Written by: Shiv Patel | Advisor Asset Management

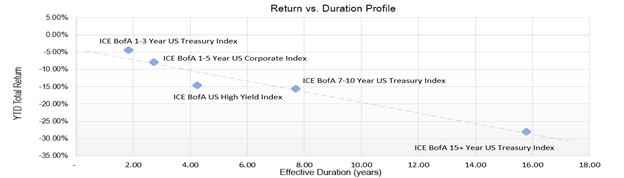

The impact of higher interest rates on portfolios has undoubtedly overshadowed the 2022 investment playbook, especially for fixed income investors. With the Federal Reserve having already enacted multiple rate increases in the year thus far, the majority of fixed income investments have experienced their largest price declines in history, particularly those with relatively higher durations.

Source: ICE Data Services, Bloomberg. As of 9/30/22 | Past performance is not indicative of future results.

And while recent inflation reports have mostly encouraged the current interest rate trajectory, there have been whispers of approaching levels that would, at last, stabilize prices.

As such, fixed income investors seem to be enticed to position back toward higher duration assets. However, we feel such a move may be impulsive, and liken it more to a trading idea than a sustainable investment strategy.

Going forward, it is important to consider that although the rise of interest rates have been swift, and may be heading toward peak levels, the volatility of interest rates is likely to persist. More specifically, the wavering expectations between unrelenting policy tightening and a potentially renewed cycle of policy easing in the event of a recession has proven to cause dramatic fluctuations across market interest rates.

Following alarming CPI (Consumer Price Index) data in June, the 2-year Treasury yield — generally the most sensitive to monetary policy — rose 61 bps (basis points) in just three days from June 10 to 14, rising to 3.42% from 2.81%. Subsequently, the Fed implemented their first 75 bps increase to benchmark interest rates, an historically sharp increase in a relatively short period of time.

However, inflation concerns at the beginning of the month quickly shifted into recession concerns later in the month, as the market started to believe that such an abruptly hawkish Fed may drive the economy into a recession. Consequently, the 2-year Treasury yield retreated back down to 2.81% a few weeks later on July 5.

Source: Bloomberg | Past performance is not indicative of future results.

This interest rate volatility continued through the year and is evident by the drastic rise in the ICE BofA Swap MOVE Index, which measures bond market volatility. Over the last five years, the index was only higher in March 2020 during the Covid selloff.

Source: Bloomberg

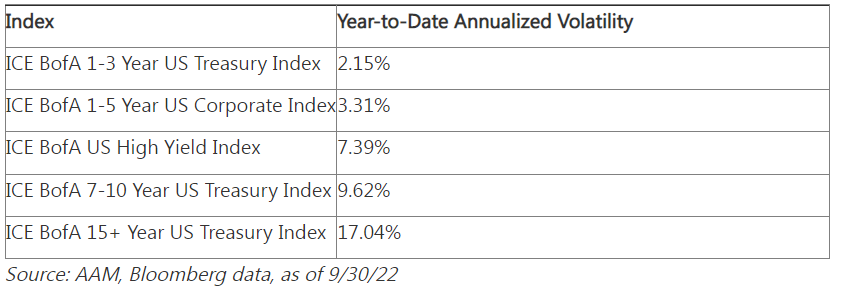

Accordingly, volatility across various fixed income portions of the market were also elevated, with a clear correlation to duration risk. While the ICE BofA 1-3 Year U.S. Treasury Index displayed relatively lower volatility due to its lower duration exposure, the volatility of the ICE BofA 15+ Year U.S. Treasury Index was nearly eight times higher.

As investors continue to weigh the risks between persistent inflation or the onset of recession, we believe this type of volatility is likely to continue for the remainder of the year and into next year. Thus, we continue to believe that limiting portfolio duration is necessary for the market environment ahead.