On September 13, 2021, the House Ways and Means Committee released its proposals to raise revenue so the nation could invest in its future. The changes include increasing income tax rates, changing the rules around retirement plan contributions and distributions, and amending estate and gift tax laws. With the proposals still in debate on Capitol Hill, we don't yet know what specific changes are coming, but one thing is sure: taxes will be increasing in 2022. That reality makes it vital that you create a strategy today. Making a few smart moves before the changes are enacted may help mitigate the impact on your future tax bills—even if you aren't financially fortunate enough to be counted among the ultra-wealthy that the proposal is designed to target. Here's a brief (and far from comprehensive) look at what's changing, who will be affected, and the steps you can take to lessen the blow.

Income Tax Rates

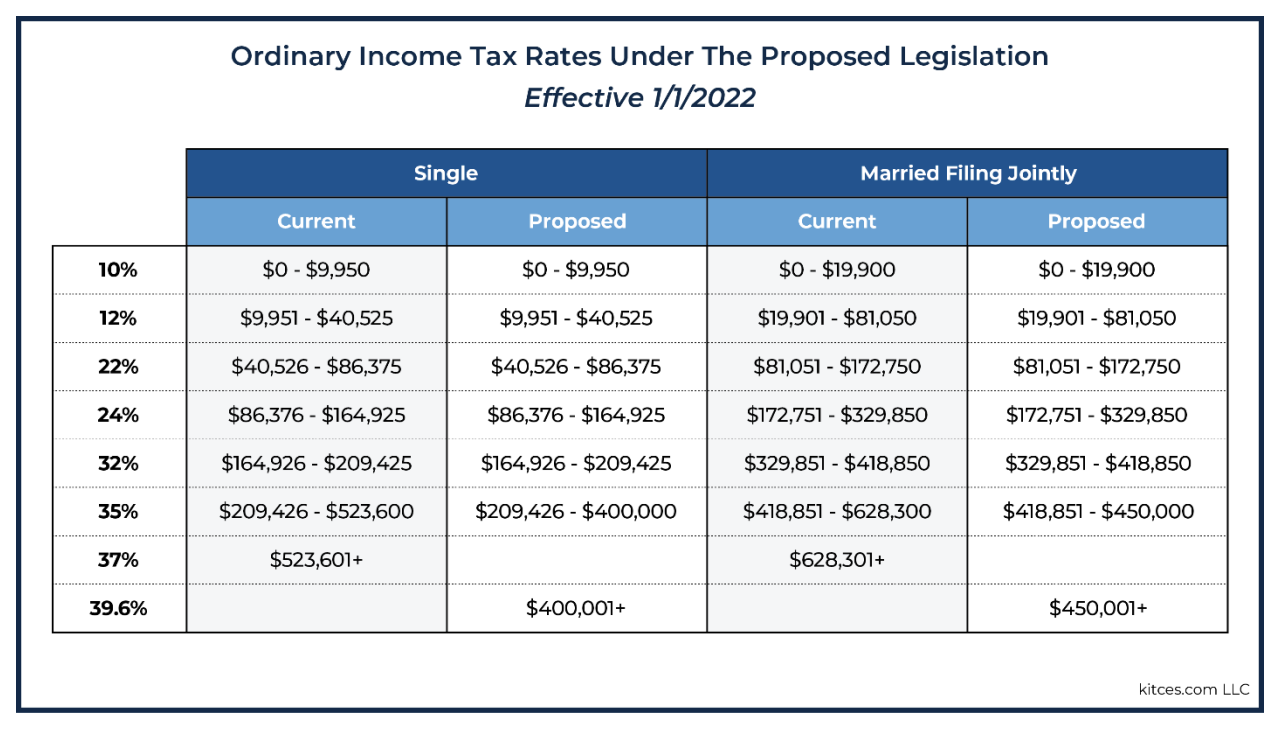

Most taxpayers are familiar with tax-rate brackets that dictate the percentage you pay based on your individual or joint income (depending on how you file). The good news is that the proposal includes no change for taxpayers with annual income of $209,425 or less (single) or $418,850 (married, filing jointly); for this group, all brackets up to 32% remain the same. As you can see below, income levels for the 35% bracket have been reduced by $123,600 (single) and $178,300 (married, filing jointly). As well, the existing 37% bracket will disappear completely, with income above $400,001 (single) and $450,001 (married, filing jointly) being taxed at 39.6%.

Clearly this won't affect everyone, but if you do fall into that 'high income' group (the definition of which is certainly debatable here in Southern California!), it would be wise to explore strategies that accelerate as much income as possible into the 2021 tax year. Here are some tactics I am exploring with my clients:

- Take (and give) end-of-year bonuses in 2021. If you expect a sizable bonus from your employer, ask if the payment can be made before December 31, 2021. If you are an employer and are giving bonuses this year, schedule payments before the end of the calendar year.

- Exercise stock options in 2021. If you are planning to exercise non-qualified stock options or have options that are expiring—especially if that additional income will push your income into a higher bracket—take action before December 31, 2021. Managing your tax bracket is always a wise move, but the impact may be more dramatic than usual this year.

- Delay deductible expenses into 2022. From a tax perspective, you will want to be taxed on as much as possible in 2021 (when taxes are lower), and as little as possible in 2022. Since deductions lower your Adjusted Gross Income (AGI), shift deductible expenses to next year to lower your income.

Capital Gains Tax Rates

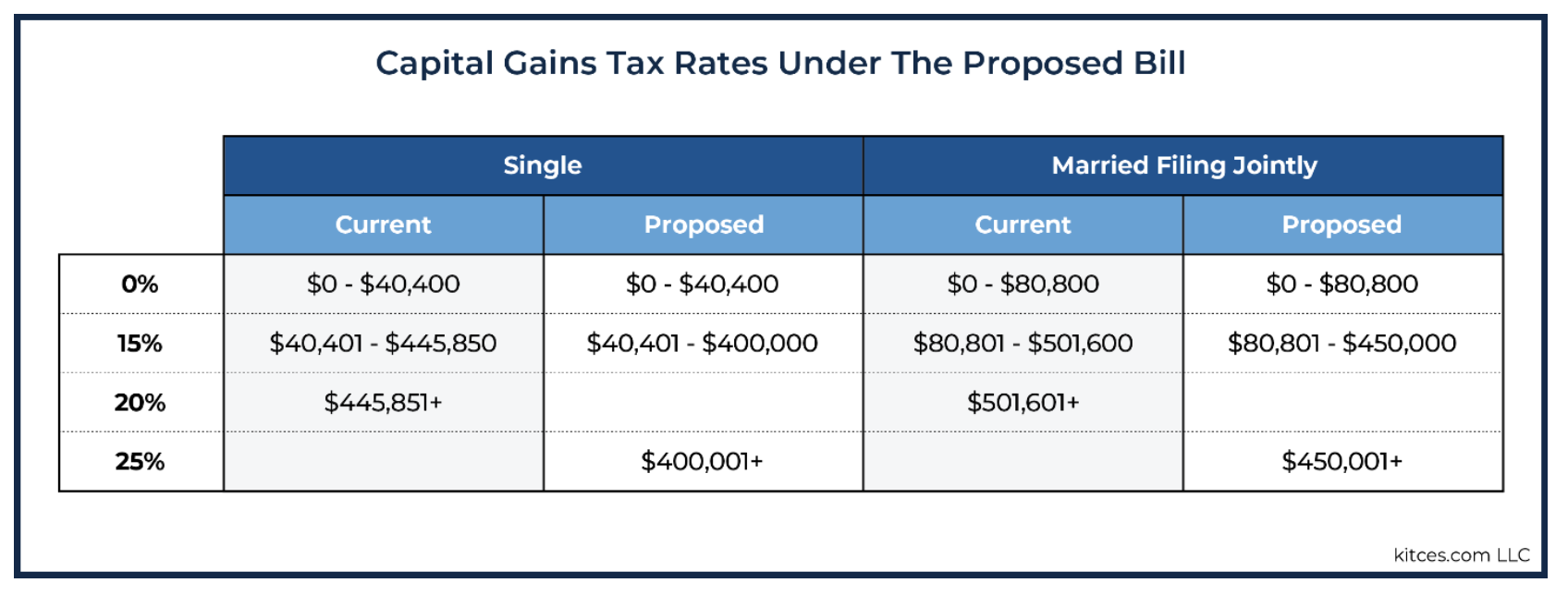

Under the current law, the tax rate on capital gains is capped at 20%. Under the proposed law, the rate will be 0% for those with annual incomes of less than $40,401 (single) or $80,800 (married, filing jointly), and climbs to 25% for those with annual incomes above $450,000.

To the government's credit, this approach is designed to tax those who can most afford to pay. The challenge comes when taxpayers who typically earn lesser amounts experience one-time capital gains events that throw them into a higher bracket during a single year. Examples include selling a home, selling a block of stocks, taking an emergency withdrawal from a retirement account to cover an emergency expense, or selling a small business. In all cases, middle and lower-income individuals may be penalized with a tax rate designed to 'tax the rich’—even when the taxpayer is nowhere near qualifying as a 'one-percenter’.

In years past, there was a great tool called the 'fairness clause' that allowed individuals to average the income of one-time capital gains events over several years, lessening the tax implication. Unfortunately, that clause no longer exists. This means one-time events have the potential to create serious tax liabilities. One approach I'm working on with several clients is to accelerate capital gains to 2021 to take advantage of the current tax rate before anything changes. If you think this may be beneficial for you, let's look at your options together.

If the proposed changes do become law (which could happen as late as the last day of the year), the shift in the capital gains tax structure is planned to be effective as of September 13, 2021, the day the legislation was proposed. My guess is that this was included to discourage a major market sell-off. Regardless of the reasoning, it is vital to work with your financial advisor, enrolled agent (EA), or CPA to create a strategy that minimizes your capital gains taxes however possible.

Estate and Gift Tax Rates

Under the current law, other than assets that are being passed on to a spouse or charity (which are and will continue to be free of gift/estate tax), transfers of assets under $11,700,000 per person can also be transferred estate-tax-free. Amounts that exceed that limit are taxed at the current estate and gift tax rate. While this was scheduled to be reduced on January 1, 2026, the current proposal cuts that exemption in half to $6 million (single) or $12 million (couples) beginning January 1, 2022. If you have considered making a gift of more than $6 million, it is probably wise to act before the January 1 change.

If your net worth is high enough that this change will impact your estate planning strategy, you may want to consider a 2021 gift into an Intentionally Defective Grantor Trust (IDGT)—a type of irrevocable trust that allows you to retain the income tax liability on your gifted assets during your lifetime, while allowing the assets in the trust to transfer to heirs free of the estate tax. The proposal is expected to change the rules for grantor trusts, removing the tax exemption by including them in the trust in the grantor's estate. (There's a reason lots of lawyers will be working overtime to create new trusts before New Year's Day!) You must act now or lose the tax benefits of an IDGT.)

There is some good news for estate planning. The annual gift exclusion remains unchanged at $15,000 per donor, per donee. Also, the proposal does not include changes to the step-up in basis, which helps minimize capital gains tax by adjusting the cost basis (or value) of an asset owned at death to the asset's value on the day of death. Cheers to that!

Other Proposed Changes

There are a few other changes worth mentioning. If they apply to you, let's talk about what we can do to help mitigate the impact.

- The proposal prohibits the conversion of after-tax IRA amounts into Roth accounts. In other words, no more backdoor Roths! (To read more about this strategy and learn if it may make sense in 2021, see my blog post on the topic here.)

- The proposal adds a 3% surtax for taxpayers with ultra-high incomes of more than $5 million annually. It also includes a single-year RMD (required minimum distribution) of 50% for anyone with an annual income of more than $400,000 (single) or $450,000 (married, filing jointly) who holds IRAs that have combined balances of more than $10 million (single) or $20 million (married, filing jointly). While I am not a fan of changing the rules of the game when people in this fortunate situation contributed to their IRAs legally according to the tax laws, these are moves that will undoubtedly achieve the objective of taxing the rich. (Is this a ‘wealth tax’ or ‘income tax’? Hmmm).

As we move closer to year-end, it is essential to be aware of the proposed tax law changes and their effect on your tax situation. I am working with clients on a case-by-case basis to take action where needed (especially in the case of some one-time taxable events as discussed above) and preparing to move quickly once the proposal is passed. This year is particularly challenging because of the proposal's timing, but tax laws have always been a moving target—which makes active tax planning a must. As a Certified Financial Planner™ (CFP®) and Enrolled Agent (EA), it is my job to stay one step ahead when I can, and to help create strategies that support your long-term financial health. As always, I am here to help!