“Reopening stocks” are moving higher.

Some names are hitting all-time highs. Others are breaking out as I type.

That’s not easy to do in today’s “slim pickings” environment. Simply put, most stocks are struggling. The S&P 500 is down 10% this year. The tech-heavy Nasdaq’s down 15%.

Yet stocks that were hit hardest by COVID—those that specialize in travel, vacations, and hotels—are bucking the trend.

Not only does this confirm things are getting back to normal, as I’ll explain, but traders can take advantage of this shift. It’s a straightforward way to profit while markets continue to chop around.

I’ll give you specific trade setups in a minute. First, let’s look at how the ebb of COVID has handed out great trading opporutnities in the past… and why I think history is repeating itself.

The first breakout of COVID-19 turned the world upside down…

Travel stopped. Restaurants and other businesses closed their doors.

And people stopped going into the office.

This lit a fire under work-from-home stocks.

Zoom Video (ZM), the global leader in teleconferencing, rallied 756% between January and October 2020.

DocuSign (DOCU), a company that lets you sign paperwork without stepping foot in an office, also took off. Its share price rallied 385% between March and August of that year.

And Shopify (SHOP), a global leader in online shopping, spiked 441% during that same period.

Cloud computing stocks also went nuts.

Cloudflare (NET), a company that accounts for about 10% of all internet traffic, soared more than 537% from its March 2020 lows.

These were unprecedented moves. And many of these stocks will continue to deliver big returns in the coming years…

There’s a reason Amazon’s letting its employees work remotely indefinitely. COVID proved the work-from-home model works.

But work-from-home stocks are not my top picks right now.

You see, the tide is turning…

COVID cases are falling sharply…

In the past week, the US has averaged about 108,000 COVID cases per day. That’s nearly a 40% drop from week prior.

States all over the country are scaling back mask mandates.

California got rid of its indoor mask mandate for vaccinated residents in early February. New York has ended mask mandates for most indoor public places already. And Massachusetts is letting its mask mandate expire on February 28.

People want their lives back.

I’ve seen more folks without masks on in the past couple weeks than I’ve seen since the pandemic started.

Like the initial COVID outbreak, this shift is sending a specific group of stocks higher…

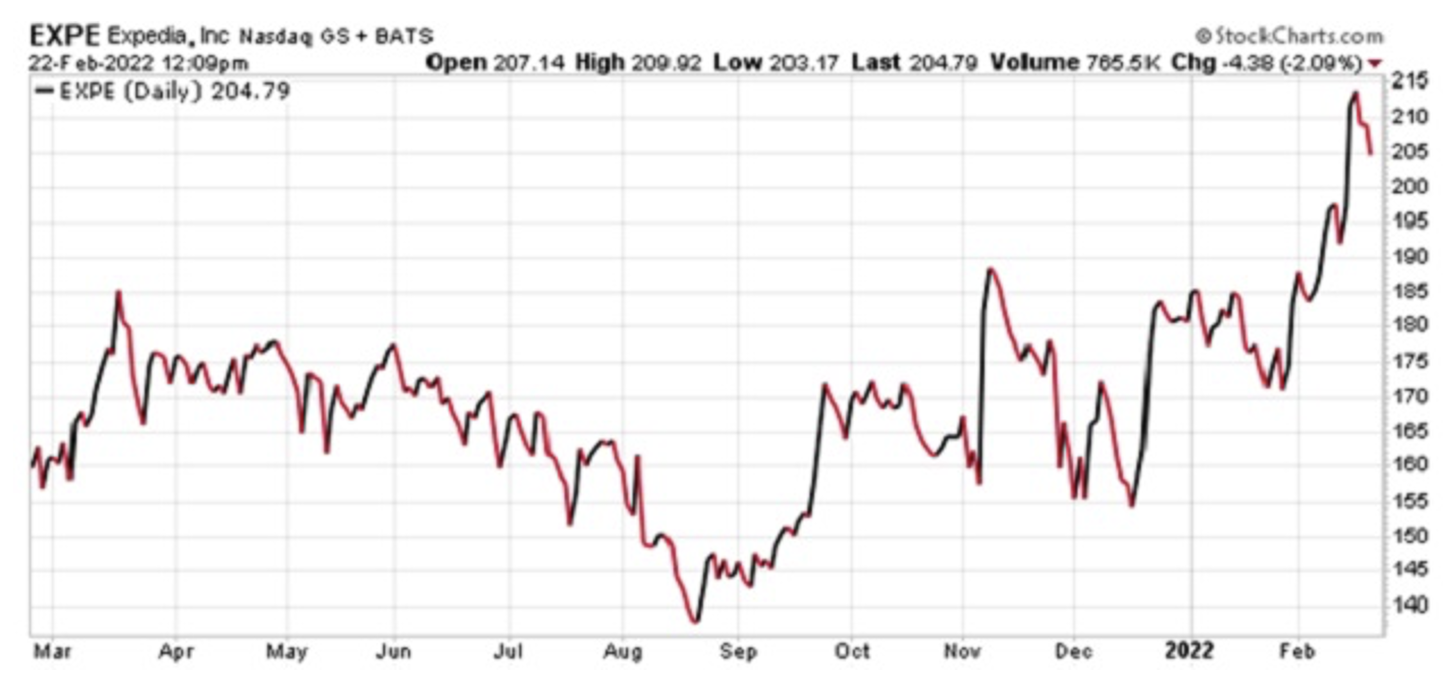

Look at this chart. It shows the performance of Expedia (EXPE), a company that books hotels, flights, and car rentals.

Expedia just broke out to new all-time highs!

This is a big deal.

You see, the stock market is forward-looking. In other words, it prices in news before it makes the headlines.

In other words, EXPE is telling us people will soon be taking more vacations and business trips.

And it’s hardly the only stock sending this signal.

Booking Holdings (BKNG), a competitor to Expedia, is also trading at new all-time highs.

Keep in mind, most stocks aren’t trading like EXPE and BKNG right now. They’re breaking down instead of hitting new all-time highs.

But as I’ve said before, there’s always a bull market somewhere. And right now, there’s a bull market forming in reopening stocks.

Hotel stocks are also showing remarkable strength…

Here we have Hilton Grand Vacations (HGV), which owns and operates the Hilton Hotel Brand. You can see that it’s in an uptrend.

Not only that, HGV is on the verge of breaking out of a base it’s been building since November.

Playa Hotels & Resorts (PLYA) — which owns and operates hotels and resorts in Mexico, the Domincan Republic, and Jamaica—is also standing out in a sea of red.

It’s up 7% since the start of the year. And it’s trading above its 200-day moving average (blue line), which shows it’s in a strong uptrend:

Of course, not everyone is hopping on a plane to take that long-awaited vacation……

Some folks are simply doing things they’ve put off for the past couple years, like getting back to the gym.

We can see this in the recent price action of Planet Fitness (PLNT), which owns gyms across the country. PLNT has rallied 20% over the past four weeks. It now appears to be on the verge of a big breakout:

These aren’t the kinds of stocks I normally cover at RiskHedge…

They’re not “high tech.” But tech stocks are generally out of favor right now, along with most sectors.

So, instead of swimming against the current, I suggest looking at stocks displaying relative strength. In other words, stocks maintaining bullish chart structures despite the broad market selloff.

That’s exactly what we’re seeing with reopening stocks.

Many of these reopening businesses got crushed during the pandemic. Their share prices cratered, because people couldn’t use their services.

But reopening stocks are back on the rise again. You’ll be hearing more about this from the mainstream soon. Trade accordingly…

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: Facebook, Microsoft… Now Walmart?