The hedge fund industry is dynamic, comprising of numerous strategies that attract varying degrees of interest over time. Demand for each strategy is impacted by many variables including capital market valuations, expectations of economic growth, inflation, market liquidity, and risk appetite, among others. Industry professionals spend a great deal of time analyzing these variables in order to identify which strategies they believe offer the best opportunities for out-performance. One way to consider this is to ascertain which strategies are attracting current investor interest.

In this paper, we compare and analyze data submitted by investors during the 4th quarter of 2021 from Gaining the Edge – Cap Intro Florida with data collected from investors who recently registered to attend Gaining the Edge - Cap Intro New York, taking place on Nov 2nd & 3rd and virtually from Oct 31 – Nov 18th. In the registration process, investors complete a detailed survey about which types of strategies and managers they are currently interested in meeting. This gives us broad insights into both overall demand for each strategy as well as changes in demand.

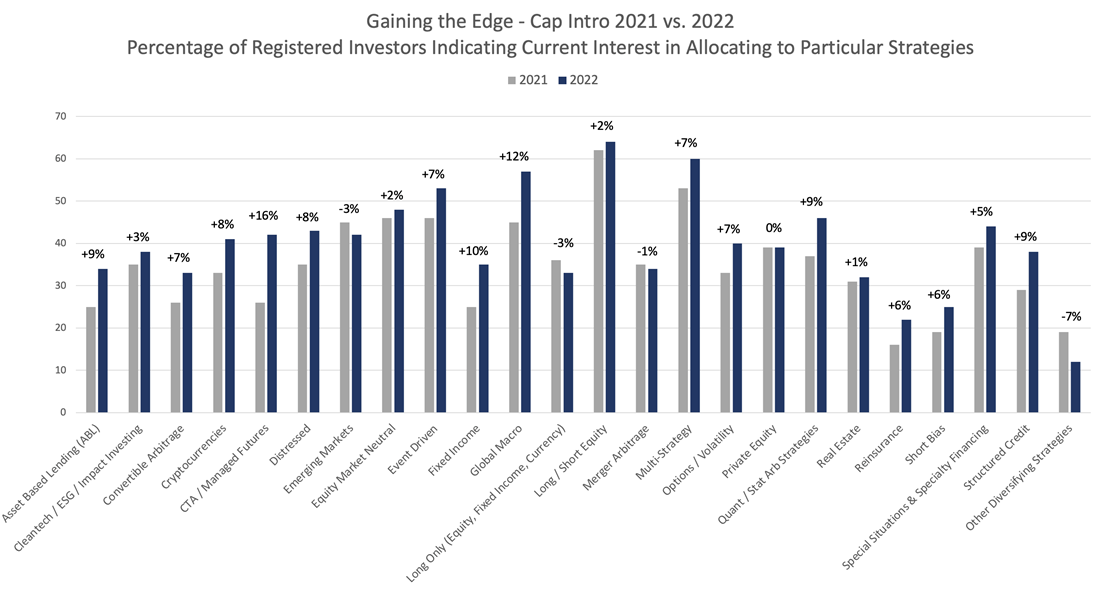

The following are some observations of our survey results:

Almost all strategies have seen an increase in demand. This can be attributed to growing investor concern relative to equity and fixed income markets due to high inflation and rising interest rates. The two strategies with the largest increases in demand are CTAs at 42%, up from 26% and Global Macro at 57%, up from 45%. Both strategies have typically had either low or negative correlation to capital markets when they selloff and tend to do well during periods of increased volatility.

Two strategies that have experienced a decline in demand include Emerging Markets at 42%, down from 45%, and Long Only Strategies at 33%, down from 35%. Both changes are consistent with an investment environment in which allocators are reducing overall risk in their portfolio.

Long/Short Equity has the largest demand at 64%, up slightly from 62%. Over the past few years, we have seen a steady increase in demand for Long/Short Equity strategies, marking a reversal from the previous decade. This indicates continued positive sentiment regarding fund managers’ ability to generate alpha in stock selection. These managers benefit from both increased volatility in the equity markets and expanded valuation gaps across equity markets, driven by massive inflows to equity index funds. As a result, we expect greater demand for managers that focus on small- and mid-cap companies and those situated outside of the U.S.

Cryptocurrency, despite its recent significant market declines, continues to see an increase in demand at 41%, up from 33%. This asset class has evolved from being considered exotic and speculative to being more broadly accepted. The increase in demand is not cyclical but reflects strong, long-term trends within the industry where investors are bullish long-term on block chain technology. ESG investing also has gained meaningful momentum in the U.S. over the past 3 years as large institutional investors have begun incorporating ESG criteria into their investment policies. Opinions of what qualifies as an ESG strategy are fairly broad and vary from one investor to another. Thus far, incorporating ESG objectives has led to a wide range of definitions and guidelines. We expect the ESG criteria to become more standardized across the industry. The standards will influence not only the qualifications for designation as an ESG compliant strategy, but also set expectations as to how managers across all strategies should incorporate ESG awareness into their investment processes.

Another high-level trend we see is the divergence by investor type in how hedge fund strategies are being considered in the portfolio allocation process. Specifically, many pension funds have evolved their hedge fund strategy from simply outperforming hedge fund indices to building thoughtful portfolios of diversifying strategies. This has narrowed their broad interest across strategies to a focus on strategies with low correlation to the capital markets. We expect pensions to have net positive inflows to the hedge fund industry as they reallocate assets away from traditional fixed income mandates into diversified hedge fund strategies. This transition is expected to enhance risk-adjusted returns to their overall portfolios. Since average pension fund allocations tend to be multiple times larger than those from other types of investors, their strategy preference has a disproportionate impact on industry flows. The data we shared from the surveys gave each investor equal weighting. Practically speaking, strategies with higher interest from pension funds, such as CTAs and reinsurance, will likely see much higher asset flows than the survey data would indicate. In contrast, flows into cryptocurrency strategies will likely be proportionately smaller than the survey indicates as this is currently not a strategy many large institutional investors will consider in the short term.

Other strategies showing high investor demand include Multi-Strategy (60%), Event Driven (53%). Equity Market Neutral (48%) and A full list of results are below.

In addition to indicating strategies of interest, investors were also asked to indicate the minimum fund size they require to consider making an allocation. Of the respondents, 33% would consider new fund launches and 61% were open to funds with less than $100 million. 96% of investors would consider funds under $1 billion with only 4% noting they required a fund to be $1 billion or larger. They were also asked about the minimum length of track record with 37% willing to invest in a manager with less than a one year track record. These results indicate a reduction in the minimum asset requirement for various investor types. This may be, in part, attributable to the significant investment large pension funds have put towards improving their internal processes. A majority have built out their research staffs and in doing so, have increased their confidence and comfort with investing in smaller and emerging managers.

As we head into the 4th quarter, we anticipate an increase in hedge fund allocations and this survey should provide good guidance on the strategies to which assets will flow.

1000 to 1500 industry alternative industry professionals are expected to participate in Gaining the Edge - Global Cap Intro taking place in-person November 2 & 3 at the New York Marriott Marquis and virtually from October 31 through November 18, making it one of the largest, capital introduction events in the industry. Virtual and in person registration is complimentary to approved investors/allocators. If you would like more information or register please visit: https://www.agecroftpartners.com/cap-intro-home

Related: Rising Short Term Interest Rates Should Help Some Hedge Fund Strategy Returns