Written by: Gabriela Santos

After a strong five months, equity markets are experiencing a correction so far in April. As the most talked about and invested companies (the “Magnificent 7”) prove to not be invincible, investors are considering what other opportunities exist. International equities deserve a second look, especially those in Asia, as attractive macro and microeconomic developments are unfolding. With that said, the region encompasses a multitude of very different economies and markets, with at times very different market dynamics. Corporate governance changes favor Japan, while the combination of favorable economic and company fundamentals favors India within the EM space. Investors should consider trimming decade-long international equity underweights – and Asia is the key place to look for opportunities.

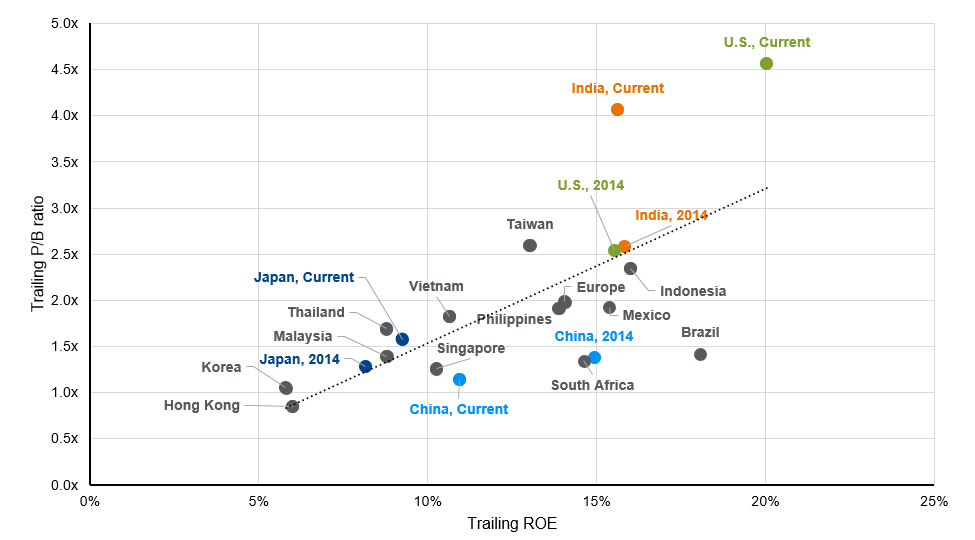

As previously written, strong performance has recently come from companies listed overseas – unlike headlines might suggest. In particular, some markets in Asia are going through attractive top down and bottom-up changes. The region is home to five of the ten largest equity markets in the world: China’s two mainland exchanges, as well as those in Japan, India, Hong Kong. However, these markets have different characteristics in terms of liquidity, valuations, earnings quality, and trends. One way to think about the nuances in equity markets is to consider the return-on-equity (ROE or how efficient profitability is) with the price-to-book ratio (P/B or how much investors are willing to pay up for a stock).

As shown below, there is a wide range in emerging markets, including “high quality”, and hence traditionally “expensive”, markets like India versus “lower quality” and traditionally “cheap” markets like China and South Korea. As a result, investors should evaluate these markets differently. For India, the excitement is justified due to a combination of favorable demographics, economic reforms, and supply chain realignment. Oftentimes, investor pushback is that Indian equities are expensive given its price-to-book over 4x (almost as high as the U.S.). Critically, though, its return-on-equity is almost as high as the one in the U.S. (and consistently so over the past decade). As such, Indian equities do deserve to trade at a premium to other EM and global markets – and investors may miss out should they wait for India to cheapen significantly. In fact, this is the attractiveness of investing in Indian equities: a good macro and micro story.

These differences also exist between developed markets, with the U.S. market having quality companies and commanding elevated valuations versus Japanese markets which have traditionally had the opposite characteristics. With Japan, however, the direction of travel is key. Recent corporate governance reforms are instilling newfound momentum and pressure on Japanese companies to improve shareholder value. As a result, Japan’s ROE and P/B are improving, presenting investors with a once in a generation rerating opportunity in a once forgotten market.

Global equity markets have very different characteristics

Source: FactSet, MSCI, J.P. Morgan Asset Management. Numbers are based on MSCI indices except for the U.S. which is based on the S&P 500 Index. ROE = return-on-equity and P/B = price-to-book ratio. Last 12-months' figures. Guide to Investing in Asia. Data are as of April 26, 2024.