Written by: Loren Bailey

“Mutually Assured Destruction.” That is a term that I have not heard since the 1980’s, but it has been kicked around more than once over the past few weeks. It’s a phrase I’d hoped was long forgotten and irrelevant (wishful thinking). Well, let’s take this possibility off the plate right now. In a showdown of nuclear weapons between Russia and the US or any other weaponized country, we will all be in trouble and the markets, if they continue to exist, may consist of trading rocks and seashells as opposed to stocks and bonds. A conclusion about how to invest during World War 3 would be a non sequitur. Instead, our present discussion is a more realistic approach for dealing with more conventional conflicts. So…short of nuclear annihilation, what impact does war have on the markets and just how negatively might your portfolio be affected?

To be sure, we’ve already seen oil and gas prices go up due to sanctions on Russia, making an already tight oil market even tighter. Inflation was also a major concern before Putin’s invasion of the Ukraine. But now, with sanctions flying around and markets being restricted, what will happen to the prices of goods and services? How will the markets react to continued uncertainty or, much worse, if war is not contained to the Ukrainian borders?

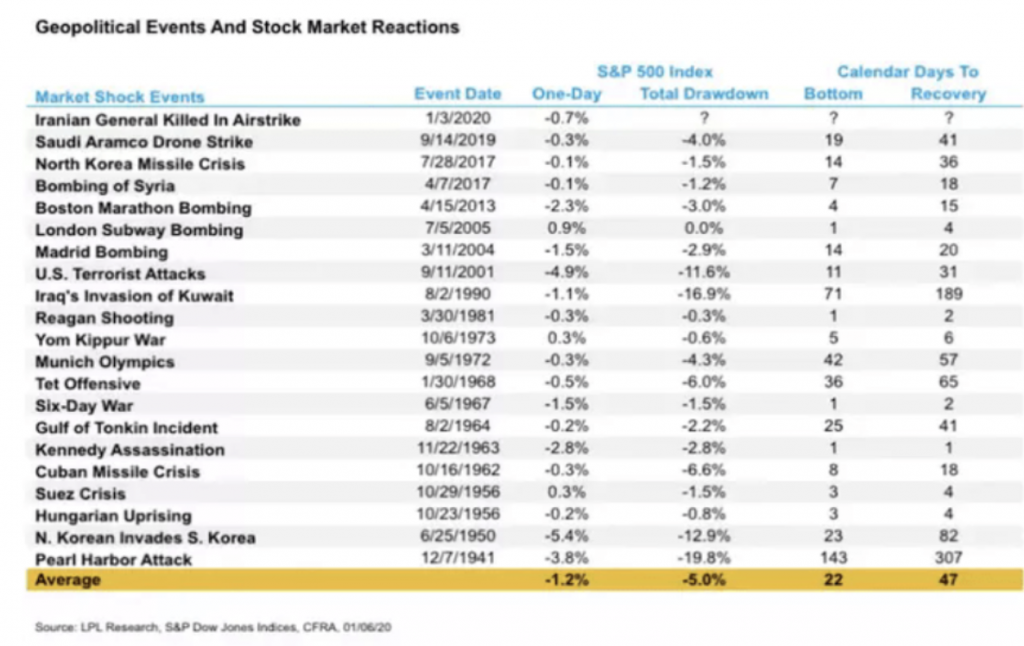

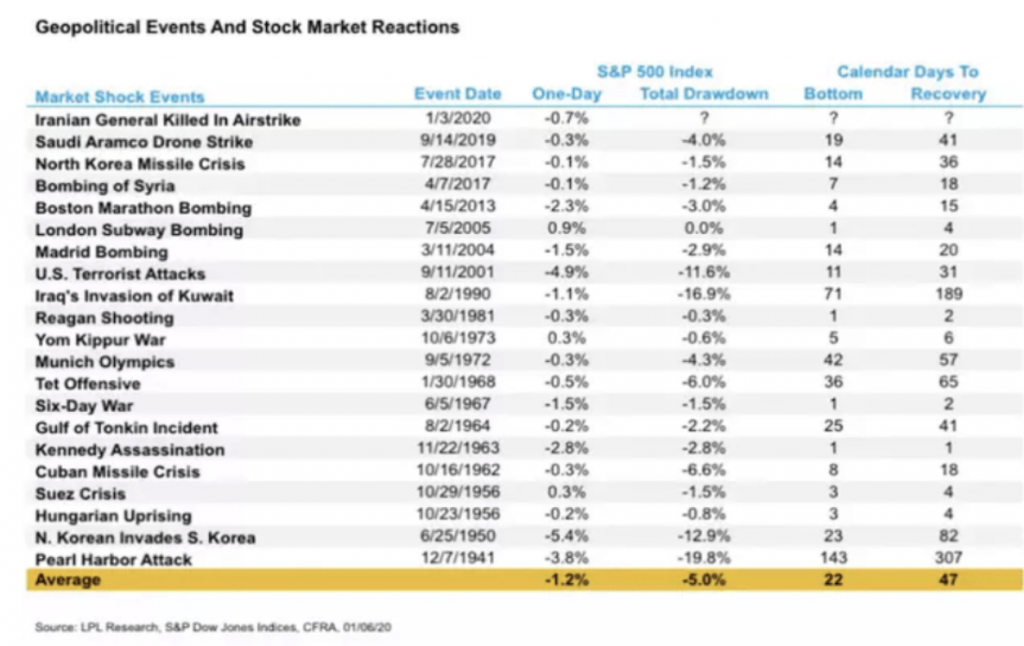

Markets react negatively to the unknown, as most geopolitical events and conflicts can be shocking and unpredicted. When something “big” happens in the global universe, our natural tendency is to ask, “What happens next?” The markets ask the same question and they usually have an adverse initial reaction because the markets don’t like uncertainty. However, the ultimate effect on the marketplace may not be what you might think as suggested in the chart below.

If history is a reliable witness, the downturns which occur at the beginning of an event or conflict are relatively short-lived. The chart shows the immediate effect, the total loss (Drawdown), the absolute low, and the recovery of the market as shown by the S&P 500 index. As shown, the 9/11 attacks resulted in an immediate 5% dip. Before it was all over with, the S&P 500 index went down 11.6%. But it only took a month for the market to recover. The event with the biggest market impact was, not surprisingly, the attack on Pearl Harbor. The immediate reaction was a 1-day sell-off or 3.8% with an ultimate market loss of roughly 20% at the absolute low. It set the stage for our entry into World War 2, which lasted another 4 years. After the initial attack on our country, how did the markets perform while the world was in peril?

The market went down 19.8% after Pearl Harbor and it took 307 days to recover. From there, the markets continued to climb. Over our 4-year involvement, the Dow returned over 50% with an average 7% plus per year return. While millions of soldiers and civilians were dying at the hands of the biggest global conflict known to man at that time, the markets continued on to new highs.

Misery and suffering come along with war, along with unspeakable horrors. But, through crisis and conflict, the markets historically perform contrary to what you might expect. As fear and uncertainty subside from the shock of initial event, the markets tend to continue along their previous performance trends.

Ed Clissold, chief strategist for investment research company Ned Davis (NDR) said “Once investors begin to grasp the scope of the crisis, the uncertainty abates and the stock market can recover. Some stocks still struggle, but benchmark indices tend to rally. In other words, history has shown us that wars and conflicts have little to no impact upon market performance in the longer term.” When NDR examined 50 crisis events of the last century, a similar pattern emerged; the Dow fell an average of 7% right after the new event then rose over the next three weeks an average of 4.2%, and 6% over the following nine weeks. At the end of 18 weeks, the Dow was up an average of 9.6%. How does this compare to our current Ukraine conflict? The current invasion is still fresh, but when Russia invaded the Crimea in 2014, the Dow had an initial drop of 2.4%. After three weeks, it gained 1.2%, after nine weeks, 4.4% and after 18 weeks, 5.7%.

How will our markets perform as a result of the current conflict in the Ukraine and what should you do?

Of course, we need to see how this develops. So far, the economic sanctions against Russia have created three major concerns. The first is the interrelationship within Europe and amongst the trading partners of Russia – will the sanctions create a drag on the global economy and, in turn, slow ours. The second is the flow of oil and how high prices could rise without Russian exports eligible in the market. The third is whether the Fed will act in a timely manner and address inflation with the “right touch” when raising rates. The second of these concerns, the flow of oil, is being properly dealt with as we introduce new producers to the oil market. This will take time. As for the other two, we are a little over a month and a half after the Russian invasion, so it’s too early to tell. Those concerns could seriously stunt growth and even lead to a recession in our country. While these outcomes are very possible, the likelihood is that they will be shorter-term issues.

Historically, during wars, stock markets tent to be less volatile than at other times. One might argue that the volatility we’ve seen recently has been due to a combination of the previous interest rate/inflation fears combined with the new Ukrainian scenario. As a result, we should try to take the current market gyrations into proper perspective.

So, what is the take-away from all of this?

- Stay invested. Selling during a temporary downturn can rob your portfolio of returns.

- Stay on the path. Maintain your current philosophy and strategy. Straying from it could be very costly in the longer term.

- Stay focused. Panicking during these times may seem reasonable and even rational. But research shows us that keeping with your investment philosophy, even during painful global events, will result in the reward of a more valuable portfolio.

If you still have questions or concerns about your portfolio, whether you are on the correct path, or whether you think “all is lost” we can help!

Related: Risk of Recession