Written by: Marc Odo | Swan Global Investments

Escaping the Devil’s Bargain

Studies on high-yield, passive derivative income strategies (covered calls) reveal a significant negative relationship between income and overall returns. Investors who overlook this trade-off might have unwittingly entered into a disadvantageous “Devil’s Bargain”.

In this post, we will explore research concerning passive, covered call income strategies, give an overview of the derivative income category and due diligence considerations, and take a closer look at a ‘active-active’ approach deployed in a new ETF.

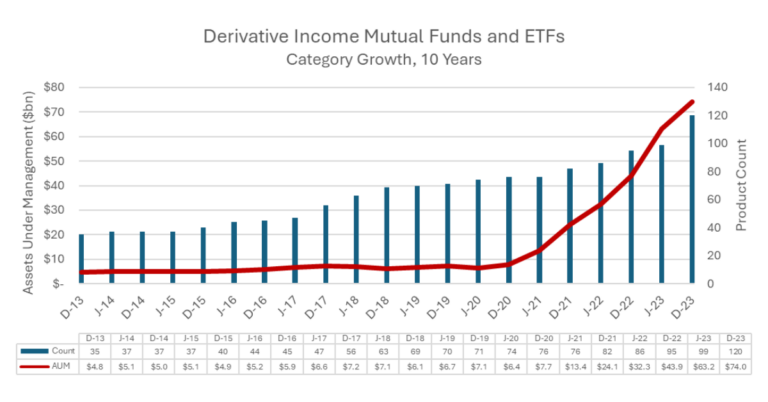

Source: Morningstar Direct, 12/31/23

The Devil’s Bargain

A recent paper by Roni Israelov and David Nze Ndong explored the trade-off between generating high distributions and total returns. Their paper can be summarized by the old saying, “You can’t have your cake and eat it too.”

Published in October of 2023, this paper was entitled “A ‘Devil’s Bargain’: When Generating Income Undermines Investment Returns,” and its release was very timely.

The number of strategies and assets within the Derivative Income category has grown at an extremely rapid pace over the last decade. Investments in this asset class have grown from under $5bn to $74bn. The number of products has increased from 35 to 120, with new products being launched on a weekly basis. Most of this growth has occurred in the last five years.

The Devil’s Bargain in Passive Covered Call Strategies

Most of these strategies employ a variation of covered call writing. While covered call writing can be a good source of returns, one should realize that call writing is not “free money.” The amount of premium available from writing calls is directly related to the risk of the trading strategy.

To stand out in a crowded field, some funds offer double-digit distributions. One new fund was extremely successful in fundraising by offering eye-popping distributions. It was able to raise almost a billion dollars in a year’s time by distributing a yield in excess of 75%.

If a strategy has set investor expectations that they will receive a high level of distributions every month or quarter, simply writing options might not be sufficiently profitable to maintain a high “yield.” Faced with a “distribution shortfall”, a Derivative Income strategy might have to resort one or more of the following:

- The strategy could lower investor expectations. While certainly the most prudent option, this might not be popular with investors. If an investor purchased a particular strategy with the sole purpose of achieving sky-high yields, any reduction in the distribution might be a reason to sell the strategy.

- The strategy could take on more risk. The premium available in call writing is directly related to the risk of those options. Options with strike prices at- or near-the-money offer more premium than out-of-the-money options, but face a greater risk of going in-the-money. If maintaining a high level of distributions is of paramount importance to a strategy, they could choose to collect more premium by writing higher-risk options.

- The strategy could leverage. Rather than writing calls against an underlying equity position on a 1:1 basis, the strategy could potentially write multiple options against a single position, effectively leveraging up the trades. Admittedly, much of the leverage in options-based mutual funds or ETFs was purged following the “volmageddon” event in February 2018 when several leveraged strategies spectacularly failed. SEC rule 18f-4 was meant to limit the kind of leverage that led to the “volmageddon” blow-ups. However, a creative portfolio manager can always find a way around the rules and leverage remains something to be aware of.

- The strategy could return an investor’s capital under the guise of “yield.” Unfortunately, yield is a fuzzy concept. Some investors seem to think any distribution they receive from a strategy is generated via the profits of that strategy. However, this isn’t always the case. If the strategy’s profits are insufficient to meet the investor’s monthly or quarterly expectations, the strategy could return a portion of the investor’s capital to maintain an artificially high level of distributions.

This last one is harder to detect. If a strategy ramps up its risk, those risks tend to be exposed in a sharp, sudden event. However, the return of capital is more a slow, gradual erosion that only becomes apparent after the passage of time. While both are usually unsustainable in the long run, their weaknesses are revealed in different ways.

An example helps illustrate this point. Say, for example, a strategy heavily advertises its annual distributions of 15%. Simple math suggests this strategy will need to manufacture 1.25% per month, every month, to maintain a steady stream of distributions that meets its investors’ lofty expectations. Potential sources of return could be price appreciation of the underlying equity portfolio, dividends from the equities, and/or premium collection from writing calls.

The Cost of the Bargain: Growth of Capital

Keep in mind that the writing of calls explicitly limits the price appreciation potential of the underlying equity in a covered call program. The writing of calls is a trade-off where the call writer willingly forgoes some of the future capital appreciation potential in exchange for cash today. As we are often reminded, there is no free lunch.

It is quite easy to imagine a scenario where this hypothetical covered call strategy’s equities miss out on capital appreciation and the premium collection and equity dividends fail to generate monthly profits of 1.25%. If the strategy is unable to meet investor expectations, they might sell some of the underlying equities and return the proceeds to the investors.

Obviously, this type of approach is not sustainable in the long run. If one is constantly whittling down the capital base it will be increasingly difficult to generate the necessary premiums or dividends.

Moreover, such strategies would be imperiled by a steep market sell-off. Covered call strategies typically do not feature an explicit market hedge. It is true that the writing of calls tends to be profitable in downward markets. But in the face of a true bear market sell-off of -20%, -30%, -40% or more call writing would only be able to offset a fraction of that amount. Finally, when markets do rally a call-writing strategy’s participation in the upswing will likely be limited by the short call positions.

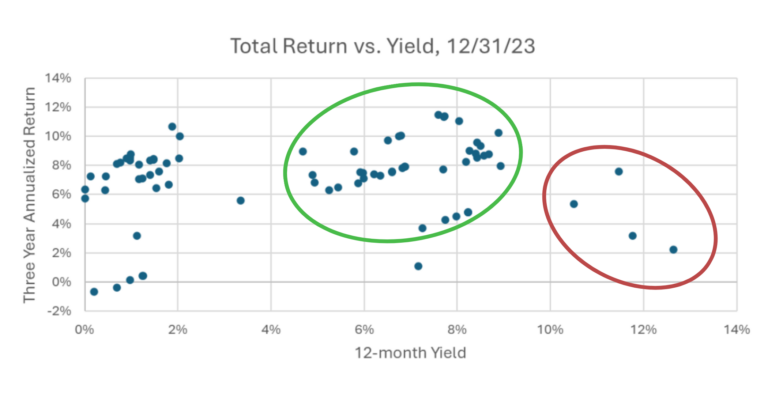

When attempting to sort through the myriad of options available in the Derivative Income category, it is important not to be seduced by the highest-yielding strategies. Looking at the historical record, strategies with more modest distributions in the 6%-8% tend to have the best total returns.

Source: Morningstar Direct, 12/31/23

Swan Global Investments recommends keeping the following points in mind when researching Derivative Income strategies.

- Have reasonable expectations. Strategies with the best overall performance have tended to have distributions in the 6%-8% range. Double-digit distributions often come paired with poorer overall returns.

- Focus on total returns. Ideally a call writing strategy has multiple drivers of profits acting in concert with one another, each contributing to total return.

- Understand that distribution (or yield) doesn’t equal profits. Just because a strategy pushes out high distributions doesn’t always mean the strategy has been profitable. The strategy could be simply returning capital.

An ‘Active-Active’ Approach for Sustainable Income & Capital Appreciation

Swan’s Enhanced Derivative Income Strategy, and the ETF launched based on this approach (ticker: SCLZ) were developed with these guidelines in mind. The underlying investment strategy follows an “active-active” approach. Total return is the goal, not the world’s highest yield.

- Active Stock Selection. O’Shares Investments provides an underlying index consisting of 50 stocks, actively selected based on quality screens for attractive growth characteristics, strong dividend profiles, and low leverage.

- Active Options Management. Calls are written on the individual names within the stock portfolio. Moreover, the option portfolio is actively managed. The timing, sizing, and moneyness of call writing and overall portfolio coverage is driven by Swan’s proprietary active management process. The process seeks to maximize the risk-return trade-off when writing options. Finally, Swan employs an “active defense” approach to retain some of the capital appreciation potential when the stocks in the portfolio rally.

Swan Global Investments views all these various decision points as potential sources of alpha. While it is highly unlikely that every single investment decision will be profitable simultaneously, by diversifying the sources of potential alpha and emphasizing risk control, Swan believes the Enhanced Derivative Income Strategy can generate sustainable income and long-term capital appreciation.

This distinct “active-active” approach may be a way for investors to escape the “Devil’s Bargain” when derivative income strategies face a distribution shortfall.

Related: New Home Sales Slip as Investors Reexamine Rate Cuts