It’s one of the biggest differences between rookie traders and successful ones…

New traders crave action. They always need to be doing something in the markets.

Successful traders know patience is a virtue. They only buy when the opportunity is right.

Which is why I haven’t recommended a new stock to my premium subscribers in over a month.

This might surprise you.

You see, I usually place 2–3 trades a month between my IPO Insider and Disruption Trader advisories, sometimes more. In fact, from May to mid-October, I recommended 23 stocks across my two advisories.

Some of those positions have performed exceptionally.

DigitalOcean (DOCN), has surged more than 100% since August.

Bill (BILL) is up 110% since June.

And Affirm (AFRM), the buy-now-pay-later pioneer, has rallied 115% since August.

Don’t worry if you missed these moves. Because another great buying opportunity is shaping up right now. In a minute, I’ll show you how to make the most of it.

But let’s first look at why I’ve been sitting on my hands over the past month, waiting…

Fear is in the air again…

And it’s reminding me a lot of what I saw back in May…

Before I recommended 23 stocks over the next five months.

Back then, inflation fears were running rampant. Just look at this cover that Barron’s published for its May 2021 issue.

Source: Barron’s

Over the summer, inflation fears continued to dominate the news. And after a quiet period in October, we’re starting to see the negative headlines again.

In fact, the government just reported that its core measure for inflation, the consumer price index, surged 6.2% last month. That’s the highest since 1990!

Source: CNBC

The global economy also continues to suffer from problematic supply chain bottlenecks. That’s fueling a lot of the inflation we’re witnessing. And it’s leading to widespread shortages.

In other words, there are plenty of things keeping investors up at night. And I take these matters seriously.

But they make me bullish on stocks.

That’s because the most powerful bull markets tend to climb a “wall of worry…”

Contrary to what many folks believe… stocks tend to perform best when fear, uncertainty, and doubt are running high.

I’ve seen it over and over again through many cycles. The biggest gains come when people are the most worried.

I know it sounds counterintuitive. But if you wait until everything is rosy, it’s usually too late. When everything’s rosy, investors get complacent. And when investors get complacent, markets tend to struggle.

I don’t see much complacency now. Investors are on edge. Hardly a week goes by without a famous personality calling the financial markets a bubble.

But keep in mind… a high level of investor nervousness by itself doesn’t mean much. That’s because it’s hard to measure. You have to go by “feel” and judgement… and human judgment can always be wrong.

That’s why I need to see it confirmed with cold hard evidence.

After eight long months… the important small-cap Russell 2000 index is finally breaking out…

And history shows when small-cap stocks rise, the rest of the market usually follows.

The iShares Russell 2000 ETF (IWM) measures the performance of small-cap stocks. Since 1979, whenever the Russell is up, the S&P 500 has been up 92% of the time.

Take a look at the Russell’s recent action. It’s finally breaking out of a sideways trading pattern it was stuck in for most of this year.

As a professional trader, I can’t argue with this price action. It’s incredibly bullish… and not just for investors who own small-cap stocks.

It’s bullish for the stock market as a whole.

“Ok, Justin… how do I make the most of this opportunity?”

First, focus on quality.

Specifically, I suggest focusing on hypergrowth stocks in cutting-edge industries.

Second, focus on newer names.

What do high-flying stocks Upstart (UPST), Affirm (AFRM), and DigitalOcean (DOCN) all have in common?

They’re all recent IPOs.

IPOs are my bread and butter for a couple reasons. The first is investor appetite. Simply put, investors love investing in and trading new stocks. And IPOs are the shiny new objects in the market.

The IPO market is where the market leaders of tomorrow come from. It is, without question, the best place to find the next big company.

This has been on full display lately. Today’s hottest trends are buy-now-pay-later and the metaverse.

The best stocks to cash in on these megatrends are all recent IPOs.

But the very best stocks are at the forefront of multiple megatrends…

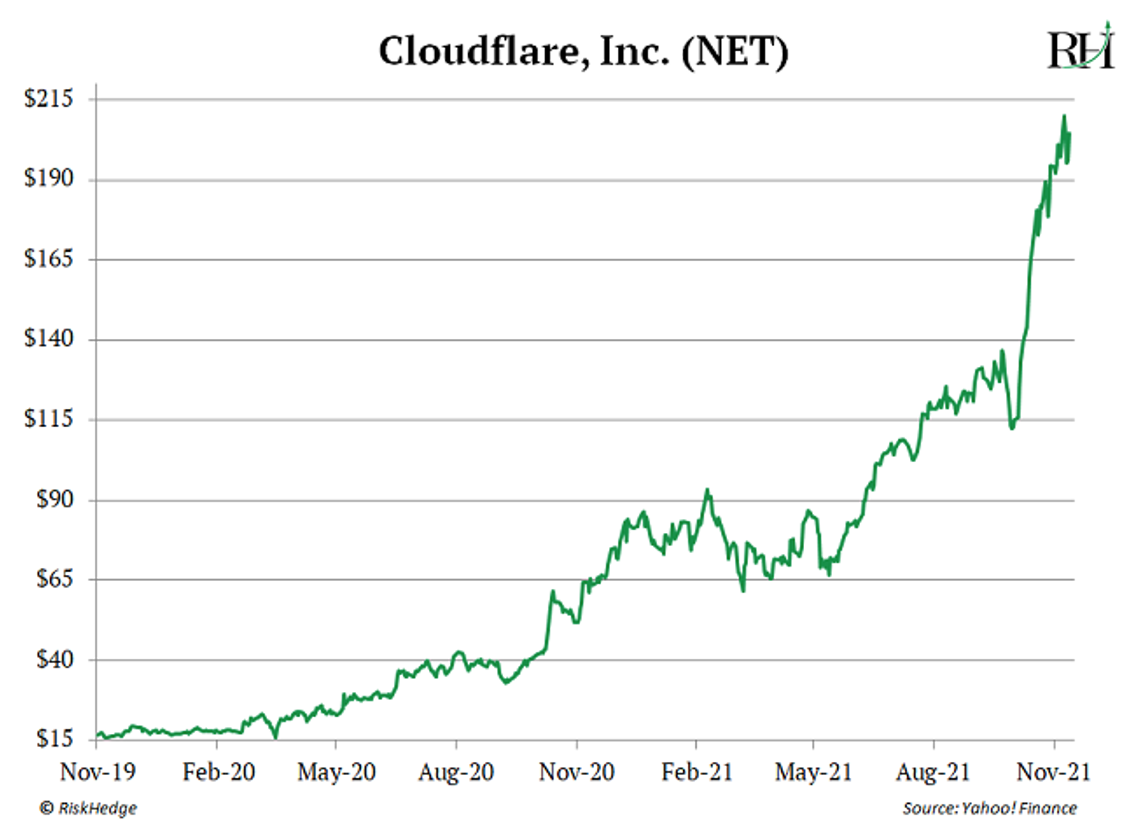

Cloudflare (NET) is a perfect example of this.

Cloudflare, as long-time readers know, is a pioneer in edge computing.

It’s also one of the world’s most important internet infrastructure companies. About 10% of the world’s internet runs through its network. It’s also a leader in the cybersecurity space.

In fact, Cloudflare is the largest holding in the ETFMG Prime Cyber Security ETF (HACK), which invests in a basket of cybersecurity stocks.

In other words, Cloudflare is at the crossroads of three of today’s biggest megatrends.

That’s almost unheard of. At any given time, Cloudflare will have a major bullish narrative working in its favor.

As you can imagine, that’s done wonders for its share price. Cloudflare has now rallied nearly 1,000% since we added it to the IPO Insider portfolio in November 2019.

Now, 11-baggers like Cloudflare are obviously rare. But finding one and investing in it early can do wonders for your portfolio. I’ll have more to say about this soon.

How are you feeling about the markets right now? Nervous? Excited? Cautiously optimistic? Tell me at jspittler@riskhedge.com.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

Related: The Real Reason Facebook Just Went “All In” on the Metaverse