I read Jamie Dimon’s shareholder letter with interest this week. His message does not read like a shareholder letter from a banker …

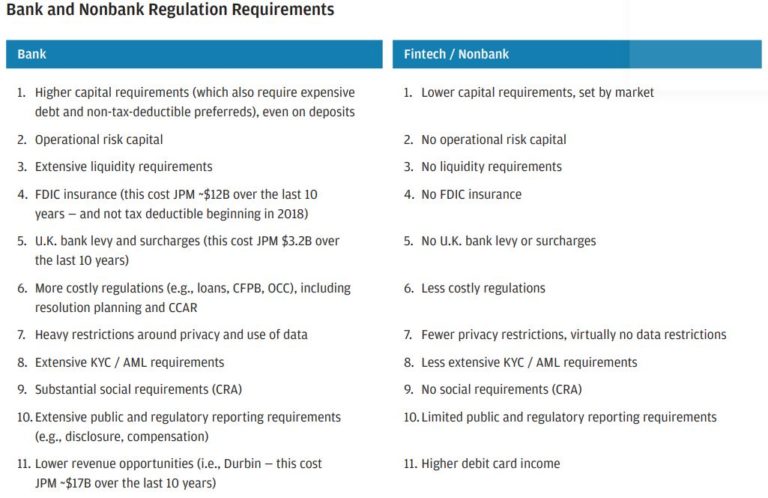

Banks “are facing extensive competition from Silicon Valley, both in the form of fintechs and Big Tech companies (Amazon, Apple, Facebook, Google and now Walmart), that is here to stay. As the importance of cloud, AI and digital platforms grows, this competition will become even more formidable. As a result, banks are playing an increasingly smaller role in the financial system.”

[Banking] “is bogged down in the past — it needs to focus on the future.”

“Acquisitions are in our future, and fintech is an area where some of that cash could be put to work.”

“Businesses must earn the trust of their customers and communities by acting ethically and morally.”

“The problems that are tearing at the fabric of American society require all of us – government, business and civic society – to work together with a common purpose.”

“History teaches us that as a successful society ages, the common social purpose that binds it becomes less important.”

“We are stymied by self-interest, selfishness, and the build-up of bureaucratic plaque and institutional sclerosis.”

“The Chinese see an America that is losing ground in technology, infrastructure and education – a nation torn and crippled by politics, as well as racial and income inequality – and a country unable to coordinate government policies (fiscal, monetary, industrial, regulatory) in any coherent way to accomplish national goals. Unfortunately, recently, there is a lot of truth to this.”

“We are hampered by short-term thinking that’s never comprehensive.”

“We have an opportunity to make the world a better place for ourselves, for our children and grandchildren, and for all living things that share this planet with us.”

Jamie Dimon’s shareholder letter, April 2021

For those who follow my blog, you will know that I am working heavily on how we can use digital for good by creating purpose-driven banking. You might also know that Jamie Dimon has been leading the charge to move towards stakeholder capitalism during his chairing of The Business Roundtable (see page 11).

It is surprising therefore to read a shareholder letter from a bank leader respected by all, calling for a new manifesto for banking, for business, for government and for America, as that’s what this shareholder letter reads like.

In fact, so many of the statements Jamie makes over his more than 60 pages of rationale are in synch with my own thinking, it’s scary. The challenge for Jamie, and all other bank CEOs, is how to synch that thinking with the business itself.

Business is still too driven with short-termism and shareholder return whilst, as Jamie points out, the more you focus on long-term development of the business, the more likely you will increase shareholder return.

Business is still too skewed towards making a buck at the expense of community and society but, as Jamie points out, if business only looks at making a buck then community and society will spurn that business in the long-term.

Business is still too driven by profit and lacks inclusion, diversity and equality but, as Jamie points out, businesses that are exclusive, homogenous and unequal will not survive.

I was tempted to share the whole newsletter here but, with so much content, can only recommend you read it, in full, over a strong cup of coffee. Meantime, a few interesting charts.

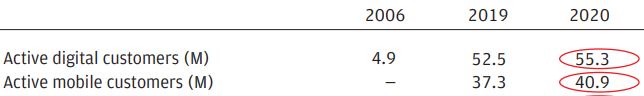

JPMorgan Chase has just over 55 million retail digital customers …

#Recommended

Related: Jamie Dimon Is Scared of FinTech