Written by: New York Life Investments

What inflation data tells us

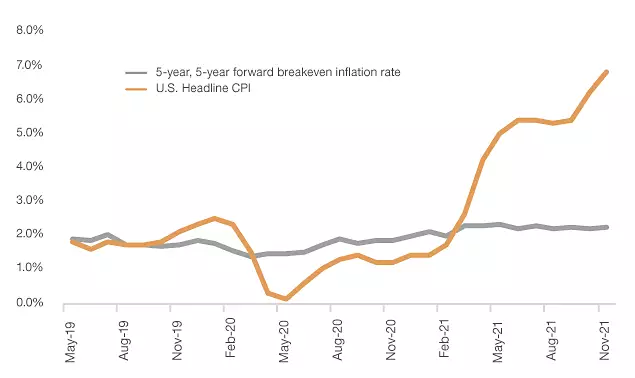

November’s inflation print, while mostly in line with market expectations, was staggeringly high. Headline inflation increased by 0.8% month-on month, moving prices 6.8% above last year’s levels. Removing more volatile food and energy costs, prices still increased by 4.9% year-on-year, well above the Fed’s 2.0% target.

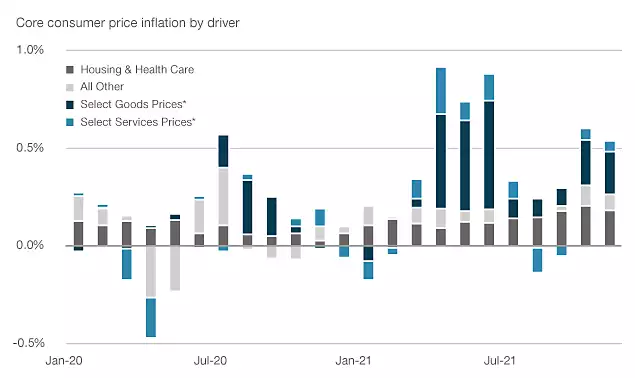

COVID-19-impacted sectors still account for a large portion of the U.S. inflationary pressures. Changes in behavior due to virus constraints, resulting in higher demand for recreational goods or home improvement inputs, has contributed to higher prices. Fiscal policy has aided this demand shift by providing significant financial support to households. Meanwhile, global supply chains and production have strained to keep up with strong demand.

But the story no longer ends there, as price pressures broaden. Importantly, housing prices (including rents), which make up approximately 40% of consumer price indices, continue to firm. Given current home price trends and tightening rental markets, these pressures are unlikely to end soon. Other services inflation is mixed, but overall services prices firmed at a pace above the pre-crisis trend.

Inflation is persistent...

Core consumer price inflation by drive

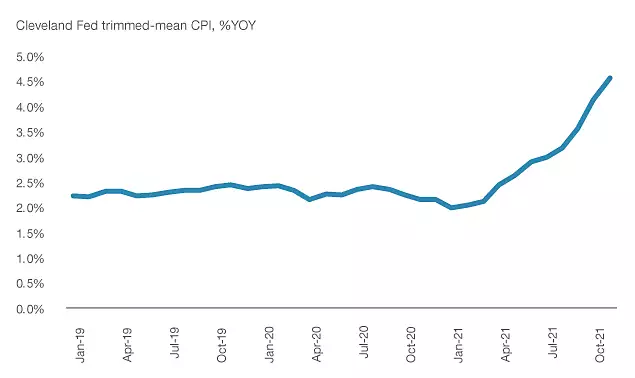

... and broadening

Cleveland Fed trimmed-mean CPI, %YO

Sources: MacKay Shields, Bureau of Labor Statistics, 12/10/21. Core consumer price inflation is overall consumer price inflation, less food and energy. The Cleveland Fed trimmed-mean consumer price index attempts to measure underlying inflation trends by removing volatile items. *Select goods prices include new, used, and rental vehicles, recreational goods, and household furnishings prices. Select services prices include lodging away from home, airfare, and recreational services prices. These goods and services are separated to demonstrate cost factors that may be impacted by supply-demand and supply chain imbalances related to the COVID-19 recovery, including labor shortages in many service sectors. , as distinguished from housing, healthcare, and other services that may represent broadening inflationary pressures.

We expect supply chain bottlenecks and strong demand to keep inflation elevated at least through Q1 2022, before imbalances fade and inflation moderates over the second half of the year. Still, by the end of next year core personal consumption expenditure (PCE) inflation is likely to remain well above the Federal Reserve’s two percent objective. The timing of any “peak” in inflation pressures will have important implications for the path of monetary policy and related market outcomes.

Implications for monetary policy

Nothing in the November 2021 inflation data should dissuade the Federal Open Markets Committee (FOMC) from moving forward with plans to speed up the tapering of asset purchases. The Fed has a meeting next week, and we expect they’ll announce that quantitative easing will end by March 2022 instead of June.

A faster taper gives the Fed the option to raise rates sooner. Many economists and investors have pulled their rate liftoff assumptions forward in recent weeks, and we expect the Fed’s dot plot to show some adjustment next week as well.

The timing and pace of rate hikes depends on what inflation will do in the months ahead. If inflation peaks early in the year, the Fed may be able to hold out for more expansive labor market improvement. That said, we believe the bar for this outcome may be high. While labor market conditions have room to improve, they have recovered meaningfully in recent months and the unemployment rate may soon fall below 4.0%. This means that, as long as labor market improvement doesn’t halt, and if inflation remains near current levels, then the Fed’s hands may be tied.

For more on Fed policy, we recommend a read through MacKay Shields’ recent piece outlining why market risks may be skewed towards more tightening.

Economic and market risks

Increasing inflation risk has important implications. First is the real impact inflation has on household and business balance sheets. Absent commensurate adjustments (i.e. wage increases or price pass-through), purchasing and investment power can suffer as prices rise.

The second has to do with the policy response to inflation. Rate hikes may do little to improve supply chain bottlenecks, but they can help reduce demand pressure, thereby alleviating a key contributor to price increases. If the economy is on its way to overheating, this demand-reduction tactic could be constructive. A higher cost of capital can smooth the economic cycle without causing a recession, and slower-but-consistent growth is valuable for business and investment planning. The Fed is highly attuned to the economic risks of its policy stance, and would certainly prefer not to slam on the proverbial economic brakes. That said, this is a difficult “soft landing” to orchestrate.

Another major risk has to do with market volatility. For most of 2021, expectations around Fed policy were well anchored. The FOMC effectively communicated that tapering would begin at the end of this year, and investors were broadly comfortable with high but “transitory” inflation. Now, over the course of a few weeks, the arc of monetary policy has shifted. Investors should expect volatility in the level and curvature of interest rates as uncertainty prevails.

Sources: New York Life Investments Multi-Asset Solutions, Bloomberg Finance LP, U.S. Bureau of Labor Statistics, 12/10/21. U.S. headline CPI is represented by the Consumer Price Index (CPI), which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Past performance is no guarantee of future results. An investment cannot be made in an index.

If inflation persists and the Fed is forced to raise rates sooner, the yield curve is likely to remain under considerable flattening pressure. If, by contrast, inflation subsides, the yield curve can re-steepen because the current aggressive expectations for rate hikes could be revised down.

How to invest

- Prepare for higher volatility by leveraging nimble managers. Uncertainty around COVID-19’s impact, economic growth, and policy are likely to prompt volatility in the coming months. We encourage investors to work with managers who can incorporate insights about the top-down economic cycle as well as bottom-up supply chain implications – and be nimble to address related opportunities and risks.

- Consider a broader fixed income allocation. Our research shows that non-core bonds tend to outperform during periods in which interest rates are rising. Allocating to a broader set of fixed income asset classes, including floating rate securities, bank loans, convertible bonds, short-duration high-yield securities, and high yield municipal bonds, may generate opportunity amid rates risk.

- Build portfolio resiliency. Our research also shows that there is a tradeoff between focusing on inflation-hedging asset classes and focusing on total return. While inflation is a key risk for 2022, investors still expect a relatively shallow Fed-hike cycle ahead. With this in mind, we encourage investors to think twice before allocating heavily to inflation-hedge securities. In our portfolios, we are leveraging inflation-resilient strategies that also leverage durable investment themes such as infrastructure equity, broader geographic exposure, and non-traditional (ESG) risk metrics.

Other resources

In addition to the links provided above, investors can reference recent comprehensive work on inflation according to their interest:

- Markets are still not pricing in enough monetary policy tightening (here)

- Diversifying fixed income as interest rates rise (here)

- Scenarios for inflation and multi-asset allocation implications (here)

- Tying inflation and economic scenarios to market outcomes (here)

Related: Five High Conviction Ideas for a Post-Pandemic World