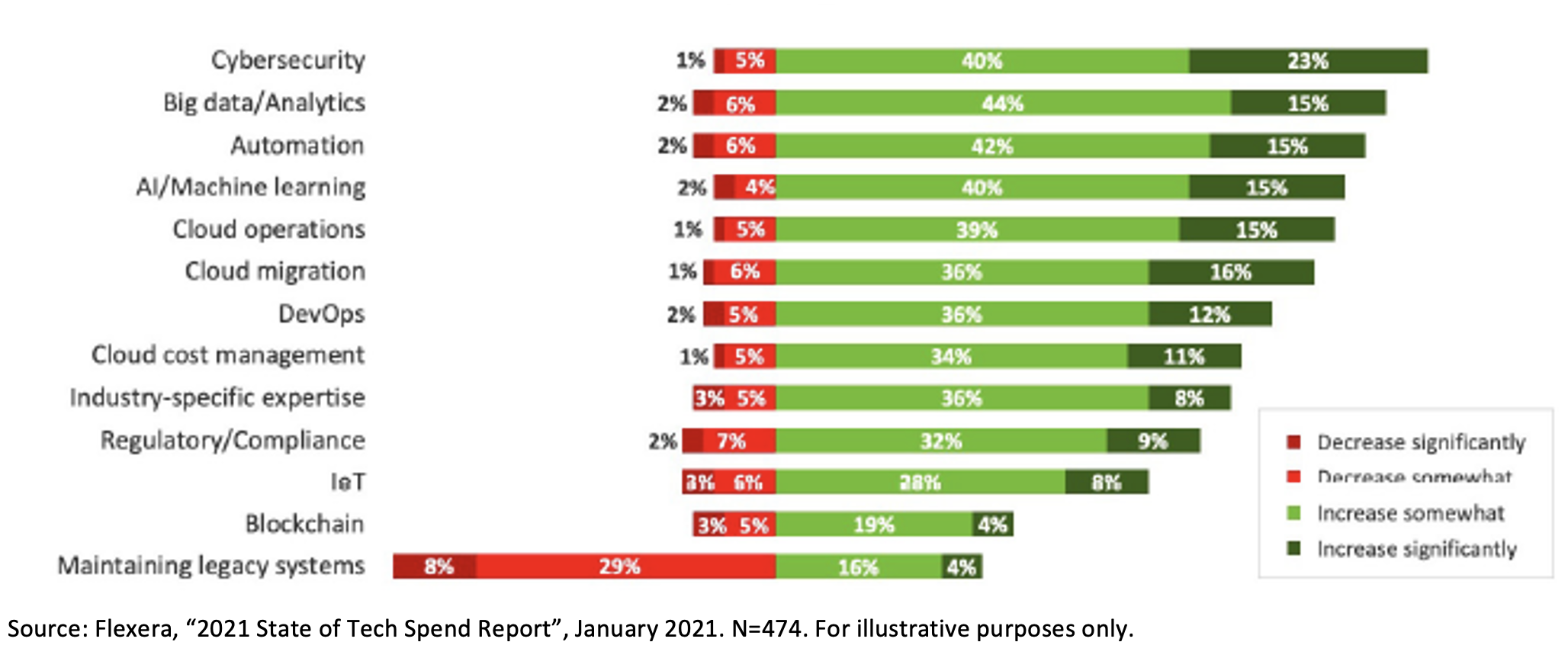

Rising corporate spending on tech presents opportunities for emerging innovators, as tech budgets shift from capital expenditures on physical infrastructure to increasingly prioritize the adoption of innovative technologies, such as cybersecurity, automation and robotics, blockchain, and data analytics, typically supplied by external vendors.

Corporate IT spending is increasingly shifting to external vendors

Planned changes to use of external IT resources (% of respondents)

Growth in external spending across multiple categories should support incremental revenue growth for product and service providers, which are primarily private. For example, as of February 2, there were 184 unicorns in the internet software and services space, 77 in artificial intelligence, and 43 in cybersecurity. There are many more that do not (yet) meet the unicorn classification.

This growth should also open up exit opportunities within the tech ecosystem. Innovation among larger tech companies has in recent years effectively been outsourced to smaller companies, which the giants then acquire as they look to gain a competitive edge. Google’s growth, for example, was supported by 250 acquisitions in the decade to November 2019.

Long-term opportunity

Corporate spending is just one part of the tech story but it is expected to grow almost half a trillion dollars from 2021 to 2023. While finance companies have taken the lead in tech investment, we expect other sectors to catch up as technology reshapes business models across the spectrum.

Private capital is well positioned to support this growth and help investors gain exposure to rising business spending on tech, armed with ample dry powder. Tech companies account for an ever-rising share of private investment: According to PitchBook data, in 2021, private equity and venture capital funds invested $1.25 trillion in tech companies, which accounted for more than 60% of total completed deal value. As of February 28, tech represents more than two-thirds of deal value so far this year.

The access private capital can offer to a wide universe of tech companies and the patient investment style it employs make it well suited to investing in this and many other long-term themes. If a client can afford a degree of illiquidity in their portfolio, we believe there is a compelling case for investing via private markets to benefit from rising business spending on tech.