Written by: David Lebovitz and Peter Hamburger

"The outcome of the 2020 U.S. presidential election, coupled with positive news on vaccines late last year, has resulted in a significant shift in market dynamics."

For the majority of the bull market that followed the global financial crisis (GFC), and pretty much all of last year, a handful of stocks were responsible for the majority of the U.S. equity market’s gains. As these high-growth, mega-cap companies outperformed, more and more investors piled in, pushing the S&P 500 to an all-time high just months after hitting a pandemic-induced low. However, the outcome of the 2020 U.S. presidential election, coupled with positive news on vaccines late last year, has resulted in a significant shift in market dynamics.

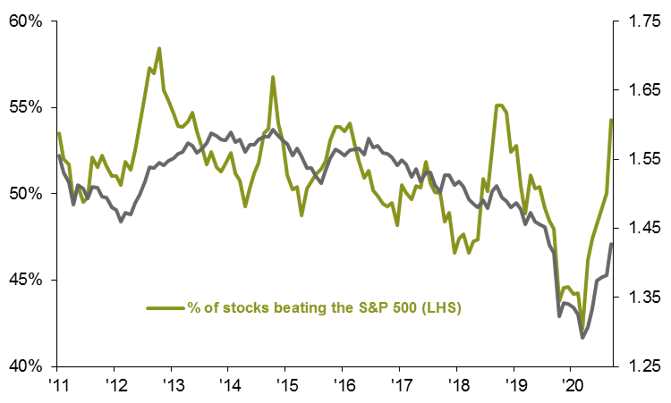

As the prospect of a robust economic recovery and higher inflation have materialized, interest rates have risen and long-forgotten value stocks have begun to outperform. At the index level, this has two implications – the percentage of S&P 500 stocks beating the index has increased, and the “average stock” has begun to show signs of life. This has left S&P 500 gains somewhat muted in aggregate, but the performance beneath the surface has been fascinating. For example, the NYSE FANG+ index, which tracks some of the most highly traded mega-cap technology companies, is up nearly 112% over the past 12-months, but a mere 1% year-to-date; on the other hand, the Russell 1000 Value index is up less than half that much over the past 12-months, but nearly 12% year-to-date. Rotation? I think so.

This dynamic highlights the risk and reward around employing momentum-based investment strategies, as well as the importance of diversification. Simply owning the best performing stocks was a good approach for quite some time, but as we have seen, momentum can turn sharply. This is when being active and diversified pays off. As we look across client portfolios, we continue to see many investors are overweight growth and underweight value – in fact most portfolios on average have double the exposure to growth relative to value. Although we are not inclined to chase recent performance, it seems reasonable to expect that a more balanced approach to equity markets could help investors navigate what remains a very uncertain world.

The "average stock" has been outperforming

% of S&P 500 constituents beating the index, S&P 500 equal/market-cap weighted rel. perf.

Source: Standard & Poor's, FactSet, J.P. Morgan Asset Management. Data are as of March 30,2021

Related: Should Investors Be Concerned About a “Taper Tantrum” Hurting EM?