It’s easy to stick with investments that are leaving all other assets in the dust. In fact, logic tells us because they’re performing so well, we should buy more. While we’re at it, shouldn’t we dump the lousy performers in our portfolio as well? But logic does not make for a quality investment strategy. These emotions are what makes investing so difficult.Additionally, when diversifying your investments , mediocrity is inevitable. Given the tear U.S. Stocks have been on, it’s a good time to talk through the risks and benefits of diversifying away from areas that have been the top performers. Despite how cliche it’s become at this point, the phrase “past performance is no guarantee of future results” is still a truth. Memories of previous bubbles seem like the distant past. Some of us don’t want to believe and others don’t want to miss out on gains any longer. Whatever the reason, it’s inherently difficult to diversify away from seemingly never-ending profits. So in this episode, we discuss the answer to why you even want to bother diversifying with international and emerging market stocks and what the results could be going forward.

Why have U.S. stocks been so tempting?

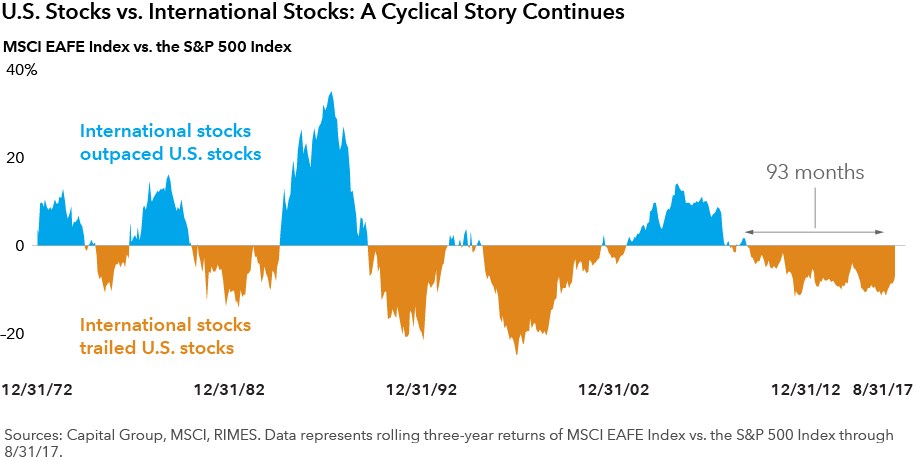

The U.S. stock market has enjoyed outstanding results over the past ten years, earning around 10.7% per year (S&P 500 with dividends through August 2018). With numbers that consistent, it’s hard to find a reason to diversify with international equities when U.S. stocks are on such a hot streak. But we live in an interconnected world, our coffee, cars, electronics, are all created across the globe. While US stocks represent just 50% of global market values, 70-75% of Americans invest solely in U.S. stocks, influenced by home country bias which is common throughout the world.Furthermore, out of the last 20 calendar years through 2016, no country had the best-performing equity market for more than two years. As Howard Marks once said, “There’s little I’m certain of, but these things are true: cycles always prevail eventually.” A great example of this is from 2003 to 2009, foreign stocks beat U.S. Stocks by 7.3% a year (measured with MSCi ex US vs. S&P 500). Cycles will happen, which makes a well balanced diversified portfolio a sound disciplined strategy, demonstrated in the chart below from Capital Ideas. Related: 3 Most Asked Financial Questions

Related: 3 Most Asked Financial Questions