Stocks are advancing on the back of strong earnings from Nvidia that signaled robust AI momentum amidst elevated demand for semiconductor technology. Treasurys are gaining as well, because weaker-than-expected economic data has bolstered rate cut anticipations while subduing inflation expectations. But the most significant news occurring is a legal standoff between the Trump administration and the US Court of International Trade which blocked the Commander in Chief’s signature tariff plan. Still, there are many avenues the cabinet can take to impose levies via higher-ranking courts as well as distinct governmental authorities.

Turning to the economic calendar, today’s principal print was the BEA’s second estimate of first-quarter GDP, which featured lighter consumer spending and price pressures than initially reported, a heavier subtraction from net exports and less impactful upgrades to business investment and government expenditures. Simultaneously, increases in unemployment claims also pushed traders into fixed income as the continuing segment jumped to a 42-month high, pointing to prospective workers struggling to secure new jobs. Pending home sales, published later at 10:00 am, also missed by a mile and then some, as greater inventories are failing to counter 7-handle mortgages amidst pricey listings. Investors are bullish against a heavy amount of news flow, picking up stocks in 10 out of 11 major sectors, Treasuries across the curve, gold bars, silver futures and forecast contracts. Conversely, participants are unwinding volatility hedges and reducing exposures to the greenback and cyclical commodities.

GDP Revised Upward Slightly

US economic growth was upgraded by a tenth of a percent from -0.3% to -0.2% for the first quarter of 2025. Consumer spending and the core PCE price index were downgraded from quarter over quarter (q/q), seasonally adjusted annualized growth rates of 1.8% and 3.5%, to 1.2% and 3.4%. Business investment and imports came in higher than the originally reported 9.8% and 41.3% and were revised to 10.3% and 42.6%. Overall, the significant slowdown in consumption is something to keep an eye on going forward.

Pink Slips Increase

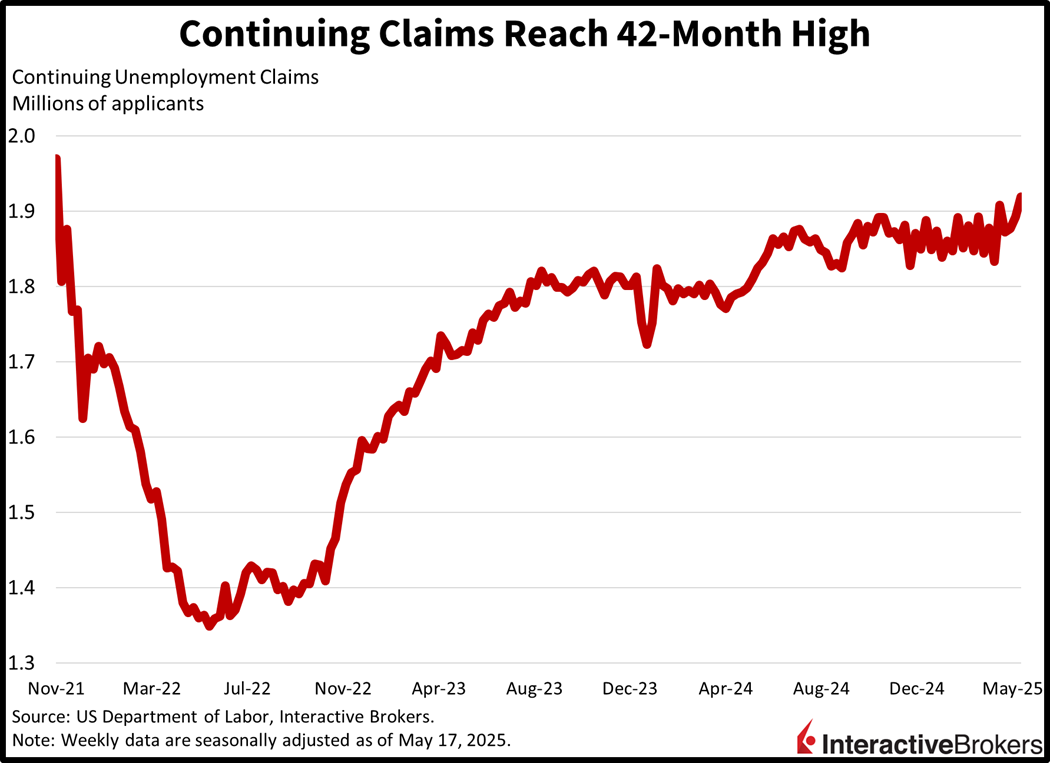

Unemployment claims picked up in the past two weeks, signaling a modest labor market slowdown. Continuing filings rose to their loftiest level since November of 2021, hitting 1.919 million for the week ended May 17, well above the median estimate of 1.890 million and the prior period’s 1.893 million. Initial applications also climbed, rising to 240,000 for the week ended May 24, exceeding the 230,000 forecast and the previous interval’s 226,000.

Greater Inventory Fails To Boost Home Sales

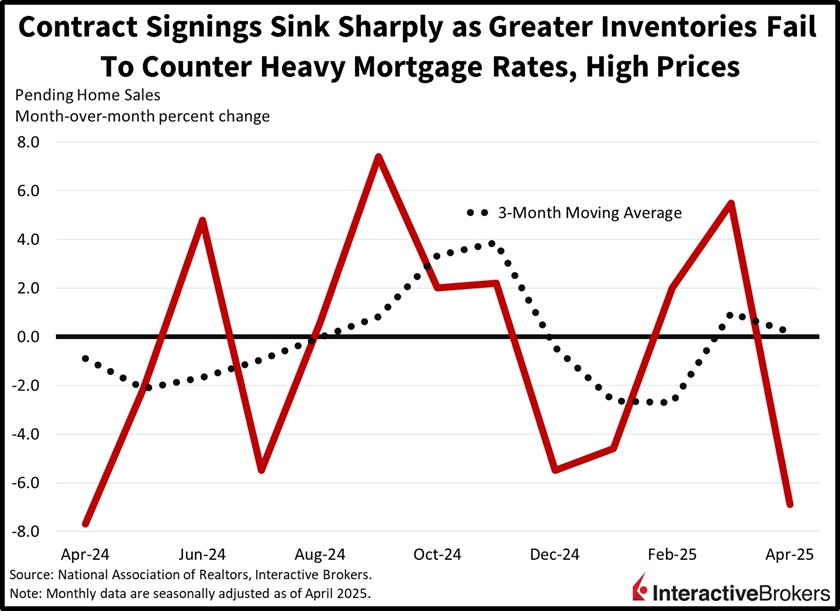

Residential contract signings tanked sharply in April, as elevated mortgage rates and prices overwhelmed the positive impact of greater inventories. Pending home sales, a leading indicator of closing transactions, dropped 6.3% month over month (m/m), well below the -0.9% expected and the 5.5% growth rate from March. All regions contributed to the weakness with the West, South, Northeast and Midwest slipping 8.9%, 7.7%, 5% and 0.6%.

Longer Journey Across Trump Trade Tunnel?

Today’s news doesn’t change my buoyant economic outlook as I’m expecting conditions to accelerate once uncertainty regarding cross-border commerce diminishes. But the recent legal standoff is a setback that has the potential to weigh on activity and sentiment, as it may very well extend our journey across the Trump trade tunnel. It’s also possible that this is just a quick hiccup, as the presidential administration may take the case to the Supreme Court as soon as this week. With the final earnings report from big-tech behind us alongside benign inflationary pressures, I’m bullish on stocks and bonds from here.

International Roundup

Australia’s Capital Investments Fall

The first quarter was disappointing for capital expenditures in Australia. Plant and machinery outlays fell 1.3% q/q after dropping 0.6% in the last three months of 2024, according to the Australian Bureau of Statistics. Meanwhile, private new capital allocations sank 0.1% while economists anticipated a 0.5% increase. In the final quarter of 2024, the metric expanded 0.2%. Private funding for buildings and other structures bucked the trend, climbing 0.9% q/q compared to 0.2% in the fourth quarter. Mining was another outlier with investment climbing 1.9% white total expenditures for other industries fell 1.95.

Foreign Buying of Japanese Assets Decline

Foreign investors yanked $2.3 billion from Japanese bonds in the week ended May 24, the fourth straight week of outflows. Meanwhile, foreign investors purchased only 309.3 billion yen worth of Japanese equities, down from 715.3 yen in the preceding reporting interval. While the buying of equities dropped substantially, it was the eighth consecutive week of net inflows.

But Household Sentiment Strengthens

Household sentiment in Japan climbed to 32.8 this month, up from 31.2 in May and above the consensus forecast of 31.8. Within the overall benchmark, the subindex for employment climbed to 37.3 from 35.7 and views of income growth reached 38.3, up from 37.5. Households’ willingness to buy durable goods also strengthened, moving from 24.2 to 25.4.

Related: Markets Surge Again: How Trump’s Trade Deal Comments Sparked a Stock Rally