Written by: Nate Tonsager

The CPI inflation report released this week showed that it’s going to be difficult to close out the final mile in the fight against inflation. However, thanks to that report, it seems like investors are finally coming to grips with the Fed’s message of higher rates for longer.

I feel comfortable saying there will continue to be volatility, both up and down, as the markets react to the monthly inflation data reports. If the inflation data supports rate cuts, markets will likely go up. If the inflation data supports leaving rates alone, markets are likely to go down.

For example, this Tuesday (2/13) there were marginally higher CPI inflation readings than what the analysts expected. Well, that sent the S&P 500 down -1.4% and the Nasdaq down around -1.6% on the day. Mostly because the markets interpreted this dataset as a reason for the Fed NOT to cut interest rates.

But too many people love to oversimplify the impacts from Fed rates by saying, “High rates/rate hikes are bad for stocks, and low rates/rate cuts are good for stocks.” Sure, the sentiment of that relationship is generally true, but it’s never that simple.

If that’s all you’re fixated on when it comes to the Fed, I think you are missing what’s probably most important to investors: the ability to plan around a significant period with higher interest rates.

Impacts of Rate Instability & Uncertainty

Interest rate levels feed into every part of the economic system. The rate set by the U.S. Federal Reserve is a key component to establishing interest rates for countless loans, interest payments and other yield-focused investments. If you want to try and guess which direction rates are headed, start with the rate set by the U.S. Fed. Wherever it goes—up, down, or sideways—the effects filter through into the broader economy.

Since the end of the pandemic, interest rates have been on the rise. Beginning in March 2022, the Fed went from a nearly 0% rate to over 5% in roughly a year. Arguably the most painful part was the staggering speed of these hikes.

It’s tough for a business or an individual to effectively plan for their long-term future when there’s that much volatility in interest rates and borrowing costs. Uncertainty around rates can cause many investors and business leaders to delay major purchases or investments until they have more clarity.

Frankly, I don’t blame them.

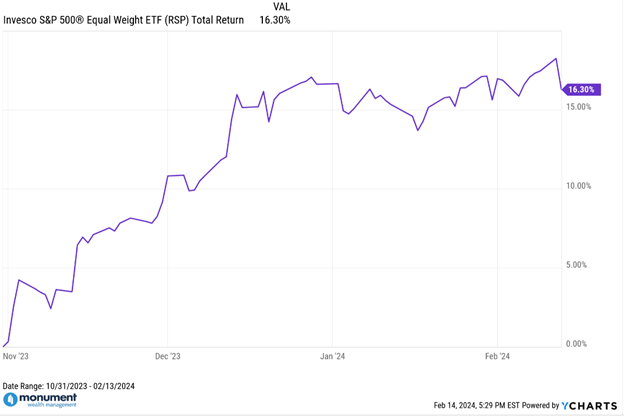

Thankfully, it seems that the Fed has signaled an end to this hiking cycle during its past couple of meetings. Removing some of the unknowns around rates is one of the primary reasons we’ve seen broad market rallies like the equal-weight S&P 500 ETF (ticker: RSP) being up around +16.3% total return from 10/31/23 through 2/13/24 (see chart below).

It’s not a coincidence that there was also a Fed meeting at the end of October. Here’s an example of upside volatility caused by the Fed.

Without the fear of rates moving significantly higher, it should give business leaders the opportunity to start planning and financing longer-term investments that will boost future growth. That’s good news for investors looking for the next wave of growth. Yes, the cost of debt is higher than a few years ago, but if rates aren’t likely to rise significantly in the future, companies and investors can appropriately factor that into the investment decisions being made today.

Finding A New “Normal” for Interest Rates

Higher rates become less of a storyline for your portfolio when you can plan for them ahead of time, but that only works if rates stay relatively flat. Thankfully, the Fed’s goal isn’t to be consistently making major moves. What they want is for rates to find a new normal or a “neutral” level.

The Fed is known for its dual mandate which boils down to low unemployment and manageable inflation. By doing that they are attempting to create a “neutral” economy that is neither too hot nor too cold. An economy that is too cold is growing below trend or said differently, might be leaving economic meat on the bone. But an economy that runs too hot can lead to runaway inflation.

So, what’s the specific “neutral” interest rate for the Fed?

While it’s impossible to know for sure, the Fed itself has estimated it to be around 2.5% when inflation is at its 2% target, or around 0.50% above the current inflation as explained in this Reuters article. So, with inflation currently around 3%, then “neutral” in the Fed’s eyes might be around 3.5%.

Interestingly, I think it’s also very possible that the “neutral” rate level post-pandemic has actually moved higher than the previously estimated 2.5% like this article written by the Minneapolis Fed President suggests. A higher “neutral” rate would mean the Fed needs to cut even less from here as inflation moves back down towards their target.

With the Fed rates currently sitting at 5.25% to 5.50%, they are doing exactly what they said they would: Taking a restrictive stance and staying like that until they are totally comfortable inflation is well under control. It’s going to be some time before the Fed decides to go back to a “neutral” rate policy, and that “neutral” might be even higher than what it was before.

All of this means that interest rates probably won’t be moving a whole lot lower from here.

0% Interest Rates Are Gone: Get Comfortable with the New “Normal”

Let’s be honest, we all got used to 0% interest rates and free money. Businesses could easily finance short-term growth initiatives without too much fear of future consequences and costs. Money was so cheap that many businesses and investors failed to create and follow through on a long-term plan.

That’s not the case anymore.

Gone are the days of 0% interest rates, at least for the foreseeable future, but that doesn’t mean the world is ending. All it means is that companies and investors need to adapt to what could be a long-term trend of higher rate levels if they haven’t already. Everyone knew interest rates were going to have to go up eventually whether they admitted it or not. It’s not healthy, normal, or sustainable for an economy to permanently have 0% rates.

So, if you locked in low rates years ago, kudos to you. Ride that for as long as you can. However, if you’ve been delaying a purchase or investment in hopes of timing a drop in rates, maybe it’s time to reconsider. Who knows how long you might be waiting at this point?

(Also, don’t ever try to time the financial markets. EVER.)

Right now, the combination of the economic data and the Fed’s public messaging of “higher for longer” make it seem like there are minimal rate cuts on the horizon. While that might make borrowing more expensive, planning for your investments should be easier now that there’s potentially more stability, and maybe even some predictability in rate levels.

Related: The Risk of Trying to ‘Get Rich Quick’