Written by: Pictured Rocks Investment Advisors

We apologize for the ill-timed analogy to ventilators, given the current COVID-19 crisis, but thought it was apropos to active management these days. In 2019, only 29% of active equity managers beat their underlying benchmarks in a year where markets were up over 30%. That is down from 37% in 2018. We view active management in a portfolio akin to putting a patient on a ventilator - it has its place only after exhausting all other (passive) options, since it usually doesn't work and the cost to the client (patient) can be devastating.

If anyone is reading this post that has an actively-managed mutual fund that charges a 5% upfront front-load and over 100bps expense ratio, then you have a 'ventilator' in your portfolio. It may have sounded good as an option because your advisor told you that this active manager can bring your portfolio back to life, but, like ventilators, most active funds fail and can be devastating to your portfolio based on their consistent underperformance and high fees (side effects).

We have previously stated that where we fit active managers into a portfolio is where we find a lack of leadership in that respective asset class, which usually occurs within niche areas of the market. Given the proliferation of passive funds across every niche area of the market and the unrelenting flows into those passive funds, a game of chicken and the egg has been created. Most passive funds are market-cap weighted, meaning they tend to overweight the larger companies either in an equity or fixed income strategy. People have argued that passive, market-cap weighting has made larger companies outperform, given the enormous amount of passive inflows over the years, which has distorted their valuations. We'd argue that these larger companies, which are mostly technology companies, are simply the biggest beneficiaries of a secular change in the global economy where technology is now more important than people (laborers). A sea change is occurring in how technology is solving solutions across so many sectors and industries. In our opinion, the larger companies got to that size for a fundamental reason, not due to passive flows.

With that in mind, let's take a look at 3 core equity allocations within an investor's portfolio where we would argue passive management is the better choice over active management:

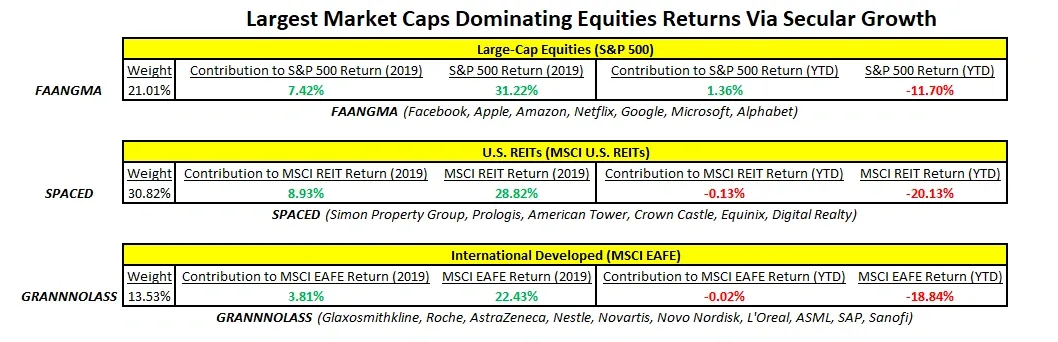

Large-Cap (S&P 500), U.S. REITs (MSCI REITs), and International Developed (MSCI EAFE).

In each of the 3 core areas of an equity allocation, it is fairly evident that the most popular market-cap weighted passive strategy is the best choice, given where the returns are coming from.

Large-Cap (S&P 500): FAANGMA stocks comprise about 21% of the S&P 500 (SPY), and generated almost 24% (7.42% / 31.22%) of the S&P 500's 2019 returns. They are also the few positive contributing stocks to the S&P 500 in 2020 thus far during the COVID-19 crisis. Any active, large cap strategy HAS to hold these 7 FAANGMA stocks to keep up with the S&P 500, so it doesn't make sense to pay up for active strategies that will have to mirror the benchmark (i.e. closet indexers). Good luck trying to outperform SPY without over-weighting these 7 names in the active portfolio and taking on excessive concentration risk; it's possible, but we're in a game of playing odds and those odds are low.

U.S. REITs (MSCI REITs): SPACED stocks comprise almost 31% of the MSCI REITs (VNQ), and generated almost 31% (8.93% / 28.82%) of the MSCI REITs 2019 returns. They are also leading the entire U.S. REIT universe in 2020 during the COVID-19 crisis, and have only detracted -0.13% of the -20.13% returns for VNQ. Again, any active, U.S. REIT strategy HAS to hold these 6 SPACED stocks to keep up with the MSCI REITs index, so it doesn't make sense to pay up for active strategies that will have to be closet indexers. Good luck trying to outperform VNQ without over-weighting these 6 names in the active portfolio and taking on excessive concentration risk; it's possible, but we're in a game of playing odds and those odds are low.

International Developed (MSCI EAFE): GRANNNOLASS stocks comprise over 13.5% of the MSCI EAFE (EFA), and generated almost 17% (3.81% / 22.41%) of the MSCI EAFE 2019 returns. They are also leading the entire International Developed universe in 2020 during the COVID-19 crisis and have only detracted -0.02% of the -18.84% return for EFA. Again, any active, International Developed strategy HAS to hold these 10 GRANNNOLASS stocks to keep up with the MSCI EAFE index, so it doesn't make sense to pay up for active strategies that will have to be closet indexers. Good luck trying to outperform EFA without over-weighting these 10 names in the active portfolio and taking on excessive concentration risk; it's possible, but we're in a game of playing odds and those odds are low.

Our point is not to denigrate active management. But building portfolios is about seeking higher risk-adjusted returns at a lower cost. This starts with analyzing exactly what drives or will drive the particular area of the market as we did above, both from a core and satellite allocation perspective. If it can be ascertained that active management has more than a likely shot at outperforming its passive benchmark within that particular area of the market, then it may be prudent to pay up for that active strategy. Most of the time, and the data supports it, it's simply not worth the risk, similar to a ventilator.

Related: The Problem With Financial Predictions

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.