Written by: Marc Corigliano

Investing has changed a lot over the years. My grandparents gained exposure to the markets by doing one of two things: buying stocks or buying bonds. Throughout the 20th century, a litany of different investment vehicles were introduced, giving everyday investors the ability to access the capital markets. Mutual funds, exchange traded funds (ETFs), unit investment trusts (UITs), real estate investment trusts (REITs) and separately managed accounts (SMAs) are just a few of the more well-known vehicles brought to the mainstream.

Mutual funds, historically the retail investment universe’s largest player, started seeing capital flow towards ETFs in the mid-2000s. SMA investors had historically been defined as institutional investors and on occasion included the Ultra High Net Worth Individual (UHNWI). Near the end of the Great Recession, as more and more Americans gained access to workplace retirement plans that contained mutual funds and ETFs, minimum investments on SMA’s started to lower. Wealthy retail investors started asking the question “Am I too wealthy for a mutual fund?”

This brief article will examine three investment vehicles: mutual funds, ETFs and SMAs. Exploring a few of the benefits of each vehicle, along with some of their negatives, will hopefully allow you to answer this question.

Mutual Funds

The mutual fund is a powerful product that many generations have used to grow wealth. Mutual funds let investors buy shares of many different companies at one time. They are professionally managed, offering you the choice between several different styles. Active and passive management approaches are two of the main differentiators employed by fund managers. The amount of capital needed to access a mutual fund is usually quite small, with some fund sponsors offering shares for an initial investment as low as $100. Overall, the mutual fund’s greatest accomplishment has been giving generations of people access to capital markets that were historically reserved for institutional and wealthy investors.

However, mutual funds do have negative features to consider. The transparency of mutual funds can surely be called into question as funds only disclose their underlying holdings on a quarterly basis. Liquidity can be another negative when comparing mutual funds to other vehicles. Funds are liquid at the end of each day and while most investors view this as a positive, active traders might see this as a constraint to capturing intra-day gains. Having legacy assets inside of a mutual fund prior to your purchase can be detrimental as well. These legacy positions could contain embedded capital gains which are then distributed to you, even if you were not invested while those assets grew.

The last drawback to consider when investing in a mutual fund is its fees. These include operating expenses (both net and gross), 12b-1 fees, sales charges and redemption fees. It can be even more challenging to evaluate fees when considering the various share classes of mutual funds. Different share classes typically have different fees, and the different share classes are usually a component of the variety of platforms in which you are purchasing shares of the fund. At the end of the day, all fees come out of the fund’s Net Asset Value, or NAV. This can be convenient for an investor, but unless you monitor those fees, they have the potential to erode your investment without you even knowing.

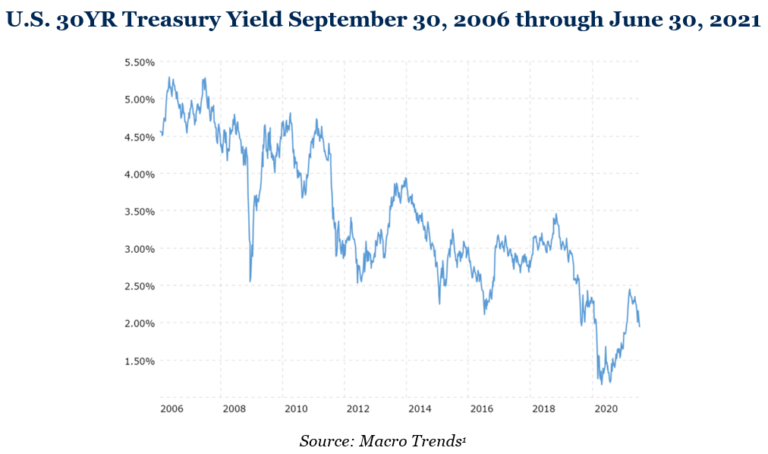

As noted above, when evaluating mutual funds, you might overlook the fact that you are usually accessing a legacy basket of assets. Although we discussed this as a potentially negative impact, especially when considering taxation, at times it can work to your advantage. A fixed income mutual fund, which has shares purchased on June 1, 2021, could very well be holding bonds which the fund purchased in the year 2006. This can be an attractive feature to a fixed income investor. Below is a chart of the U.S. 30YR yield from 2006 to 2021.

This chart can be used to visualize the declining rate environment seen since 2006. An investor going out on the open market and buying a U.S. 30YR treasury bond today would be acquiring bonds with a current yield well below 2.5 percent. Purchasing shares of an aged fixed income mutual fund would most likely give that same investor access to bonds which were purchased many years earlier. These bonds, which are inside of the aged fixed income fund, could have acquisition yields north of 4.5 percent. The mutual fund may not have identical duration and credit exposure to a U.S. 30YR treasury bond, but for an investor focused on income, this cash flow differential is powerful. It is important to note that this scenario is directly benefitting from a declining rate environment. Should the opposite occur, and rates were historically trending upward, the same benefits may not apply.

Exchange Traded Funds (ETFs)

Many of the negative consequences associated with mutual funds can be mitigated when investing in an ETF. Usually an ETF is low fee, tax efficient and very transparent. Those three benefits do come with caveats. ETFs are low fee because a professional money manager is not usually selecting the securities within the fund, unlike a mutual fund. The job of an ETF is often to mimic the performance of a specified benchmark. As the holdings of a benchmark are very transparent, so are the holdings of an ETF. Since the market performance of the index is consistently the same performance an investor will experience, there is no alpha being generated by an ETF.

The chart below shows how the popular ETF SPY performed relative to its benchmark during a six-month period ending July 12, 2021. The blue line represents SPY while the yellow represents the S&P 500 index, demonstrating how close the performance between the two is.

The last thing to mention regarding ETFs is that some are financially engineered. It will not take long for you to do a quick Google search and find ETFs that are leveraged, some even two or three times! These vehicles can also be inversely levered, and you can buy/sell options on ETFs. The ability to financially engineer an ETF is a unique feature, but one that can turn on an investor quickly. It is important to research all aspects of investments, even ETFs, to ensure you understand the associated risks.

Separately Managed Accounts (SMAs)

SMAs offer a unique blend of aspects that both a mutual fund and an ETF offer. The first benefit is tax efficiency. An investor in an SMA owns the underlying securities which are selected by a professional money manager. Investors can hold those securities throughout year end, or harvest gains/losses. SMAs are very customizable. Investors that are passionate about ESG investing or perhaps a religious screen can usually implement that type of overlay with their manager. Neither a mutual fund or an ETF can put an ESG overlay on for one client; it is either the whole fund or nothing at all.

An important aspect to remember when utilizing an SMA is that there are a few hurdles to investment. Manager access and account type are usual hurdles; however the minimums are typically much higher than a mutual fund or ETF. Such roadblocks to investment have been mitigated in recent years, stoking renewed interest in these products. Depending on the investment manager and asset class, the minimum investment for an SMA can start anywhere around $50,000 and stretch well into the seven-figure range.

This point has historically been the root of our overarching question. If an investor’s capital far exceeds the required minimum for an SMA, why wouldn’t they choose that type of vehicle?

Remember that individual securities are being purchased within an SMA, and although we mentioned that as being unique, there are some challenges associated with it. There might be a delay to the deployment or the removal of capital from an SMA. Take municipal bonds for example. You may have to wait four to six weeks in order to have your capital deployed due to the lack of supply within the market. The same can be said about removing capital from an SMA. Unlike a mutual fund which has daily liquidity, or an ETF with intra-day liquidity, you may have to wait some time to receive your capital from an SMA. This is dependent on the underlying liquidity of the asset class in which you are invested. The yields found in an SMA, whether from fixed income or equities, all depend on an investor’s timing. Think back to the example previously given regarding the U.S. 30YR treasury. Opening a fixed income SMA in today’s rate environment will give an investor today’s range of acquisition yields.

In Closing

Let’s look back to the main question addressed here today, “Am I too wealthy for a mutual fund?”

Your answer: It depends.

Really, this question should not be answered based on the variable of wealth alone. What factors are important to you in an investment vehicle? Is it transparency? Liquidity? Perhaps management constraints? These are all different aspects that should be evaluated when you decide what the appropriate investment vehicle is. Each of the vehicles discussed here today has its own merits, as well as its own detractors. Investors should create portfolios based on their goals relative to their personal level of acceptable risk. Once it is time to piece that portfolio together, there is a vehicle that can suit the needs of every investor, regardless of wealth.

For more information on which investment vehicle may be right for you, please reach out to any of the professionals at Fiducient Advisors.

Related: The Clock Could Be Ticking for Favorable Estate Planning Provisions

1 https://www.macrotrends.net/2521/30-year-treasury-bond-rate-yield-chart

2 https://www.google.com/finance/quote/SPY:NYSEARCA?comparison=INDEXSP%3A.INX&window=6M