Written by: Joseph Burns | iCapital Network

Shifting capital from public bonds and stocks into select alternative strategies can protect capital and improve returns in an inflationary environment.

Because we all occasionally suffer from information overload in a nonstop news cycle, putting current market conditions into a historical framework is difficult. Case in point – We know that fixed income has struggled as the Bloomberg Barclays U.S. Aggregate Bond Index (U.S. Aggregate) has annualized at less than 3% since 2013.[1] It is nevertheless surprising that the index just had its worst quarter in four decades.[2]

While many investors have embraced a “buy-the-dip” strategy in the stock market, thinking about the bond market historically tells us that this approach is unlikely to provide the same opportunistic bounce as it sometimes offers in public equities.

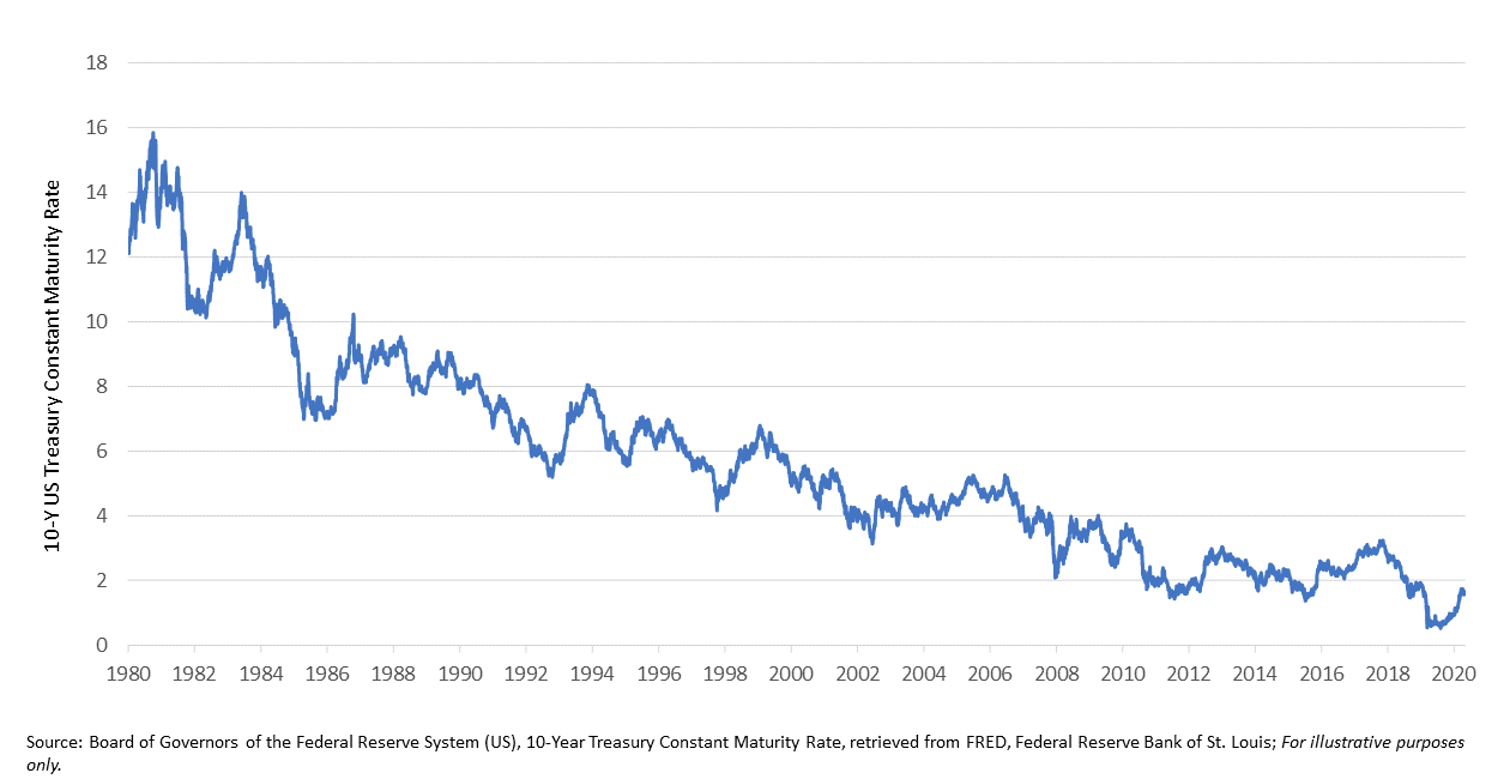

Going back to 1981 – that last time bonds experienced a quarterly decline on par with the first quarter of this year – 10-year U.S. Treasury bonds yielded over 15% and bonds of all kinds were about to embark on a 30-plus year bull market. Obviously, the starting point in today’s market paints a far different story.

Is the Party Finally Over for Fixed Income?

Government bonds comprise roughly 40% of the U.S. Aggregate index, along with 30% in agency mortgages, 20% investment grade bonds, and 10% in non-U.S. developed and emerging market debt and securitized credit. And with the flagship Fannie Mae 30-year agency mortgage bond now yielding

less than 2.5%,[3] along with single-A corporate bonds trading with an effective yield of 1.9%,[4] traditional bond investors are facing real, structural problems across the entire fixed income marketplace.

And Is Inflation Finally on the Rise?

Possible inflation fighters: real assets, private credit, and diversified growth equity

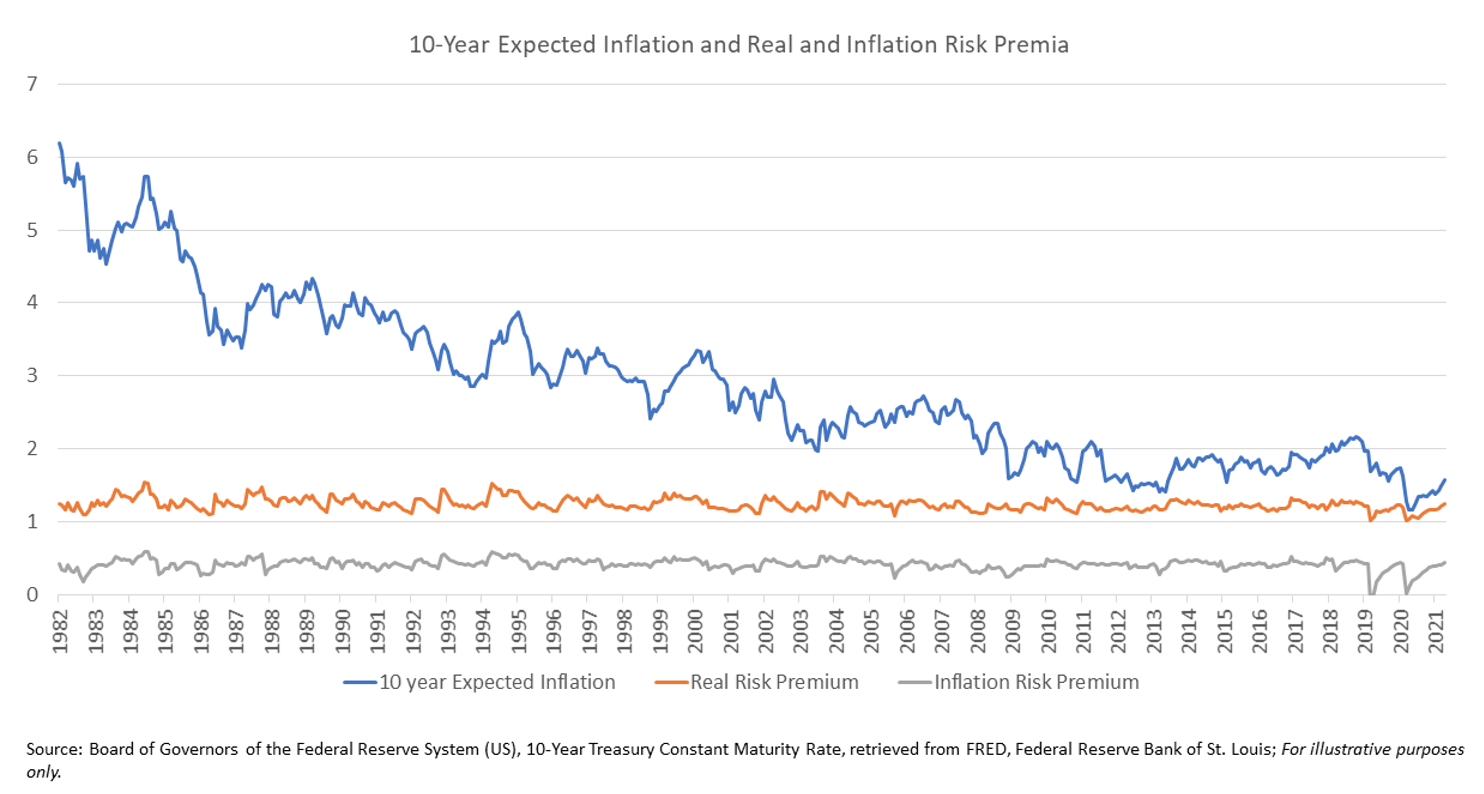

After steadily declining over the past 40-years, inflation expectations are now on the rise, leading advisors to question which asset classes or investment strategies may offer protection and diversification. Here are three choices worth considering:

- Real Assets – Real assets and commodities tend to be positively correlated with inflation and interest rates, unlike financial assets such as stocks and bonds. According to a recent note by Bank of America's chief investment strategist Michael Hartnett, the price of real assets relative to financial assets are now at the lowest point since prior to the Great Depression, nearly a century ago.[5]

- Private Credit – The tradeoff from public to private credit securities requires a shift in liquidity and client expectations. But securitized credit, specialty finance, direct lending, and exposure to floating rate securities can provide protection, diversification, and capital appreciation.

- Growth Equity – While value may outperform growth in public markets, particularly for those companies trading at extreme valuations (by discounting future earnings), shifting awayfrom long-only public equities and into private market strategies and hedged equity offers valuable exposure to less efficient markets and active asset allocation and risk management.

Many investors and advisors have already begun shifting away from traditional fixed income and into strategies and structures that can improve client outcomes. Anticipating the challenges of tomorrow through thoughtful portfolio construction and multi-asset diversification appears to be the right approach in today’s environment.

Related: Familiar Income Friend Has Inflation-Fighting Potency

[1] Source: Evestment. For the period Jan. 2013 through March 2021, the Index generated an annualized return of 2.77%.