The 1970s Inflation Is Back – But Not Officially

In 1983, the Bureau of Labor Statistics (BLS) made a change to an integral component of inflation indexes. The adoption of owners’ equivalent rent (OER) to estimate shelter costs meant home purchases would no longer be considered a consumption expenditure but instead a capital asset or investment. OER is determined by a monthly survey of consumers who own a primary residence. The survey asks how much consumers would pay to rent instead of own their home. OER represents approximately 25% of the Consumer Price Index and 12% of personal consumption expenditures (PCE). – Penn Mutual

Aroldis Chapman v Nolan Ryan’s Fastball

We’ve been asked on several occasions if the current outbreak of inflation will compare to the 1970s (see our post, Feels Like 1977)?

We usually respond with a rhetorical baseball analogy that goes something like this,

Who’s fastball had more velocity in their prime: Nolan Ryan or Adoldis Champman?

Most answer, “obviously, Chapman’s, the radar gun doesn’t lie, it clocked his record fastball at 105.1 mph in 2010! Nolan Ryan was clocked only at 100.9 mph in 1974.“

We then counter with this,

It all comes down to where the pitch is measured.

The moment a baseball leaves a pitcher’s hand, it starts to slow down because of drag. According to University of Illinois physicist Dr. Alan Nathan, a pitch that leaves a pitcher’s hand at 100 mph will (at sea level) slow down by 9 to 10% by the time it crosses the plate some 55-58 feet later.

So that 100 mph pitch could be measured at 100 mph (at the pitcher’s hand), 99 mph (at 50 feet from home plate), 94 mph (midway on its journey) or 91 mph (as it crosses home plate)—the rate of decrease varies based on atmospheric pressure, so a pitch at the altitude of Denver’s Coors Field slows less than a pitch at Tropicana Field in St. Petersburg, Fla.

… The first radar guns that began appearing at ballparks in the late 1970s and early 1980s measured pitches much closer to the plate.

… So when you read of 85-90 mph fastballs from the early 1980s, realize that they would be registering much faster with current measurement tech. An 85 mph fastball (if registered by a Speedgun at the plate) would be roughly 93 mph if measured by Statcast out of the pitcher’s hand.

And that makes the 100 mph pitches Nolan Ryan threw in 1974 (as measured by Rockwell laser/radar instruments relatively close to the plate) even more remarkable today. – Baseball America

Do the math, folks, after normalizing the data to a standard measurement, add another ten mph to Ryan’s fastball, and you get a velocity of 110 mph. Back to the 1970s.

The CPI of 2022 Is Not The CPI Of The 1970s

Most our readers have heard our sermon on this topic many times but it bears repeating.

As Ryan’s fastball can’t be compared to Chanpman’s, so too it is with the comparative inflation data.

To paraphrase the above,

It all comes down to how inflation is measured.

In 1983, the BLS switched to a shelter measurement in the CPI basket, 33 percent of the CPI basket based on survey data, the based owners equivalent rents (see Appendix) . The old measure pre-1983 was calculated based on the net acquisition approach (see Appendix), the cost of buying a new home measured by, including, among other things, by actual house prices and mortgage rates.

The post-1983 measure, Owners Equivalent Rent (OER), is based on these monthly surveys sent out to homeowners,

If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities? – BLS

We get the BLS’s academic argument of separating housing as an investment good and housing as a consumer service, but the OER measure grossly understates the cost of shelter and inflation.

It is also fatally flawed because marginal buyers always set prices in all markets. Taking the average survey data is far from marginal pricing.

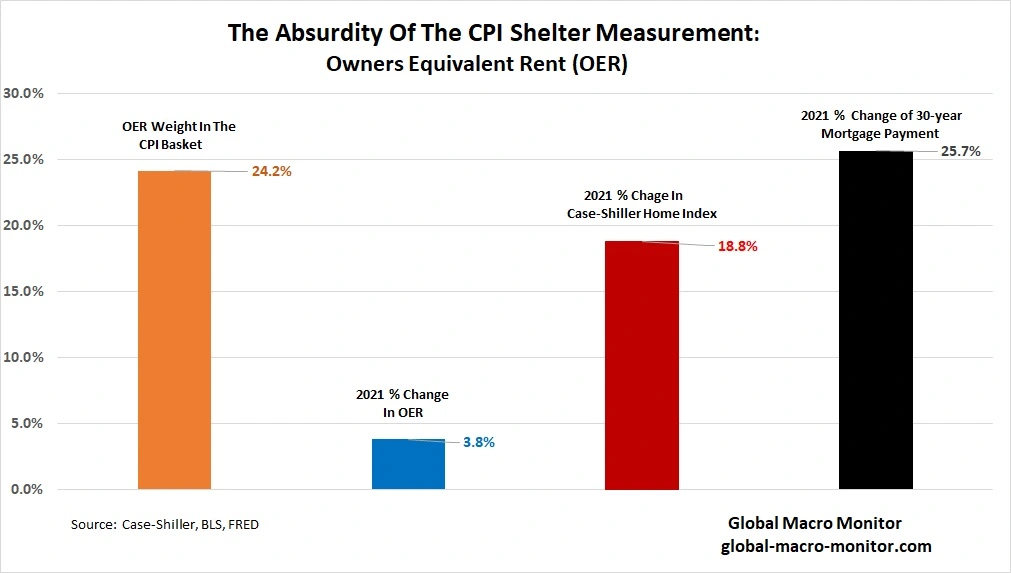

The following chart illustrates our point and the absurdity of the BLS measure of shelter.

The change in the OER, almost 25 percent of the CPI basket, was up a measly 3.8 percent in 2021 versus the 25.7 percent increase for a standard fixed-rate mortgage payment. The data are based on a conventional 30-year fixed-rate mortgage, up 44 bps in 2021, and the average home price increase of 18.8 percent as measured by the National Case-Shiller National Home Price Index.

It’s hard to believe the Fed just stopped buying mortgages. Irresponsible and reckless monetary policy.

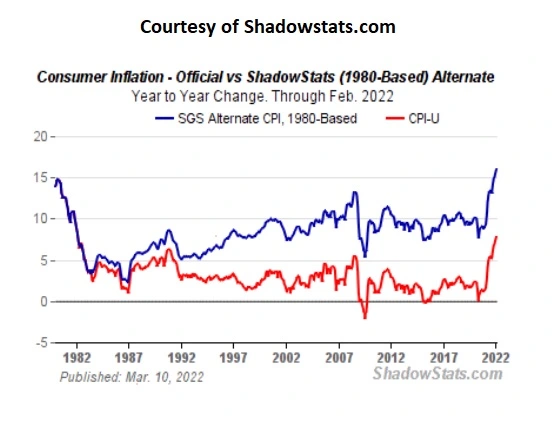

ShadowStats does an excellent job of normalizing and retrofitting the inflation data to its original measure using the net acquisition approach (see appendix) and comparable to the pre-1983 CPI.

It’s impossible to take the current standard measure of shelter and backtest it. Who do and how do we conduct a survey, such as the following,

If someone was going to rent your home in 1977, how much do you think you would have rented it for, monthly, unfurnished, and without utilities?

Welcome to the 1970s, folks.

Here’s to hoping the big hair, perms, and disco do not return with inflation.

Monetary Policy

It looks like the Fed is going to slow-walk the tightening of monetary policy and set to repeat the mistake of the 1970s. Lord, help us when inflation hits 20 percent.

The intellectual consensus among policymakers at the time was that cost-push inflation (the type of inflation arising from an increase in the prices of inputs to the economy, i.e., worker wages) was outside the influence of monetary policy (Romer and Romer 2012). In the words of an economist who presented to the Federal Open Market Committee in May of 1971, “the question is whether monetary policy could or should do anything to combat a persisting residual rate of inflation … The answer, I think, is negative. … It seems to me that we should regard continuing cost increases as a structural problem not amenable to macro-economic measures” (Romer and Romer 2012). – Federal Reserve History

Related: Big Oil: The Fallacy of a Windfall Profits Tax

Appendix

In general, two methods are commonly considered for incorporating the owner-occupied housing cost in inflation indices: the “net acquisition” and “rental equivalence” approaches.

The rental equivalence approach measures the evolution of the rents which owners would have to pay if they rented their accommodation. This means it is not based on actual prices or actual monetary transactions but imputed ones.

The net acquisition approach measures the price paid by households for new accommodation from outside the household sector. It is thus based on actual monetary transactions, but excludes transactions between households, which on net have no influence on the income available to the household sector. The net acquisition approach thus treats houses like other durable goods. — European Parliament