Following a V-shaped recovery in 2020, China’s economic growth was expected to moderate this year; however, the pace of deceleration has surprised investors. It is now becoming clear that Chinese policy makers no longer focus exclusively on the quantity of growth, but also on its quality. In addition, several other policy goals are taking priority as well, such as deleveraging, decarbonization, common prosperity and public health. As a result, the floor for Chinese growth is lower than it used to be – but it still exists. October and early November data point to a bottom in growth this quarter, which should provide support to EM assets, commodity prices, and global multinationals in 2022.

Consensus expectations for China’s 2021 economic growth have moved down from 8.4% in January to 8.0% today and for 2022 from 5.5% to 5.3% (according to Bloomberg). Investors are realizing that China today is very different from the China just five years ago: GDP growth is no longer the only priority as the focus has shifted to:

- Quality of growth: Unlike previous periods of deceleration, China has not tapped on the usual accelerators of real estate and infrastructure investment, as this is seen as low quality growth. Instead, focus has remained on areas seen as crucial to China’s long-term growth, including small and medium-sized private businesses, high end manufacturing, technological innovation, domestic consumption, and green sectors.

- Deleveraging: Unlike other countries, China began to normalize its monetary and fiscal policy back in December 2020. As a result, investment in the already indebted industries of real estate and infrastructure has slowed considerably. Residential real estate should remain an area of de-emphasis as it finds itself at the epicenter of several priorities.

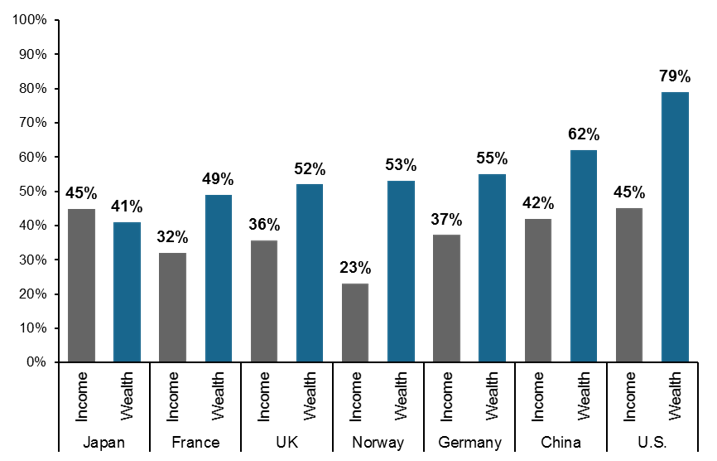

- Common prosperity: China’s share of national income going to the top 10% of the population has increased from 31% in 1990 to 42% in 2019. Going forward, China aims to grow the pie, but also to split it better too by lowering the cost of housing, education, and health care and regulating large companies so they balance efficiency and equality. This has contributed to the real estate deceleration, as well uncertainty affecting private investment and hiring more broadly.

- Decarbonization: China’s goal of peaking CO2 emissions by 2030 and becoming a net zero CO2 emitter by 2060 requires significant annual reduction in energy consumption intensity, leading to a slowdown in high energy intensity sectors and a spike in energy prices.

- Public health: China continues with a “zero tolerance” approach to the pandemic, introducing localized restrictions when local cases flare up. This has restrained the services recovery, but has kept the cumulative confirmed death toll at 3.2 per million people versus 657.2 globally.

As a result, China has allowed growth to slow considerably in the second half of this year to an estimated 4%. While the floor for Chinese growth is lower than it used to be, some growth is still required in order for China to meet its goal of doubling GDP per capita by 2035 (4.7% annual GDP growth). As such, Chinese policy makers have been fine tuning reforms and boosting support to priority industries. Indicators show early signs of growth stabilization, with October data, such as retail sales and industrial production, beating expectations. In addition, the NBS November Composite PMI ticked up to 52.2, the highest level in four months. More confidence in China’s growth path would be an important support to EM assets, commodity prices, and global multinationals in 2022.

Rather than economic growth alone, China is also focusing on equality as a key priority

Top 10%’s ownership of national income and wealth*

Source: Credit Suisse Global Wealth Databook 2021, World Inequality Database, Organization for Economic Cooperation and Development (OECD), National Bureau of Statistics, J.P. Morgan Asset Management. *Income data for Top 10% is as of 2019 and comes from the OECD. Wealth data is sourced from Credit Suisse and availability for Top 10% varies by region: China (2012), France (2017), Germany (2017), Norway (2018),Japan (2018), UK (2019), and U.S. (2019). Guide to China. Data are as of November 30, 2021.