Airline consolidation is not only relatively common but necessary for growth and competitiveness, and the recent announcement of Alaska Airlines’ planned acquisition of Hawaiian Airlines is a prime example of this trend.

The move, valued at $1.9 billion, signifies more than just a business transaction. It represents a strategic positioning for future growth in a highly competitive, highly concentrated sector.

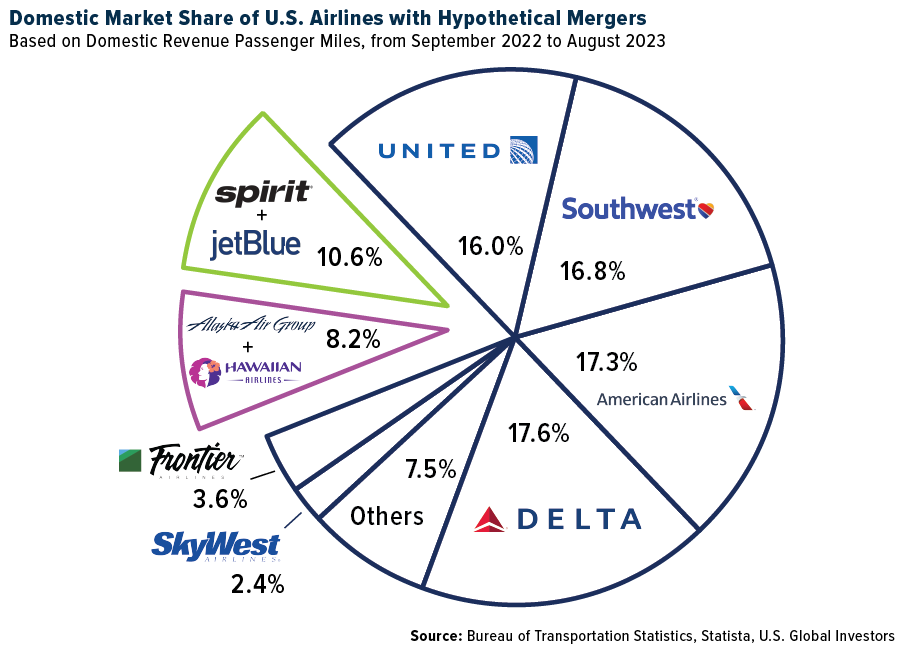

Once the deal is completed, Alaska and Hawaiian will have a combined market share of approximately 8.2%, making it the fifth-largest U.S. airline—unless JetBlue Airways succeeds in getting regulatory approval to acquire rival low-cost carrier Spirit Airlines. More on that later.

Alaska’ offer to purchase Hawaiian for $18 per share—today it’s trading under $14—includes taking on $900 million in debt, but the potential advantages are substantial. The Washington State-based carrier not only gains a significant foothold in the lucrative, $18 billion Hawaii market but also achieves several strategic benefits:

- Capacity Rationalization: The deal allows for better competition with Southwest Airlines by rationalizing capacity between the West Coast and Hawaii.

- Fleet Expansion and Flexibility: Alaska will acquire widebody aircraft for long-haul flights and increase fleet flexibility for varied route options.

- Enhanced Network Utilization: The merger promises improved utilization of large narrowbody aircraft within the combined networks.

The announcement sent Hawaiian’s parent company shares soaring 193% on Monday, reflecting the market’s optimistic view of the deal. This positive reaction underscores a broader trend in the airline industry, where smaller players seek mergers to stay competitive against larger rivals.

JetBlue’s Case To Acquire Spirit

Parallel to the Alaska-Hawaiian deal, JetBlue officially wrapped its case in federal court this week to acquire Spirit for $3.8 billion. If approved, the deal would reshape the U.S. airline industry, potentially challenging the dominance of the four major carriers and marking the most significant instance of airline consolidation since the American-US Airways merger in 2013.

According to Evercore ISI’s Duane Pfennigwerth, who was present for closing arguments on Wednesday, the judge’s line of questioning “read favorably for a settlement,” and JetBlue appeared to have “a more cohesive argument [than the Justice Department], which required less clarification by the judge.”

Among the most compelling arguments made by JetBlue attorneys is that the New York-based carrier requires scale to grow and compete against the Big Four airlines. Smaller competitors are expected to fill the gaps created by an outgoing Spirit, which JetBlue insists can’t make it alone in the current marketplace anyway.

The Justice Department is not so sure. The agency claimed that a JetBlue-Spirit merger would wipe out half of all ultra-low-cost carrier (ULLC) capacity in the U.S., depended on by many price-conscious Americans. Further, “Spirit anchors pricing in larger markets and is an innovator, with self-service bag drops an example of a recent innovation,” writes Pfennigwerth, summarizing the Justice Department’s line of reasoning.

A decision is expected after December 13.

Back To The Long-Term Average

Domestic airline stocks rallied this week on the positive news, with the NYSE Arca Airlines Index closing up nearly 13% from the previous Friday. This represents the largest weekly gain for the group since November 2020.

Taking time from its court case in Boston this week, JetBlue raised its financial outlook for 2023, with expected annual revenue growth of 4% to 5%, up from earlier guidance of 3% to 5%, and a smaller-than-anticipated adjusted loss. This uplift is buoyed by strong bookings and operational performance.

Also this week, Delta Air Lines reported robust holiday travel demand and increasing corporate bookings, projecting a bright end to 2023 and solid beginning to 2024. Speaking at the Morgan Stanley Global Consumer & Retail Conference, Delta CEO Ed Bastian doubled down on the carrier’s positive 2023 guidance, citing record revenues for the Thanksgiving holiday. Christmas bookings look to be “very, very strong,” Bastian said.

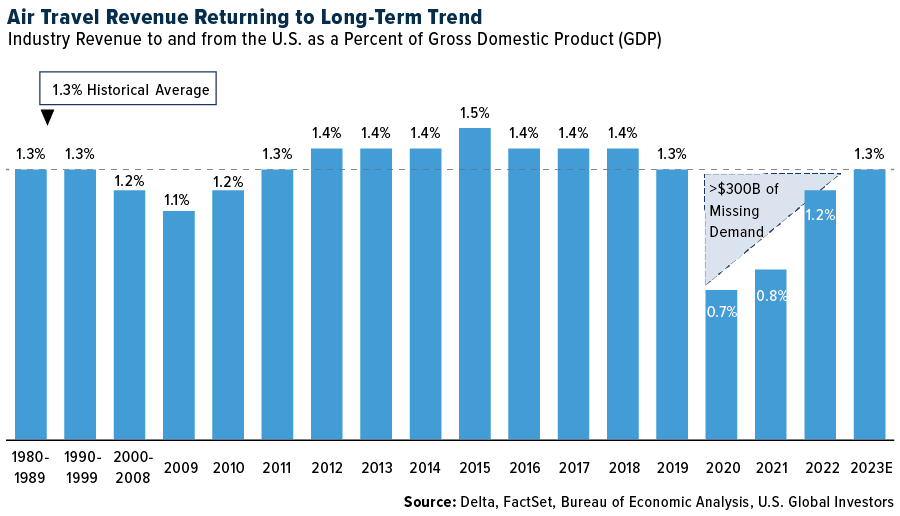

During his presentation, Bastian shared an interesting chart that shows that air travel as a percent of gross domestic product (GDP) has returned to the long-term average. Since 1980, soon after deregulation, commercial air travel expenditure has historically averaged around 1.3% of the U.S. economy, with notable deviations occurring as a result of 9/11 and the 2009 financial crisis. However, the most significant disruption was during the pandemic, resulting in approximately $300 billion of lost demand from 2020 to 2022.

The recent travel boom, Bastian pointed out, is a response to pent-up demand, though it’s only brought the industry back to the 1.3% average without addressing the missing $300 billion gap. Bastian expects to recoup this amount over the next few years as demand remains near or above present levels.

IATA Forecasts Record Operating Profits In 2024

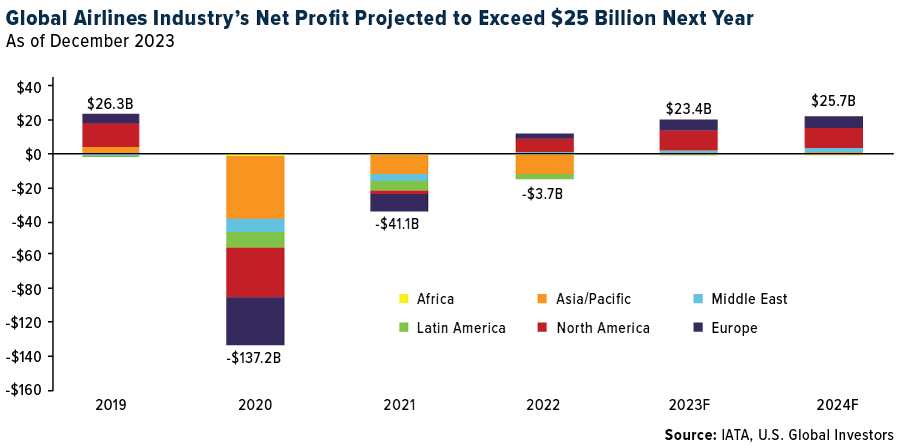

On a final, encouraging note, the International Air Transport Association (IATA) forecasts net profits of $25.7 billion for the global airline industry in 2024, with operating profits reaching a record $49.3 billion. North American carriers, which were first to return to profitability in 2022, are set to collect a combined $14.4 billion in profits, the IATA says.

This projection, coupled with an expected surge in passenger traffic, paints a picture of an industry on the cusp of a historic rebound.

The airline industry’s journey through the pandemic was fraught with challenges, but its rapid return to profitability is a testament to its resilience and adaptability. As the Alaska-Hawaiian and JetBlue-Spirit deals take shape, it’s clear that the industry is not just recovering but is actively reshaping itself for a new era of growth and competition.

Learn which airlines are generating the most money from non-ticket services by clicking here!

Index Summary

- The major market indices finished mostly flat this week. The Dow Jones Industrial Average gained 0.01%. The S&P 500 Stock Index rose 0.21%, while the Nasdaq Composite climbed 0.69%. The Russell 2000 small capitalization index gained 0.97% this week.

- The Hang Seng Composite lost 3.03% this week; while Taiwan was down 0.31% and the KOSPI rose 0.51%.

- The 10-year Treasury bond yield rose four basis points to 4.23%.

Airlines And Shipping

Strengths

- The best performing airline stock for the week was Hawaiian, up 174%. JetBlue published an investor update narrowing its December quarter net loss per share guidance to ($0.25) to ($0.35), from ($0.35) to ($0.55) prior. The improved outlook is primarily driven by better-than-expected revenue trends with top-line guidance now down 5.5% at the midpoint, versus -8.5% prior. The company attributed the improved revenue outlook to better-than-expected close-in bookings around both holiday peaks and off-peak periods.

- The Evercore ISI Air Cargo Cos. Survey improved from 52.1 to 54.6, as both international and domestic activity rose. Data firmed in recent weeks after a slow summer and early fall. International volumes slowed in the first half of the year before ticking up over the summer. Fall has been mixed. This week, international activity moved up from 52.5 to 55.0, after seeing recent improvement between the EU and U.S. as well as LATAM to the U.S.

- According to Bank of America, airline stocks returned 15% in November compared to the S&P 500’s positive 9% in the first month of outperformance since June. Year-to-date, airline stocks are now down 3% compared to the S&P 500’s 19% rise through November with the group outperforming in January, February, May, June, and November. After four months of weak returns, airline equities recovered, driven by strong holiday demand that could indicate a short-term reprieve from the price pressures of domestic oversupply.

Weaknesses

- The worst performing airline stock for the week was Alaska, down 10.2%. According to Bank of America, fourth quarter 2023 net sales to date have decelerated by about 9 percentage points compared to the third quarter, with domestic decelerating by 1.5% and international by 16.1%. Meanwhile, domestic pricing is similar in the fourth quarter to the third quarter while international is nearly 8% weaker. Fourth quarter results are largely dependent on Christmas/New Years travel, a timeframe that could benefit from recent booking trends.

- China Containerized Freight Index (CCFI) rates were down 3.4% week-over-week and 27.1% year-over-year on North American routes to the West Coast, and up 0.3% week-over-week and down 49.1% year-over-year to the East Coast. Rates on European routes were down 2.5% week-over-week and 57.6% year-over-year to northern Europe, and down 3.1% week-over-week and 50.5% year-over-year to destinations around the Mediterranean.

- According to Bank of America, United Airlines lowered system capacity by 60 basis points in April, with domestic capacity lowered by 130 basis points. United’s Canadian transborder capacity, which accounts for a 225 basis-points subset of United’s domestic capacity, saw a 15.4% reduction.

Opportunities

- Alaska Airlines announced it has entered into a definitive agreement to acquire Hawaiian for $18 per share in an all-cash transaction. The deal represents a total equity value of $1 billion, in addition to the assumption of $900 million of Hawaiian’s net debt, for a total transaction value of $1.9 billion. The acquisition has been approved by both Boards and is expected to close in 12 to 18 months pending regulatory approval and Hawaiian shareholder approval. The combined company plans to operate the brands of Alaska Airlines and Hawaiian Airlines separately while integrated under a single operating certificate, collective bargaining agreement for each labor group, and loyalty platform.

- Analysts and media alike warn that container shipping is heading for massive overcapacity in the coming years thanks to a large order book and lower freight volumes, but the facts contradict expectations, says Hapag-Lloyd chief executive Rolf Habben Jansen. He points to a few factors, all of which will take up more capacity and which, in his opinion, contradict the gloomy predictions of a capacity crisis in container shipping. “All ships are full today, even though you can read that everyone is saying that the rates are a disaster,” Rolf Habben Jansen said on Thursday during the maritime conference Hansa-Forum in Hamburg, Germany. “In my view, there is not a huge overcapacity in our industry today. There might be some, but not a catastrophe.”

- The ISI team attended closing arguments for the JetBlue/Spirit merger trial in Boston on Tuesday. The team’s high-level impression is that the line of questioning read favorably for a settlement. They perceived blunt hesitancy to grant a permanent injunction on the merger, and a line of questioning regarding the acceptability of a temporary/partial injunction or additional divestitures beyond what has already been offered was pursued. In the team’s opinion, the JetBlue side had a more cohesive argument, which required less clarification by the judge.

Threats

- According to UBS, Qantas’ path to net zero by 2050 requires Sustainable Aviation Fuel (SAF), fuel efficiency from fleet renewal, and offset purchases. Using SAF might seem sub-optimal today (relative to conventional fuel and offsets) and UBS estimates reaching net zero will be costly. Given the uncertainties, the group believes Qantas is strategically positioned to maximize its chances of participating in lower-cost domestic SAF supply, while minimizing the risk of a cost disadvantage.

- According to Morgan Stanley, looking at seasonality in dry bulk markets historically, it sees a strong possibility of correction from December through to the end of the Lunar New Year next year, and not much sustainability in the current surge in prices.

- According to Goldman at the group’s Aircraft Leasing Conference, aircraft supply is lower than demand for aircraft. There were also positive comments on access to capital, with panelists noting that there are still relatively attractive pools of capital to tap into despite the higher interest rate today. Amongst lessors with orderbooks, the feedback was mixed on placing incremental orders today, with those less enthusiastic on placing new orders citing OEM pricing and escalation. However, it was noted throughout the conference that airlines continue to be concerned with having access to sufficient lift, which bodes well for continued airline orders and more capacity in the market.

Luxury Goods And International Markets

Strengths

- Toll Brothers reported a quarterly earnings beat. The luxury homebuilder projected deliveries between 1,800-1,900 units in the first quarter of 2024 with an average delivered price per home of $985,000-$1.005 million. Meanwhile, Toll Brothers’ 2024 outlook includes deliveries totaling 9,850-10,350 units with an average price per home of $940,000-$960,000.

- China’s trade balance unexpectedly improved. The November trade balance was reported at $68.39 billion versus consensus of $54.90 billion. On a year-over-year basis, exports increased by 50 basis points and imports declined by 60 basis points.

- Sleep Number Corporation, a home products store, was the best-performing S&P Global Luxury stock, gaining 32.075% in the past five days. Shares moved higher after the company’s shares were removed from the S&P SmallCap 600 index at the end of November.

Weaknesses

- New orders for U.S.-made goods fell more than expected in October, marking the biggest monthly drop in roughly three and a half years, constrained by weakening demand for durable goods and transportation equipment and bolstering the view that high interest rates are beginning to bite into spending. Factory orders fell 3.6% after a downwardly revised 2.3% in September, the Commerce Department’s Census Bureau said on Monday.

- Two of London’s most expensive mansions have been on the market this year and are struggling to sell. The value of the two properties stands at 475 GBP ($602 million) and there are not too many interested buyers as high interest rates and high taxes curb investment.

- Faraday Future Intelligence, an electric vehicle (EV) producer, was the worst-performing S&P Global Luxury stock, losing 28.1% in the past five days. Shares have been volatile. The company announced the production of a few more long-awaited FF91 2.0 car models.

Opportunities

- Dust Identity is raising $40 million in funding to enter new markets, including luxury goods and art. The company specializes in linking physical items to digital records by tagging them with nearly invisible and unique marks of diamond dust, which allows users to verify the authenticity of the products. Counterfeiting is becoming a bigger problem in the luxury sector, and companies like Dust Identity will help the sector protect its products from fraud and theft.

- Zegna, Italy’s fashion show listed on the New York Stock Exchange, is betting on the Tom Ford brand to grow its luxury business. Tom Ford International could become one of the 10 most important global fashion brands, Chief Executive Officer Ermenegildo Zegna said in an interview at the company headquarters in Milan. Zegna wants to double its Tom Ford stores to 100 in the mid-term, including opening in Rome and Beijing next year.

- Bloomberg reported that one of the European Central Bank’s (ECB) most hawkish voices, Executive Board Member Isabel Schnabel, shifted to a more dovish stance after eurozone inflation came out weaker than expected. Schnabel said rate hikes are done and policymakers should not guide for steady rates over several quarters.

Threats

- Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, keeping a long-term rating at A1. China stepped up the usage of fiscal stimulus to aid growth. In October, President Xi Jinping increased the headline budget deficit to the largest in three decades. At 3.8% for this year, the deficit-to-GDP ratio is well above the 3% limit set before.

- Deutsche Bank downgraded its ratings on both H&M and Inditex, a Spanish luxury retailer best known for its brand Zara, to sell from hold. Analysts including Adam Cochrane say that 2024 brings the risk of a deflationary impact on the top line for retailers, and at the same time, wages face further upward pressure. The broker is predicting that a rebound in clothing sales post-pandemic is likely to fade, expecting low single-digit price deflation for clothing.

- Bloomberg Intelligence’s Deborah Aitken expects a weaker performance in the luxury space in the short term. After a challenging second half and consensus earnings cuts for 2024, luxury companies face risks such as a soft economy, currency volatility and price sensitivity. Inventory control is crucial to prevent discounts and maintain brand value in the first half of the next year. She expects the sector to grow at a normalized rate of 5%-6% next year after 8% sales growth and low-teen earnings-per-share in 2023.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was wheat, rising 4.XX% on stepped up buying with a 1.01 million-ton purchase, the most in a decade, as rains damaged the Chinese harvest earlier this year. The U.S. government is refilling the Strategic Petroleum Reserve (SPR) as much as it can, taking the advantage of low oil prices, but the amount is limited by physical constraints in the caverns, U.S. Deputy Energy Secretary David Turk said on Bloomberg TV yesterday. He was quoted saying: “We’ve been doing that for the last several months. And at this price level, we’ll keep doing it.” He added that the physical limit is 3 million barrels a month.

- Copper rebounded with other risk assets after U.S. jobs data was seen as supporting the case for the Federal Reserve to start cutting interest rates next year. The metal climbed as the figures underscored a gradual cooling in the U.S. labor market. Swaps markets are pricing in a 60% chance that the Fed will lower borrowing costs in March, which would buoy investor demand for commodities.

- China may be the world’s biggest buyer of iron ore, but even that powerful position does not mean that Beijing can succeed in dictating prices for the steelmaking ingredient, said the head of number two producer Vale SA. The comments by Vale CEO Eduardo Bartolomeo come as China has appeared to ramp up its decades-long struggle to wrest more power over the iron ore market from Brazil’s Vale and its two Australian rivals, BHP Group and Rio Tinto Group, which together dominate global production. A new centralized iron buyer, created last year to make purchases for the nation’s massive steel industry, has in recent weeks criticized iron ore prices as too high, and called for an improved pricing system. Separately, China’s top economic planning body has intensified a campaign seeking to cool a market rally this year.

Weaknesses

- The worst performing commodity for the week was China’s benchmark lithium carbonate futures price, dropping 12.XX%. Four times this week, the lithium carbonate price swung, two times limit down 7% and twice limit up 7%. After failing to sustain an early gain, oil held a run of declines amid continuing skepticism that the latest OPEC+ supply cuts will turn the market tide. Global benchmark Brent slipped near $76 a barrel after a six-week losing run, while West Texas Intermediate (WTI) was below $72. The drop came as markets continued to flash short-term weakness. Nearby time spreads were waning, indicating oversupply, even after OPEC+ ministers last week said the group will continue to curb output. European crude markets, which help set benchmark prices, are facing a supply glut due to a combination of weak regional crude demand and an influx of cargoes from the U.S.

- Venezuela is attempting to annex about two thirds of its neighbor Guyana’s land mass and is planning to take over control of it vast oil deposits discovered off the coastline by Exxon Mobil in 2015. Venezuelan President Nicholas Maduro is running for another term as president. The 11-billion-barrel discovery places Guyana in an envious position of producing more oil per citizen than any other nation. Chevron also has complications as they have operations in Venezuela and will have to sort out their position regarding the conflict.

- Staff at Trafigura Group worked with alleged fraudster Prateek Gupta to ensure that their dealings would not raise the suspicion of key lender Citigroup, according to messages made public in the court battle between the two sides. The revelation is the latest twist in a case that has shocked the commodity trading world, after Trafigura in February accused Gupta of perpetrating a massive fraud against it. The company said that it had paid more than $500 million for nickel, only to discover that the cargoes contained worthless rubble.

Opportunities

- A key indicator of supply in the global copper market just sank to the lowest level since August last year, as the shutdown of a large mine in Panama cuts the availability of ore for next year. The closure of the $10 billion Cobre Panama mine, after widespread political protests in the Central American nation, leaves world copper smelters with less raw material than expected to support their rapid expansion in capacity.

- Supporters of the nuclear industry got a little more confident about the future with language added to the must-pass U.S. Defense Bill that would require the U.S. to purchase domestically produced uranium and end cheap Russian imports. Russia supplied almost a quarter of the enriched uranium for Americas’ fleet of more than 90 nuclear reactors, according to Bloomberg. The House has a vote scheduled for next week to bar the import of enriched uranium, though it does allow for waivers. Nevertheless, the opportunity for uranium to proper is coming into focus.

- Exxon Mobil plans to raise share buybacks 14% as the oil giant accelerates crude production in the Permian Basin, boosted by its $60 billion acquisition of Pioneer Natural Resources. Exxon will repurchase $20 billion of stock next year, the Spring, Texas-based company said in a statement Wednesday. That matches arch rival Chevron, which pledged to lift buybacks after agreeing to buy Hess Corp. for $53 billion in late October.

Threats

- According to JPMorgan, European chemical companies have seen a substantial demand downturn already in 2023, partly due to material customer destocking. End of destocking should result in better volumes in 2024, with a further recovery possible depending on the macro evolution:Over the past five quarters, chemical companies have seen headwinds from weaker macro and from significant customer destocking. Based on the historical correlations, JPMorgan estimates that, for European chemical companies, this destocking likely resulted in around 6% points of average volume decline per quarter on top of around 4% average volume decline due to weaker macro.

- RBC continues to see risks to copper demand both from a potential recession facing the U.S. and Europe in 2024 and from the structural constraints facing China’s investment levels as a share of GDP. That said, one of the reasons for caution on copper has faded. First Quantum’s Cobre Panama mine has been shut by the Panamanian authorities. With only 228,000 tons in visible inventories, copper could be passporting directly into a higher price environment, without first facing a potential lull.

- According to Goldman, the lithium market has seen a renewed bear market shift with prices falling 19% over the past four weeks (and a 73% fall year-to-date). Indeed, the softening in the lithium market has become incrementally apparent with the slowdown in demand growth now in direct contrast with growing global lithium supply.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was ORDI, rising 161%.

- Bitcoin shrugged off a dip in global stock markets to set another more than 19-month high, a sign of its decoupling from other assets. The token jumped as much as 4.5% to about $43,940 on Tuesday. Bitcoin’s correlations with stocks and gold have fallen in 2023 as the crypto-specific sector has helped Bitcoin climb to 160%, according to Bloomberg.

- Bitcoin traded close to $44,000 after notching its longest winning streak since May, a rally driven in part by expectations of looser monetary policy, reports Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Maker, falling 5.55%.

- Bitcoin’s blistering rally in 2023 has made betting against cryptocurrency company stocks a losing bet for short sellers. Traders betting on declines in crypto-related companies such as Coinbase, MicroStrategy and Marathon Digital have accumulated paper losses of $6 billion so far this year, writes Bloomberg.

- Binance’s BNB token has missed out on most of the recent rally in digital assets, a sign of the challenging outlook for the largest crypto exchange after it pleaded guilty to U.S. charges and was hit with a $4.3 billion penalty, writes Bloomberg.

Opportunities

- Cryptocurrency mining hardware retailer, Phoenix Group, jumped 35% on its Abu Dhabi debut, as the first crypto-related listing in the Middle East surged amid a rally in Bitcoin, reports Bloomberg.

- Robinhood rose as much as 9.4% on Tuesday, the most since May 11, after the online brokerage said November crypto notional trading volumes were about 75% above October levels, writes Bloomberg.

- Option traders are loading up on the bet that Bitcoin will surge to $50,000 by January, when many market observers expect the SEC to finally allow ETFs to hold the cryptocurrency, writes Bloomberg.

Threats

- The Internal Revenue Service crime unit, that played a leading role in the Binance Holdings probe, is seeing a surge in cases involving crypto-related tax evasion. These investigations cover a range of issues from taxpayers failing to report income from capital gains or mining activities to individuals purposely not disclosing their crypto holdings, writes Bloomberg.

- JPMorgan’s Jamie Dimon told U.S. lawmakers he would shutter the cryptocurrency industry if he had the power. The remarks add to Dimon’s long history of bashing digital currencies which he has previously called “Ponzi Schemes” and “fraud,” writes Bloomberg.

- A Russian national pleaded guilty in the U.S. after being charged with running a cryptocurrency exchange that masked the proceeds of illegal gambling and drug deals valued at more than $700 million. Anatoly Legkodymov agreed to forfeit $23 million in cryptocurrency at a hearing, writes Bloomberg.

Gold Market

This week gold futures closed at $2019.20, down $70.50 per ounce, or 3.37%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 5.96%. The S&P/TSX Venture Index came in off 1.60 The U.S. Trade-Weighted Dollar rose 0.70%.

Strengths

- The best performing precious metal for the week was platinum, but still down 1.48%. Gold shot past a previous all-time high on Monday as it was turbocharged from the prior Friday when comments by Federal Reserve Chair Jerome Powell that monetary policy is “well into restrictive territory,” spurring a plunge in the dollar and Treasury yields as the day started. Gold’s surge on Monday completely evaporated before the markets opened in the U.S., finishing the day nearly $50 lower. On a positive note, China added more gold to its reserves in November, their 13th consecutive monthly purchase.

- Lundin Gold provided an updated three-year outlook with 2024 production guidance of 450,000 – 500,000 ounces versus the consensus of 483,000 ounces, 2025 guidance of 475,000 – 525,000 ounces versus the 501,000-ounce consensus. Cash costs and all-in sustaining costs (AISC) for 2024 increased by 4% – 5% relative to previous guidance but are expected to decline by 4% – 5% by 2026.

- According to Morgan Stanley, polished diamond prices are stabilizing after a long decline. Polished prices for 0.3-3.0 carat stone sizes modestly increased by 1%-2% month-over-month in November after declining significantly during the year due to weak demand, lack of supply discipline and competition from the lab-grown market. However, a sustained price recovery will require a pick-up in underlying demand during the holiday season. Early indicators are suggesting that sales during the holiday season have been sound so far, but they seek clarity on whether natural stones lost further market share.

Weaknesses

- The worst performing precious metal for the week was silver, down 9.83%. Surging gold prices are prompting some Indians to exchange gold jewelry for new pieces as demand rises during the wedding season in the biggest consumer of the precious metal after China. More Indians are looking to reuse their gold, and the higher prices mean imports will remain pressured in the coming months, said Surendra Mehta, national secretary at the India Bullion and Jewelers Association. Consumers have been buying to meet wedding-related needs, but are otherwise largely staying away from the market, he said.

- According to BMO, Tharisa’s 2023 trading statement for the financial year has indicated headline earnings per share (EPS) of $0.275-$0.285, which is lower than the estimate of $0.41. Year-on-year, headline earnings have fallen between 31%-33%, primarily due to the lower platinum group metals (PGM) basket prices, which have declined 26% (from $2,564/ounce to $1,893/ounce).

- Norilsk Nickel, the world’s largest palladium producer, said: “Historically record high net short positions coupled with metal destocking by automotive companies and fabricators (which, in their view, is coming to end) have been pressuring palladium price since the end of 2022, which, along with supply chain disruption led to a 15% YoY secondary (i.e., recycling) production fall in 2023. Moreover, given current precious metals prices major PGM projects in South Africa and North America are expected to incur financial losses next year (and some already became loss-making at current prices) if they opt to sustain current production levels.” As such, there is “significant risk from the primary supply of South Africa and North America amid potential cost optimization at low margin projects.”

Opportunities

- According to Morgan Stanley, the government is starting to show bipartisan support for U.S. mine development, which could help to kick-start a domestic mining boom. The Inflation Reduction Act (IRA) has two key tax credits for companies producing critical minerals. The first is a 10% production tax credit (IRA Section 45X) applicable to manufacturing costs and has no sunset provisions associated with it. The second is a 30% investment tax credit (IRA Section 48C) that applies to the capex associated with manufacturing and processing.

- Spot gold is poised to test new heights, driven by expectations of an approaching Fed pivot and favorable year-end seasonal prices. Asset diversification during economic uncertainty, coupled with high inflation and interest rates, helped the precious metal maintain its haven status this year, further supported by geopolitical tensions in the Middle East.

- For many investors, gold is looking hot right now. The precious metal just touched an intraday record of $2,135.39 an ounce thanks in part to its haven status: The more volatile the world gets, the better gold tends to do. Bullion has rallied almost 16% since early October, a surge that was initially sparked at the start of the Israel-Hamas conflict, but has since been driven by bets on the Fed will shift to monetary loosening early next year.

Threats

- According to BMO, new information suggests that the Cobre Panama mine closure (a major mine in silver production) could be longer than they had previously anticipated. Last week, the government also issued a directive to close the mine for an unknown period and the Supreme Court decision included a decision to withdraw the Cobre Panama mining concessions. These new decisions suggest that the closure could be prolonged beyond their previous estimate. They now assume the mine is closed to the end of Q3 of 2024.

- Mining executives in Peru are imploring authorities to crack down on escalating violence by informal miners, which cost the lives of nine staff members of a large, legal gold mine this weekend. “Formal mining is under attack,” Angela Grossheim, the head of industry group SNMPE and a former minister, told reporters Tuesday. “Illegal mining today is the country’s main illicit activity, even bigger than drug trafficking.”

- Bitcoin surged above $40,000 this past Mondy when gold sold off and is now closer to $44,000 as we close out the week. Speculators love the seven-day nonstop trading of Bitcoin and its volatility. Peter Schiff, renowned economist, and a cryptocurrency critic noted on X, the social media platform formerly known as Twitter, that gold’s surge to a new all-time high is far more noteworthy than Bitcoin trading above $40,000. As reported on Bloomberg, Schiff noted gold has now entered uncharted territory while Bitcoin would need to rally over 60% to reach a new high in contrast to gold, which has completely broken out.

Related: A Tribute to Charlie Munger and the Promise of the American Dream